The steep pace of global central bank liquidity withdrawals over the last six months has proven to be a material constraint on trading activity across all asset classes, and crypto has been no exception.

Since April, the total aggregate balance sheets of G6 central banks (including the Fed, ECB, Bank of Japan, Bank of Canada, Bank of England and the People’s Bank of China) has fallen by US$2.8T to $27.4T as of October 18. Comparatively, global policy makers’ balance sheets fell by $4.1T between February 2022 and October 2022 which led both US stocks and digital assets to move 2-3 standard deviations lower in the early stages of that sell off. That said, the effect of this liquidity withdrawal on crypto markets has been difficult to disentangle from other factors, as the acceleration this year occurred at around the same time that regulatory scrutiny began to gain momentum in 2Q23.

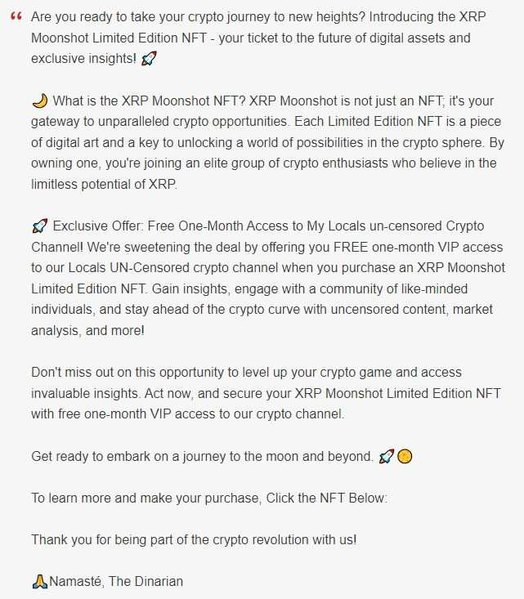

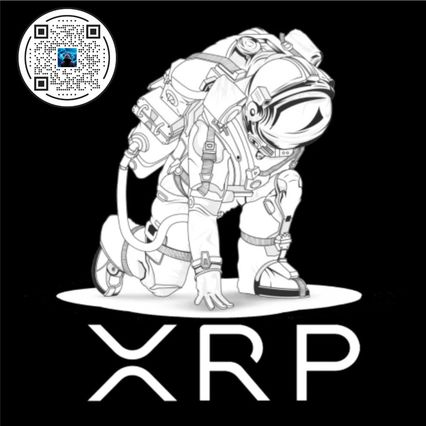

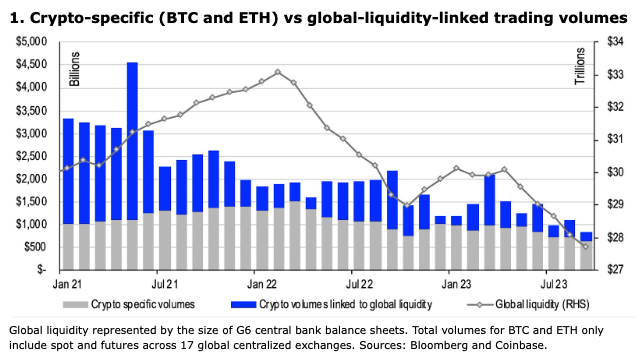

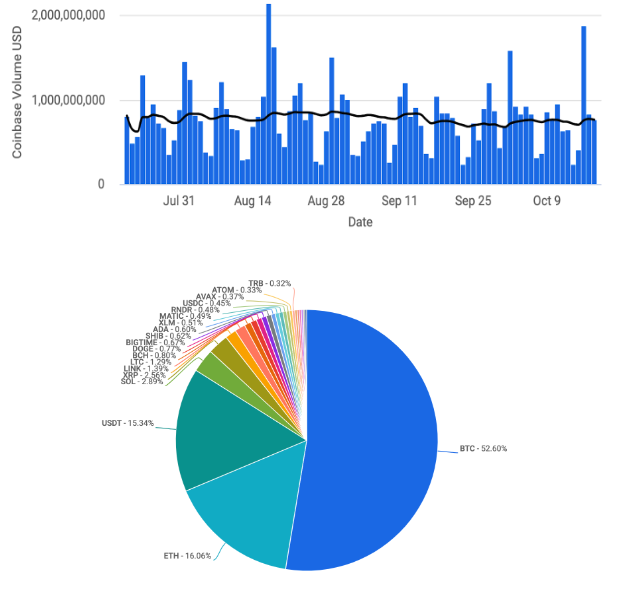

To separate these effects, we use factor analysis to identify the crypto volumes (for BTC and ETH only across multiple exchanges) associated with global central bank liquidity and distinguish them from the volumes driven by crypto-specific themes. Data alignment is a challenge here as global liquidity injections and withdrawals tend to have a lagged impact on trading activity. Nevertheless, we believe chart 1 shows that the recent sharp adjustments in trading volumes for BTC and ETH on a month-to-month basis has been driven primarily by the decline in global liquidity, whereas the pace of moderation for trading volumes linked to crypto-specific factors year-to-date has actually been smaller, more consistent and smoother.

Meanwhile, long end US Treasury bond yields have continued to climb higher, as Fed Chair Jerome Powell this week took a non-committal, data-dependent stance on monetary policy. Regarding our points on central bank balance sheets above, he also avoided discussing the role that quantitative tightening has had on the yield move, although he recognized that the current US fiscal path is “unsustainable.”

