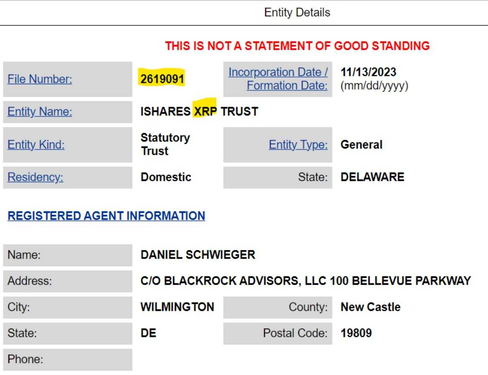

In a recent turn of events, the price of XRP (XRP) experienced a rollercoaster ride after a fraudulent filing for the "BlackRock iShares XRP Trust" with the state of Delaware.

This deceptive registration triggered a surge in XRP's value by 12% within just 30 minutes, fueled by speculators' anticipation of a potential XRP ETF filing by BlackRock, akin to the Ethereum trust the asset manager recently registered.

However, the excitement was short-lived, as BlackRock promptly confirmed the XRP filing to be a hoax, leading to a swift decline in XRP's price. The incident has now caught the attention of Delaware prosecutors, with the Delaware Office of the Secretary of State notifying the state Department of Justice about the deceptive filing.

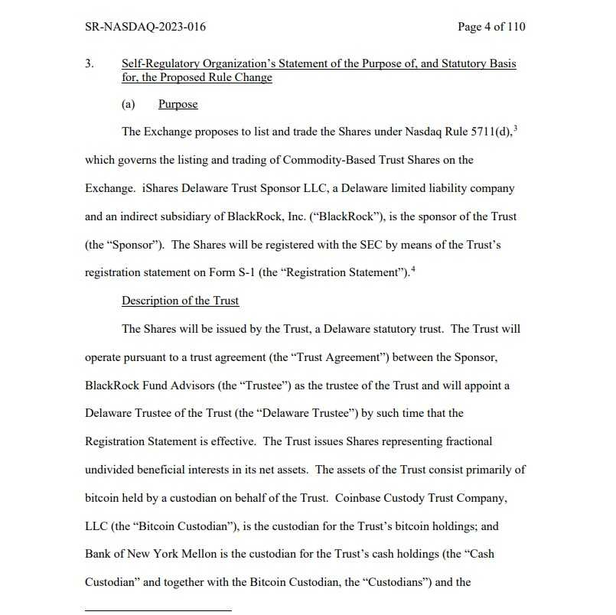

BlackRock's Bitcoin ETF Application:

BlackRock, renowned as the world's largest fund manager, currently awaits a crucial decision from the U.S. Securities and Exchange Commission (SEC) regarding its Bitcoin ETF application. The SEC has historically been cautious about approving such applications, often citing concerns related to market manipulation. Despite this history, analysts at Bloomberg Intelligence are optimistic, suggesting a 90% chance of the U.S. market having a Bitcoin ETF by January 10, 2024. This positive outlook has contributed to a recent surge in optimism and heightened activity within the cryptocurrency market.

SEC's Stance and Historical Rejections:

The Securities and Exchange Commission's historical reluctance to approve Bitcoin ETFs stems from concerns surrounding market manipulation and investor protection. The SEC has rejected numerous applications in the past, emphasizing the need for robust surveillance and regulatory frameworks to ensure the integrity of the cryptocurrency market. BlackRock's awaited decision could mark a significant milestone for the cryptocurrency industry, potentially opening the door for more institutional involvement in the market.

Market Reaction and Short-Term Volatility:

The incident involving the fake filing for the "BlackRock iShares XRP Trust" underscores the sensitivity of cryptocurrency markets to news and speculation. The rapid surge and subsequent decline in XRP's price highlight the potential for short-term volatility, driven by misinformation and market sentiment. Investors and speculators in the crypto space must remain vigilant and discerning to navigate such events, as regulatory uncertainties and fraudulent activities continue to impact market dynamics.

Regulatory Scrutiny and Delaware Prosecutors:

The deceptive filing in Delaware has not only led to market turbulence but has also prompted regulatory scrutiny. Delaware prosecutors are now actively involved, with the Delaware Office of the Secretary of State notifying the state Department of Justice about the fraudulent registration. This incident underscores the importance of stringent regulatory oversight to maintain the integrity of the cryptocurrency market and protect investors from misinformation and fraudulent activities.

Conclusion:

The recent episode involving the fake filing for the "BlackRock iShares XRP Trust" serves as a reminder of the delicate balance between excitement and caution in the cryptocurrency space. While the market eagerly awaits BlackRock's Bitcoin ETF decision, regulatory scrutiny intensifies in the wake of deceptive practices. As the cryptocurrency market continues to evolve, investors, regulators, and market participants must navigate these challenges collaboratively to foster a secure and transparent environment for the industry's sustained growth.

Authored by: The Dinarian

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.