Seize any opportunity across 7 networks with cross chain swaps on Matcha! Trade tokens directly for a different asset on another blockchain in one go, with aggregated liquidity from 100s of DEXs.

If you have ever tried to move assets to another blockchain, you’ve probably been stuck wondering which bridge is safe to use, or which tokens are compatible with the other chain. Maybe you want to keep assets on one chain while still having access to tokens on another, but there's no way of knowing how long the process will take - or if it will work at all.

Now, there’s a better way! Rather than navigating shallow liquidity and unverified platforms, switch to Matcha for simple, cost-effective cross chain swaps which get the job done, first time round.

We've made it easy to swap directly from one token to another so you can use web3 without limits, as it's meant to be. With smooth cross-chain capabilities, you can be ready for NFT mints in minutes and take your trading multichain for a seamless experience that crosses the EVM ecosystem.

How cross chain works on Matcha

Combining bridge aggregation with DEX aggregation.

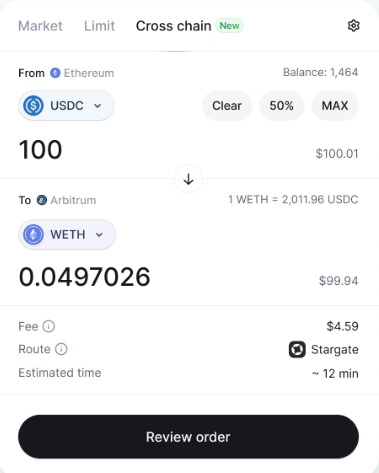

You can find the new Cross Chain feature in your trade module, right next to the Limit tab, keeping the familiar look and feel you’re used to. To set up a new cross chain trade, you simply choose the chain and token you want to sell, and the chain and token you want to receive. Fill out the amount to receive an instant quote and hit Review order to see a summary of the trade. All good? Then select Place order and confirm the transaction in your wallet.

Cross chain swaps step-by-step:

- Go to matcha.xyz and select Start Trading.

- Open the Cross Chain tab in the trade module.

- Select a token to Buy on any supported network using the menu.

- Click on Select token and use the pop-up module to choose a token to Sell.

- Enter an amount to Sell to receive a quote.

- Select Review order.

- Select Place order and confirm the transaction in your wallet.

Cross chain swaps have been integrated in Matcha using Socket API, allowing us to enhance the DEX aggregation you already know and love with industry-leading bridge aggregation. With over 3.5 million transactions processed to date, and an all-star list of integrators including Coinbase, MetaMask, Rainbow and Zerion, Socket was the obvious choice for security and ease of use. Read more about the integration in our blog what is a cross chain swap.

More than just a bridge

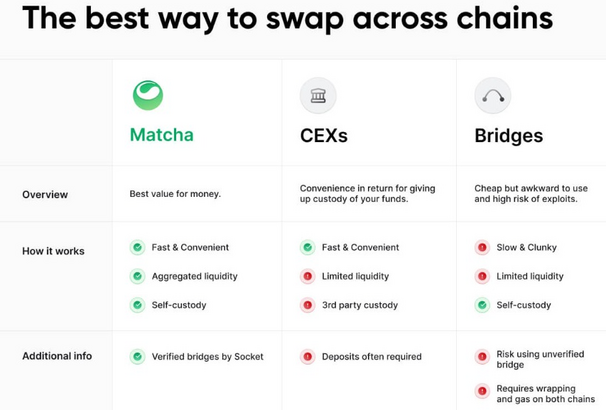

Most bridges are clunky and slow, leaving you with a forest of browser tabs and the hope that your crypto will come through eventually. Why can’t you just bridge from A to B without jumping through multiple hoops to get there? Well, now you can!

Cross chain swaps are better than regular bridges because you can swap one token for another directly, across networks, without multiple steps in-between. Matcha aggregates available bridges to find the best route for you. Instead of searching for the right bridge, moving your WETH across, and then swapping for the token you wanted, you can do it all in a single trade. Matcha will first swap to a compatible token and then bridge to the chain you want to get to.

Get confident about cross chain with simple, fast swaps and transparent routing, so you always know how many tokens will land in your wallet. Just choose the token you have, the token you want from those available, and the network to bridge to - Matcha will choose an optimal route that gives you the best value for your crypto, settled in minutes on your chain of choice.

Cross chain liquidity

The beauty of a DEX aggregator like Matcha is that you aren’t limited to one liquidity source. From blue-chip to long-tail tokens, you’ll tap into deep liquidity whatever you’re trading - and prevent unwanted price impact from eating your profits!

