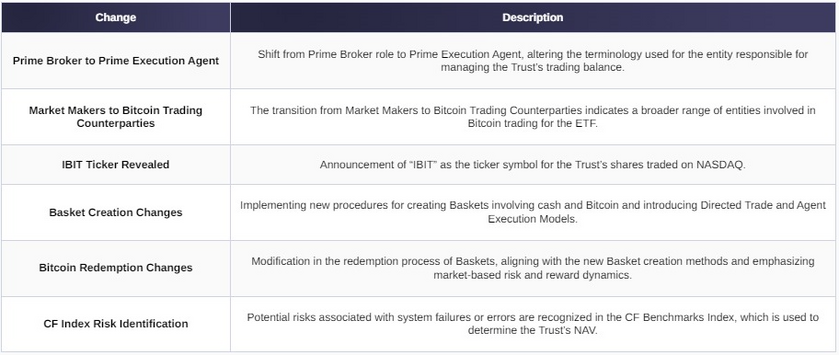

The recent amendment to the S-1 form for the iShares Bitcoin Trust introduces six substantial changes in the management and operational structure concerning its Bitcoin and cash holdings.

BlackRock’s last update introduced 21 core amendments; however, the Dec. 18 filing exhibits substantially fewer, potentially indicating final refinements before launch. The notable changes in the most recent filing are listed below:

Prime Broker to Prime Execution Agent.

BlackRock introduces a shift in its operational strategy. The Trust has replaced the “Prime Broker” role with a “Prime Execution Agent,” signaling a restructured approach to managing the Trust’s trading balances for Bitcoin and cash assets.

A Prime Broker generally provides a suite of services that enable large institutions, traders, and hedge funds to implement their trading strategies at a cost. These services typically include cash management, securities lending, trade clearing, and settlement, among others.

On the other hand, an Executing Agent is a broker or dealer who processes a buy or sell order on behalf of a client. The executing broker within the prime brokerage will locate the securities for a purchase transaction or find a buyer for a sale transaction. This intermediary service is essential because a large transaction must be done quickly and at a low cost for the client.

The change in Coinbase’s role from Prime Broker to Prime Execution Agent suggests a potential shift in the perceived responsibilities that Coinbase will have concerning BlackRock’s ETF. As a Prime Execution Agent, Coinbase’s perceived primary role is to process buy or sell orders on behalf of the ETF rather than providing the broader range of services typically associated with a Prime Broker. However, much of the language in this section remains consistent with the last filing. Updating terminology to align with SEC guidance rather than introducing material differences is a trend seen across other filings, such as the language regarding a “direct exposure” to Bitcoin.

“Although the Shares are not the exact equivalent of a direct investment in Bitcoin, they provide investors with an alternative method of achieving investment exposure to Bitcoin through the securities market, which may be more familiar to them.”

Under the new Directed Trade Model (see Basket Creation Changes below) and the Agent Execution Model. This amendment delineates the cost responsibilities between the Trust and the Authorized Participants (AP), or their agents, the Non-AP Arbitrageurs, in scenarios where there is a discrepancy between the market price of Bitcoin and its value as calculated for the Net Asset Value (NAV) per Share of the Trust.

When an Authorized Participant, or a Non-AP Arbitrageur acting on their behalf, places a purchase order, they are now financially responsible for covering the difference if the price paid for acquiring Bitcoin is higher than the Bitcoin price used in the NAV calculation. This responsibility implies that any additional cost incurred due to a higher market price during acquisition falls on the Authorized Participant or the Non-AP Arbitrageur.

Conversely, if the Trust secures Bitcoin at a price lower than that utilized in the NAV calculation, the Authorized Participant or Non-AP Arbitrageur benefits by retaining the dollar value of this difference. This provision allows them to profit from favorable market conditions where the actual purchase price is less than the NAV-based price.

Similarly, for redemption orders, the financial responsibility model is mirrored. In cases where the Trust sells Bitcoin for less than the NAV-calculated price, the Authorized Participant or the Non-AP Arbitrageur is obligated to bear the cost difference. This arrangement places the risk of lower market prices during liquidation squarely on them.

However, suppose the Trust sells Bitcoin at a higher price than the one used in the NAV calculation. In that case, the Authorized Participant or Non-AP Arbitrageur again stands to benefit, keeping the surplus dollar value from this transaction.

This amendment introduces a significant risk-reward dynamic for Authorized Participants and Non-AP Arbitrageurs, aligning their financial interests with market fluctuations and the Trust’s NAV calculations.

Retained Responsibilities as Prime Execution Agent.

Under this new framework, the Trust’s assets are still subject to an omnibus claim rather than a direct claim on specific Bitcoin or cash. This approach, along with most of this section, is consistent with the previous arrangement and maintains the pro rata share system for asset entitlement.

Further, the Trust’s cash management strategy remains essentially unchanged, with continued use of bank accounts and Money Market Funds. When it comes to executing Bitcoin sales, the Trust will operate through approved trading venues, though specifics may vary under the new agent. The agreement also includes provisions for suspension or termination by either party under certain conditions, mirroring the clauses in the previous Prime Broker Agreement.

Regarding executing Bitcoin sales, the Trust will continue working through approved trading venues, a process similar to that the Prime Broker employs. However, the specifics of these venues and the due diligence process may differ under the new Prime Execution Agent.

This shift from a Prime Broker to a Prime Execution Agent suggests a reevaluation and possible enhancement of the operational structure for managing the Trust’s Bitcoin and cash holdings. However, many fundamental asset handling and risk management aspects remain consistent with the previous arrangement.