Procyclical fiscal spending has been doing its part to support a resilient US economy, as evidenced by stronger than anticipated retail sales, industrial production and home sales data reported this week. But it’s also contributed to higher borrowing and heightened bond market dysfunction. The bond market volatility index has risen by 35% since mid-September, and we believe this has been more important for risk performance than the nominal levels of yields themselves.

In derivatives, ETH (traditional) futures open interest on the CME has finally started to pick up over the past 10 days after the muted market response to the launch of several ETH futures-linked ETFs in the US earlier this month. That said, at $421M as of October 18, ETH open interest on the CME has only recovered to the levels last observed in mid-September. Open interest weighted basis has stabilized following the trend lower in recent weeks, currently near a 1-month yield of around 1.6% annualized. Separately in options, the 25-delta 1m skew for ETH has been retracing lower over the last 10 days suggesting market players may be unwinding their downside risk protection.

Crypto & Traditional Overview

(as of 4pm EDT, Sept 15)

Asset | Price | Mkt Cap | 24 hour change | 7 day change | BTC correlation |

BTC | $28,740 | $554B | +1.7% | +3.6% | 100% |

GBTC | $22.45 | $15.54B | +1.1% | +12.1% | 82% |

ETH | $1,568 | $189B | +0.6% | +0.42% | 59% |

Gold (Spot) | $1,973 | - | +1.3% | +5.6% | 2% |

S&P 500 | 4,278 | - | -0.90% | -1.7% | 44% |

USDT | $1 | $83.5B | - | - | - |

USDC | $1 | $25.2B | - | - | - |

Coinbase Exchange & CES Insights

Monday (October 16) was the highest volume day since the mid-August sell off. An erroneous tweet (regarding a spot bitcoin ETF approval) early that morning sent the BTC price up to $30,000. Our desk saw mostly sellers on the move. Once it was clear that the tweet was incorrect, the price settled at around $28,200. The subsequent conversation among traders centered on how much an ETF approval is in fact priced in, given the market reaction. While that is difficult to say with certainty, it was encouraging that BTC held on to the important $28,000 level. With most of the market’s focus on BTC, we think ETH continues to lack a meaningful bid. Similarly, altcoins are predominantly better for sale among institutional traders.

Notable Crypto News

Institutional

- What’s All the Fuss About Bitcoin ETFs? (Coindesk)

- Binance.US accounts ‘not eligible’ for FDIC insurance protections (Blockworks)

Regulation

- Why Binance, Coinbase, Ripple and Other Crypto Firms Cite the ‘Major Questions’ Doctrine During Legal Imbroglios (Coindesk)

- Federal Reserve governor throws cold water on future CBDC (The Block)

- SEC drops lawsuit against two Ripple executives (Reuters)

General

- Binance users pull more than $500m in October amid regulatory woes (DL News)

- FTX settles customer property disputes to speed up bankruptcy proceedings (The Block)

Coinbase

- Coinbase Advanced customers in eligible non-US jurisdictions can now trade perpetual futures (Coinbase Blog)

- Coinbase For Everyone: Making Economic Freedom Accessible (Coinbase Blog)

- Our approach to preventing illicit activity in crypto (Coinbase Blog)

- Announcing Ireland as our EU MiCA Entity Location (Coinbase Blog)

Views From Around the World

Europe

Ashley Alder, the Chair of the Financial Conduct Authority (FCA) in the UK, has announced that a plan for fund tokenization will be made available later this year. The FCA had previously published a discussion paper earlier this year, focusing on enhancing asset management and exploring the possibilities of tokenization. (Ledger Insights)

An independent think tank called Policy Exchange has recently released a report outlining 10 recommendations for the U.K. government to enhance Web3 regulation and foster improvement in the country's Web3 ecosystem. (Policy Exchange)

A committee in the United Kingdom, comprising members from various political parties, is urging the government to collaborate with non-fungible token (NFT) marketplaces in order to tackle copyright infringement issues and establish a code of conduct that provides stronger safeguards for creators. (Yahoo Finance)

Asia

Mastercard has successfully concluded a trial that involved the utilization of various blockchains to wrap central bank digital currencies (CBDCs). This trial was conducted in collaboration with the Reserve Bank of Australia (RBA), the Digital Finance Cooperative Research Centre CBDC of the country, and involved the active participation of Cuscal and Mintable. (CoinTelegraph)

The Reserve Bank of India (RBI), the central bank of India, has launched a pilot program to explore a second application of its wholesale central bank digital currency (CBDC) in the call money market. The RBI intends to expand its testing of the e-rupee to encompass the entire wholesale sector, which includes activities like asset tokenization and repo transactions. (Bitcoin.com)

Shenzhen, China launched a digital yuan industrial park with incentives for ecosystem growth including up to three years of rent exemption for residents, up 20 million yuan ($2.7 million) for commercial banks who choose to establish themselves in the area, and up to 50 million yuan ($6.9 million) for startups. The government has allocated a total of 100 million yuan ($13.7 million) in support and is also offering loans at attractive rates. (CoinTelegraph)

The Week Ahead

Oct 23 | Oct 24 | Oct 25 | Oct 26 | Oct 27 | |

Notable Macro | US GDP ECB Rate Decision | US PCE U. of Mich Sentiment | |||

Notable Earnings | Microsoft Corp Alphabet Inc Visa Inc | Meta Platforms | Amazon.com | ||

Crypto | US Futures Expiration |