Finding healthy liquidity on low market cap tokens can be a challenge. Even relatively small trades can quickly drain the supply, leaving you overpaying or receiving fewer tokens than you expect. Matcha overcomes these limitations by drawing together all available liquidity, so you can execute your trades across multiple sources and networks with minimal impact on any individual source, keeping prices low.

Supercharge your trading with cross chain swaps

Whether you're trading large volumes or just speculating with spare crypto, you need an efficient path across blockchains. Cross chain on Matcha is for traders at any level, with everything you need in one place. From fund managers to small time investors, you can use cross chain to supercharge your trading strategy.

A growing number of DeFi traders have crypto on multiple networks, with over 3.7 million wallets active on multiple chains each month. You’ll want to use cross chain if you:

- Manage a web3 portfolio

- Diversify your risk

- Need flexibility of low-cost chains

- Want to find the perfect NFT

- Look for low-cap tokens

- Chase large yields

- Like to be first on new dApps

As the bull market excitement ramps up, the number of users bridging their assets has risen as much as four times from where it was just weeks ago. This coming bull cycle will likely see all-time highs in cross chain volume, which has been around 5% of total DEX volume in 2023, with $1.3B in volume over the last 7 days, compared to $28B on DEXs.

Diversify your portfolio across chains

In today’s multichain landscape, it’s hard to tell where the real opportunity is. With cross chain swaps you can spread your investments across established coins as well as up-and-coming moonshots on layer 2 chains without wasting gas. And if an investment turns out to be a dud, you can rely on Matcha to help salvage the remainder quickly and hassle-free!

As bear turns to bull, it becomes even more important to stay agile. Avoid network congestion on the mainnet by moving your holdings to a layer 2, or redistribute your profits into assets that generate passive income. Whatever your strategy is, cross chain gives it a whole new dimension!

Hunting airdrops

Ever since the early Bitcoin forks, airdrops have provided some of the highest returns in crypto, just for holding the right tokens or signing up to the right newsletter. Nowadays, airdrop farming has become a trading strategy in its own right, with new opportunities popping up every day.

But it’s not enough to sit around and wait for tokens to show up in your wallet anymore. You need to be flexible and fast to position your funds in the right place at the right time for that all-important snapshot.

While most bridges will leave you waiting up to an hour for your funds before you can swap to the token you really wanted, Matcha makes it easy to establish your position in one go, faster than most bridges will process your gas!

Token farming

Anyone who’s locked their tokens for rewards knows that all good things come to an end. Farms rarely sustain their rates for more than a few weeks. Cross chain lets you uproot your tokens when the season’s over and move directly to new opportunities, where the grass is greener.

Follow the tech

New apps and projects spring up all the time, from onchain games to tradeable social tokens. If you like to be seen as an early adopter, you need to be everywhere at once. Keep up with all the latest experiments and access to the tokens you need on the chains you need them.

Save time and money

Swap across chains and seize trading opportunities in minutes.

Bridging between networks is also time-consuming and can lead to missed opportunities and wasted gas. Save time and money by switching to Matcha, where you know in advance the route your tokens will take to reach the destination, and exactly how much it will cost.

Fast on-chain settlement means that you can deploy capital to a new network in minutes and be ideally positioned to take advantage of any opportunity before the market catches up. Don’t get sidelined waiting for your wrapped Ether to confirm when you can load your bags in a single trade.

Better than CEXs

Avoid the risk of giving up custody of your crypto.

Decentralized bridges can be off-putting to users looking for a simple and smooth way to move assets from one chain to another. That leaves many people turning to centralized exchanges (CEXs) where trading across networks is made easier due to the custodial nature of the platforms.

Since these exchanges retain control of all deposited assets, no onchain transactions need to take place to complete the transfer, but you also risk that your assets will not be returned to you, as you do not control their keys.

Cross chain bridging on Matcha ensures that your assets remain under your control at all times, while the efficiency of aggregated liquidity keeps costs low without compromising on decentralization. Now, you can swap your tokens for a different token on another chain without extra steps, while retaining full control of your crypto.

Move seamlessly across chains

Cross chain swaps let you position yourself wherever opportunity beckons, by swapping your tokens directly for another across networks without any extra steps. No more hopping between bridges and DEXs - get where you need to be in just one trade! That’s the Matcha way - simple, efficient, and great value for money.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.