One of the first enterprise blockchains that many of our readers will have heard about is Hyperledger. The member-driven, not-for-profit organization is part of the Linux Foundation where interoperability is key. Hyperledger is also paving the way for the widespread adoption of secure and scalable blockchain and digital trust solutions. Since it first appeared, solutions like Hedera have taken enterprise blockchain solutions a step further.

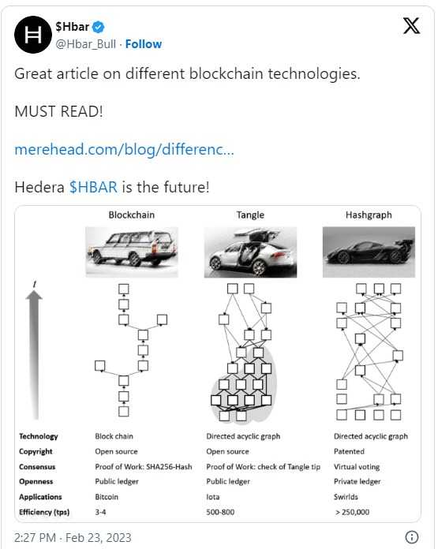

Hedera isn’t what most of us will know as a traditional layer 1 blockchain. It is open source. It operates on a proof-of-stake public ledger (like Ethereum does now) that utilizes leaderless, asynchronous Byzantine Fault Tolerance (aBFT) hashgraph consensus algorithm. Using the “Gossip about Gossip” protocol and governed by a collusion-resistant, decentralized council of leading enterprises, universities, and web3 projects from around the world.

Both Hyperledger and Hedera are supported by councils which include big organisations like IBM, Dell and others. And that is where the similarities end.

Where an average layer 1 blockchain can only manage a few thousand transactions per second, Hedera can process 100,000 transactions per second. But Hedera doesn’t operate like other blockchains. And therefore, it has little of the reputational challenges that other cryptocurrencies suffer from.

The hashgraph consensus algorithm was so compelling that the National Association of Federally Insured Credit Unions entered into a partnership with Swirlds, the inventor of the hashgraph algorithm. Bonifii, previously known as CU Ledger, is a credit union-owned credit union service organization that is creating the premier platform of digital exchange for financial cooperatives globally.

The link between Swirlds and Hedera

Hashgraph is another blockchain consensus mechanism and was developed by Leemon Baird in 2016. It was first introduced by Swirlds for private blockchain usage. As the project with bonifii continued to gather pace, Swirlds and a consortium of other companies launched the Hedera hashgraph network. The network shares many similarities with the Ethereum network, only it isn’t managed like a typical blockchain. Instead, there is a Hedera Governing Council which includes up to 39 companies. Today these include Chainlink Labs, Google, IBM, Nomura, DLA Piper, and others.

We spoke to Mance Harmon, Co-founder of Hedera and co-CEO of Swirlds Labs about how Hedera is being used by organisations to implement a more sustainable supply chain.

Carbon Footprints and Blockchain

The notion of measuring your carbon footprint as an organisation has been around for a long time. Taking your carbon footprint and compensating for that by purchasing renewable energy credits or ‘carbon offsets’. What is new is the idea that you can use public blockchains to solve some of the fundamental problems.

For example, when somebody plants a forest somewhere in the world, to pull carbon out of the air, in order to create a net positive carbon impact, how do you measure the amount of carbon that will be extracted from the air and demonstrate the commitment to let the forest grow for a period? Then, how do you trade with someone that has a carbon footprint they want to offset?

Carbon Offsets on Blockchain

“How do you create a piece of paper that represents the carbon that has been sequestered from this project?” Mance asked.

“You must make sure that the piece of paper is sold once. Or that its being used once, as opposed to being reused. It’s a bit like printing money. You are doing something that results in the creation of some sort of documentation that has value and can be traded,” Mance shared.

This is a global challenge, Mance added. “What we realised as an industry is that we could do this on the blockchain. The emphasis being on doing a good job of measuring that carbon usage and the carbon that’s been sequestered. Or the green energy credits that are being created.”

Hedera isn’t the first organisation to think of how to use blockchain to document carbon offsets. But what makes Hedera different, Mance elaborated, and why Hedera got so much traction is “because the community built a tool. It’s called the Guardian.”

Hedera Guardian makes it easy for organisations that want to measure their carbon emissions for whatever product or service that they deliver. Once they’ve done a good job of measuring the emissions, then the tool helps them to mint emission tokens.

“It’s a token that represents the number of emissions that have been created because of building the product,”

“On the other side of the equation, the same tool is used for setting up an audited process.” Mance shared.

