Crypto has a terrible track record when it comes to ads. Coinbase clearly isn’t phased.

The most awkward ads of recent memory — Matt Damon’s Super Bowl spot for Crypto.com and FTX’s anti-ad starring Larry David — played up a fear of missing out.

“Fortune favors the brave,” Damon said, so you’d better buck up and buy bitcoin before that fortune runs out.

A time-traveling Larry meanwhile missed out on groundbreaking technologies like the wheel, forks and toilets, and now doesn’t get the big fuss about crypto.

Don’t be like Larry, FTX said, invest in digital assets while they’re still the next big thing. FTX went bankrupt one year later under the weight of Sam Bankman-Fried’s fraud.

The ads were unfortunately timed, debuting near bitcoin’s all-time high only for the coin to crash 60% over the next six months. Damon and David were dragged by the media as a result, with the latter even sued for promoting FTX. By the time the FTX scandal hit, the whole notion of crypto Super Bowl ads felt a little embarassing.

It’s no surprise, then, that Coinbase’s latest campaign opts for a bit more substance than its own Super Bowl ad, which featured only a bouncing QR-code that led to a sign-up page and a $15 bitcoin giveaway that crashed the app due to demand.

The new ad leans more into the philosophical and is conspicuously celebrity-less. A little girl tells us that we’re born into a system — a system with “numbers and papers and lines and waiting.”

You work hard in that system, get good grades, go to college and still take on loads of debt. Starting a family means working two or three jobs, but you still can’t afford rent, let alone buy a house. Not to mention, used cars cost as much as new ones!

“Breaking news — everything is terrible. But does it have to be this way? What if it was different?” Coinbase asks.

Crypto (or more specifically, the crypto you can buy on Coinbase) gives us an out — a way to raze and rebuild a financial system that’s rapidly pricing us all out.

Or, at the very least, crypto might help you afford a used car. “Because you’re born into a system, doesn’t mean you have to live with it,” according to the Coinbase ad.

It’s all very “we live in a society” and even a little Marxist. Still, rather than overintellectualize an already very edgy ad, this is a great moment to check in on how the alternative crypto financial system is really doing.

- All of crypto is currently worth two Apples, or more than 10 BlackRocks.

- Ethereum’s annualized revenue is just under $3 billion — about 15% of what the average US casino brings in per year.

- That’s nearly one-tenth of Visa’s yearly profit and about one-eighth Mastercard’s.

Those metrics are cute, but don’t really capture the spirit of Coinbase’s ad. In Coinbase’s world, crypto supposedly evens the financial odds to such a degree that houses suddenly become affordable and debt becomes mostly useless.

Crypto indeed can bank the unbanked. For those without easy access to traditional finance rails, much of blockchain’s promise is that it offers a permissionless sandbox in which to store value, transfer funds, own protocols and unlock generational wealth by investing in a tidal wave of digital assets.

To some degree, all that is true. And Coinbase’s advert actually hinges on the idea that crypto is an inflation hedge. Inflation is a massive rolling boulder, and we’re Indiana Jones in Raiders of the Lost Ark desperately hoping to outrun it.

Opting into crypto — and the myriad token economies that come with it — is a cheat code for dodging it. These are internet-native currencies that may well outperform the dollar, after all.

It’s enough to make a crypto exchange want to film a dramatic advertisement about it. But one key detail missing is crypto’s own addiction to printing money.

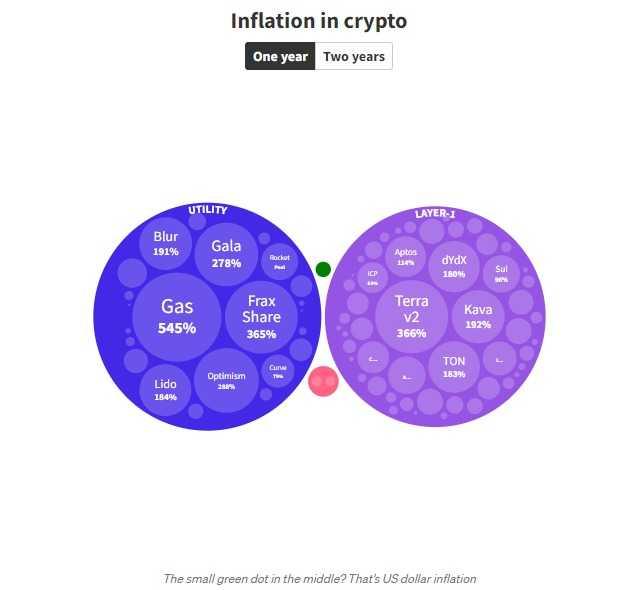

Comparing circulating supplies for the top 100 or so cryptocurrencies over the past two years shows nearly three quarters have supply inflation greater than US dollar inflation.

- About 40% have seen supplies increase by 50% or more since December 2021.

- Almost a quarter of token supplies have more than doubled.

