In recent months, the United States has seen its national debt skyrocket to staggering levels, which is expected to continue. This debt predicament is a matter that transcends political affiliations and spans across generations, impacting American citizens of all ages and socioeconomic backgrounds.

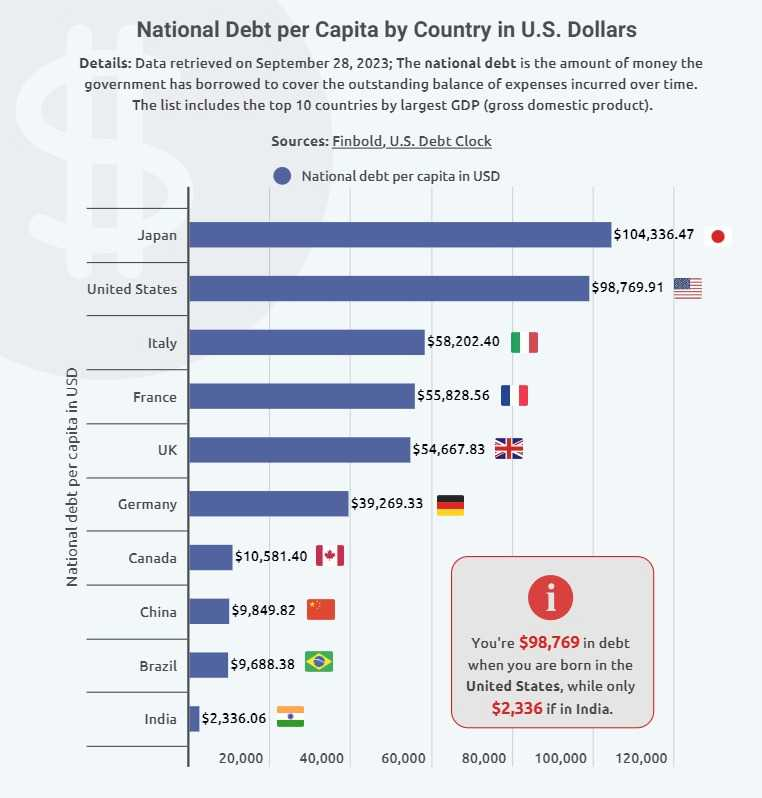

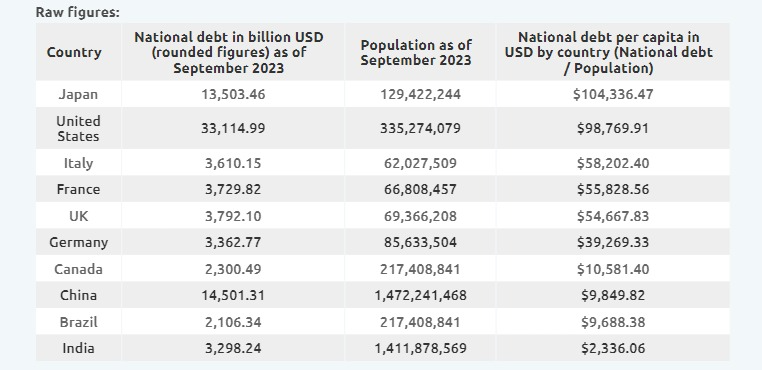

In this line, as of September 28, data compiled by Finbold indicated that the US national debt had reached an astonishing $33.11 trillion. Considering the nation’s population of 335.27 million, this equates to a debt burden of approximately $98,769.91 for each citizen. Among the world’s leading economies, the United States ranks second in national debt per capita, trailing only Japan, which carries a debt load of $13.50 trillion, translating to roughly $104,336 per citizen for its population of 129 million.

Italy follows with a per capita national debt of $58,202, encompassing a total debt of $3.61 trillion. France is next in line with a per capita national debt of $55,828. The United Kingdom rounds out the top five, where each citizen bears a debt of approximately $54,667.

Elsewhere, China, boasting the highest population worldwide at 1.47 billion, has a per capita debt of $9,849, tied to a national debt of $14.5 trillion. India, with a population of 1.41 billion, carries a per capita debt of $2,336 and a national debt of $3.29 trillion.

National debt, also called government debt, represents the money a government owes to external and domestic creditors due to overspending. It’s used to finance various expenses but can be risky if it becomes unsustainable. As the government continues to borrow money, it passes on the responsibility of paying back that debt to future taxpayers. The national debt is often described as a burden on future generations.

The US national debt crisis is not new but a long-standing issue exacerbated by the pandemic and its economic fallout. The consequences of such high debt levels are manifold and potentially devastating, with effects spreading to citizens. High debt levels can increase interest rates, reduce private investment, lower economic growth, limit fiscal flexibility, and undermine national security.

Moreover, high debt levels can erode public trust in the government and its ability to meet its obligations to current and future generations. A default would probably trigger a severe national recession, send global economy shockwaves, and sharply increase unemployment rates.

Significantly, concerns about the US national debt have been amplified, particularly as the federal government faces the imminent possibility of a shutdown amid ongoing battles among legislators over the 2024 budget. The debt has continued to rise, with tax revenues falling short of covering the expenses of numerous government agencies and programs nationwide. At the same time, the debt has been increasing faster than the economy, potentially eliciting a negative response from the public toward the government.

It is worth noting that servicing the debt has become challenging due to the accumulation of interest rates. Notably, the Federal Reserve has embarked on a deliberate path of increasing interest rates, a move aimed at slowing down the pace of economic activity.

Indeed, policymakers face the challenge of finding the right balance between leveraging debt for economic progress and managing the associated risks. This remains a pivotal challenge.

As more money is spent on interest payments for the debt, there is less money available for other priorities such as education, infrastructure, and healthcare. This can have long-term implications for economic growth and quality of life.

China’s low national debt compared to the US

While it makes sense for the US, as the world’s largest economy, to have a high national debt, the same doesn’t hold for its closest rival, China. China’s economic structure differs from the US due to its high savings rate and consistent trade surplus, which generates revenue for debt reduction. The Chinese government maintains fiscal responsibility through a cautious approach to debt and budget deficits.

China also holds significant foreign currency reserves, primarily US dollars, providing flexibility in income and debt management. Strong control over state-owned enterprises further reduces the need for borrowing. Additionally, centralized government control allows for effective debt management, with China’s debt structure being distinct, as a substantial portion is held domestically, giving greater control over terms and interest rates.

Addressing the national debt requires a combination of responsible fiscal policies. The focus is on policymakers to make difficult decisions about spending priorities and revenue generation. This may involve reducing spending in certain areas or increasing taxes to generate additional revenue.

The Dinarian On Locals is a labor of love that I pour my heart and soul into during my personal time. Countless hours are dedicated to delivering you the most up-to-date, unfiltered, and authentic news and information. Your support means the world to me, and I invite you to consider making a donation or becoming a dedicated supporter of this project. Any amount of XRP donations can be sent to XRP address: rqEy1PDACRg3p9RaVEZz6jU1g9RgguP91 or by scanning the QR code below and are not only appreciated but needed...

To those of you already backing my efforts, I extend my deepest gratitude. Your generosity fuels this mission, and I genuinely thank you from the depths of my heart. Together, we can continue to bring you the best results and make a significant impact in everyones future! ~D

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.