The auditors look at the equipment and the hardware that is used for measuring the actions taken to save energy or water consumption or anything else. These audit tools and processes are used so that there is trust in the veracity and the quality of the renewable energy credit. The token represents that activity, Mance added. It gives you a higher quality of trust. The more trust you have in the token, the more valuable it becomes.

Part of the wider problem with ESG today is how there is little or no audit trail. This means that most tokens are low quality, Mance believes, which wouldn’t be the case with distributed ledger technology.

High Quality Renewable Energy Credits

What Hedera has made possible is the process that results in high quality renewable energy credits. As well as providing high quality measurements and minting emissions tokens.

Mance pointed at some of the things happening at Tolam Earth, a startup that brings parties together in a marketplace to exchange tokens. The startup allows corporations to quantify and report the impact of their investments with shareholders, regulators, and consumers.

“It’s the creation of a new market on public blockchain for making the whole ESG equation more efficient,” Mance explained.

“Matching of the consumers with the producers to be more efficient.”

New SEC Rules to Enhance and Standardize Climate-Related Disclosures for Investors

Increasingly, governments are putting regulations on the capture of ESG data. In the U.S. there’s a soon to be implemented rules process by the SEC that states what you must report publicly in terms of your company’s production of greenhouse gases. Some of the proposed rules are about capturing the carbon footprint of your product or service. However, the new disclosure rules would also require listed companies to disclose information about its indirect emissions. As well as certain types of greenhouse gas (GHG) emissions “from upstream and downstream activities in its value chain.”

Mance highlighted how these new rules are coming. It’s important, he explained. “Especially when it’s required that you report the cumulative carbon footprint of not just your organisation, but everyone in your supply chain.”

“If you are going to be using a public network,” Mance continued. “Then you want to use a public network that is green. Because you care about the carbon footprint of all the organisations providing you products and services. It goes to your bottom line as well.”

It’s an obvious choice. Organisations need to go for a public network that is as green as possible. Which is why Hedera is the obvious choice. Hedera works differently to other blockchains, the consensus algorithm is the difference. A consequence of which is that it has the lowest carbon footprint on a per transaction basis.

The Green Solution

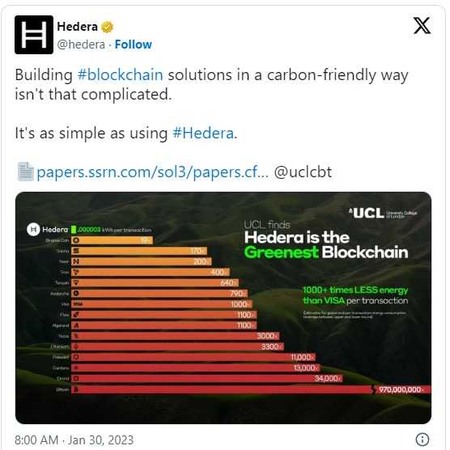

A recent study prepared by the Centre for Blockchain Technologies, University College London analysed the energy consumption of different blockchains including Hedera. The report showed that per transaction Hedera uses 0.000003 kWh whereas Ethereum uses 0.009956. Hedera is more than 15 times more efficient than the nearest blockchain that UCL analysed, BNB Chain.

Visa itself uses 0.0015 kWh to facilitate each transaction, according to a report from Digital Communications and Networks earlier in 2023.

The aim is to combine the green footprint of Hedera with the Guardian platform. The platform leverages Hedera’s public distributed ledger network to enable digital-first sustainability policies. It provides auditable, traceable, and reproducible records that document the emission process and lifecycle of carbon credits. And reduces fraud in the sustainability market.

The result of this strategy is the burgeoning ecosystem that has developed around Hedera over the years. Mance explained how the Hedera Council was part of the journey from the beginning. The companies that form the Council were always going to help govern the network. But the hope was for them to become early adopters too.

The early days of the Carbon Credit Market

It feels like the early days of crypto, Mance explained. “That’s where we are with the carbon credit market. The market has been strong and improving. And the infrastructure is being built out. I think the industry has an opportunity to help the larger ESG industry. By helping the larger ESG industry solve some of their fundamental problems and reduce friction in the marketplace,” Mance summarized.

Up to 39 members of the Hedera Council have seen the opportunity in how Hedera is tackling the carbon credits markets today. The use cases on the Hedera site are proof of a growing eco-system which is essential for a successful solution for long term sustainability.

We will be covering more stories with Hedera at the upcoming North American Blockchain Summit on the 15th to the 17th of November. Mance is a speaker at this years’ premier blockchain event. Tickets are on sale here.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.