- Their average supply inflation over the past year was 43%, compared to a US dollar inflation rate of 5.55%.

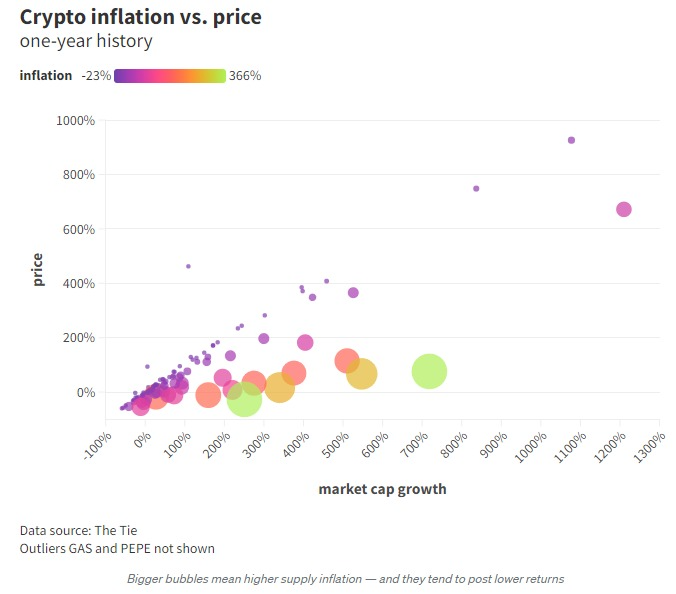

In some instances, the increases in supply converted to market cap growth even where token prices went down.

Take budding layer-1 blockchain Kava: The supply of its native token has multiplied seven times over the past two years, while its price lost 80% of its value. Its market cap still grew more than 40%.

Similar stuff for Immutable (IMX), the Ethereum layer-2 network focused on gaming NFTs: Its supply has also multiplied seven times while its token price has collapsed 75%. IMX’s market cap — determined by multiplying price versus circulating supply — grew by two-thirds.

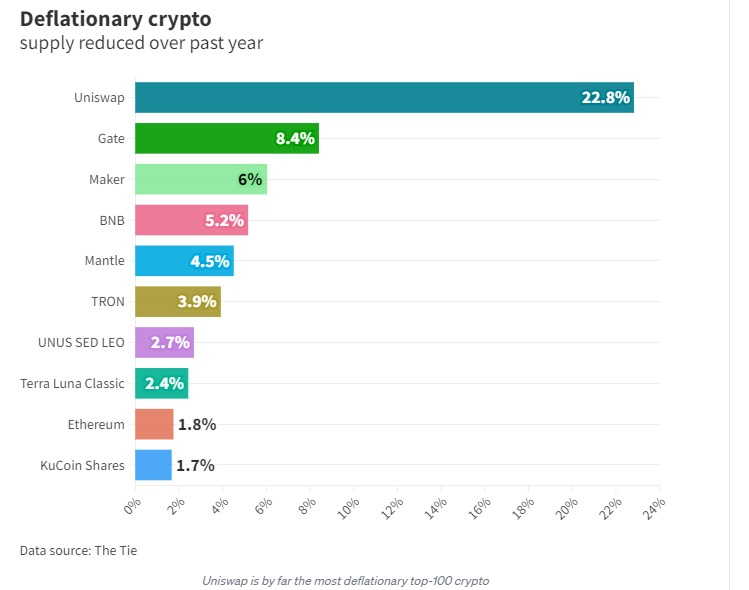

In crypto’s defense, token unlock schedules and supply distributions are usually communicated somewhere online, with maximum token supplies often outright defined by code, which can’t be done for the US dollar.

And token supply inflation isn’t exactly the same as the consumer price inflation seen in the US over the past couple of years.

In many cases, supply inflation is a feature, not a bug. Tokens are added to the circulating supply to incentivize usage, pay salaries and allround fund development.

This makes token supply inflation more similar to the stock options employees at Web2 tech companies receive, rather than anything like the Federal Reserve’s quantitative easing throughout the pandemic — on which recent US inflation has been blamed.

(Although I wouldn’t describe tokens like that around the SEC, which might get the idea that they’re tokenized equity.)

For now, crypto’s addiction to inflation isn’t totally noticeable. Less than one third of tokens with more than zero supply inflation over the past year have seen falling token prices over the same period.

Because the number goes up despite the additional supply, your average crypto investor might not even realize their tokens are being watered down by the fresh tokens regularly unleashed on markets.

Just like how the average wage earner might not see their dollars are worth less the longer they sit in a bank account, even though the US dollar is worth more and more.

The raw censorship resistance of Bitcoin and the permissionless nature of the decentralized finance economy supported by other prominent networks are certainly worth celebrating. They may even be enough to base an advertisement on.

But if what Coinbase says is true — that crypto is a legitimate alternative to our current system — then it must kick its addiction to supply inflation, or else continue to speedrun the worst of what legacy finance has offered us so far.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.