Market Makers to Bitcoin Trading Counterparties.

In another development, BlackRock has revamped the roles and compliance responsibilities within the ETF. The replacement of “Market Makers” with “Bitcoin Trading Counterparties” suggests a potential broadening of entities involved in Bitcoin trading and a more proactive approach to transaction execution.

Now, not only do Authorized Participants and Bitcoin Trading Counterparties need to have compliance programs for sanctions and anti-money laundering laws, but the Prime Execution Agent also has to maintain similar programs. This change highlights an increased focus on regulatory compliance and the prevention of illicit activities.

Furthermore, the Trust’s acceptance of Bitcoin is now explicitly extended to include those acquired through the Prime Execution Agent, in addition to those from Bitcoin Trading Counterparties. This broadens the sources from which the Trust can receive Bitcoin, potentially enhancing the Trust’s ability to manage its Bitcoin holdings more effectively.

Lastly, there is an emphasis on the Prime Execution Agent’s ongoing due diligence and monitoring responsibilities for its customers, including those related to Authorized Participants. This added layer of scrutiny is aimed at bolstering the Trust’s compliance with legal and regulatory requirements, particularly in relation to suspicious activities and transactions.

Basket Creation Changes.

BlackRock has introduced notable changes to its operational structure, particularly in how it handles the creation and redemption of its Baskets, which are the units of the ETF.

Previously, the creation of a Basket was solely dependent on delivering a specific amount of Bitcoin, which varied daily based on factors like sales of Bitcoin, losses, and accrued expenses. The Basket Bitcoin Amount was adjusted daily and made available to Authorized Participants. Now, the Trust has introduced a dual component: a cash amount and a Bitcoin amount for each Basket, reflecting a more complex structure. This change allows for a more flexible and dynamic approach to creating Baskets, accommodating both cash and Bitcoin in varying proportions.

This change introduces two new operational models for handling Bitcoin transactions within the Trust. The first is the Directed Trade Model, where the Trust engages with Bitcoin Trading Counterparties. These Counterparties, who are not registered broker-dealers, enter into written agreements with the Trust to trade Bitcoin. They may be affiliates of Authorized Participants or different broker-dealers known as Non-AP Arbitrageurs. In this model, the Bitcoin Trading Counterparties act in their own interest (in a principal capacity) when trading with the Trust. The second model is the Agent Execution Model. Here, the Prime Execution Agent conducts Bitcoin purchases and sales on behalf of the Trust, acting as an agent. This is done through the Coinbase Prime service under the Prime Execution Agent Agreement.

For Baskets creation, the Authorized Participants need to submit purchase orders, which are acknowledged by BRIL unless the Trustee or Sponsor refuses them. The timing for these submissions varies between the two models. For the Directed Trade Model, orders are placed on the trade date, while for the Agent Execution Model, there’s an earlier cutoff time, potentially the evening before the trade date. These orders determine the cash needed for the deposit and the corresponding Bitcoin amount the Trust needs to purchase.

The fee structure remains consistent, with a standard creation transaction fee for each order, which includes an ETF Servicing Fee and Custody Transaction Costs. BRIL, an affiliate of the Trustee, handles these services and fees.

The process of accepting purchase orders has also been streamlined. Upon acceptance by the Trustee, BRIL communicates the required Basket Amount to the Authorized Participant for the cash to be delivered in exchange for the Baskets. This system underlines a shift towards a more cash-centric approach in the Trust’s operation, diverging from the direct use of Bitcoin in transactions.

Bitcoin Redemption Changes.

The Trust has provided a structure similar to creations for redemptions, with the same Directed Trade Model and Agent Execution Model. This symmetry ensures consistency in the Trust’s operational framework for creations and redemptions.

The amendment has also introduced a new dynamic to determining the Basket Amount regarding redemptions. In addition to the daily adjustment, an indicative Basket Amount for the next business day will be made available to Authorized Participants, providing them with guidance for future transactions.

Moreover, the Trust has emphasized the potential for delays in Bitcoin transactions due to network issues, highlighting the inherent risks in dealing with digital assets.

Under the direction of the Sponsor, the Trustee has also been granted the authority to suspend the acceptance of purchase orders or the delivery or registration of transfers of Shares in certain circumstances, adding a level of control to manage unforeseen events or market disruptions.

These changes reflect a more sophisticated and nuanced approach to the operation of the iShares Bitcoin Trust, considering both Bitcoin’s volatility and the regulatory environment it operates within. The introduction of cash components, dual trade models, and potential for borrowing Trade Credits indicate a move towards a more flexible and responsive ETF structure, aiming to cater to varying investor needs and market conditions.

CF Index Risk Identification.

BlackRock has also highlighted a potential issue related to the Index Administrator, specifically system failures or errors. This amendment addresses the possibility that the computers or facilities used by the Index Administrator, data providers, or Bitcoin platforms could malfunction, leading to delays in calculating and disseminating the CF Benchmarks Index. This index is crucial as it is used to determine the Trust’s net asset value (NAV).

The amendment elaborates that errors in the CF Benchmarks Index data, computations, or construction could occur and might go unidentified or uncorrected for some time or even indefinitely. Such mistakes could adversely impact both the Trust and its Shareholders. In essence, if the CF Benchmarks Index encounters errors, it could lead to investment outcomes that differ from what would have occurred if these errors had not occurred.

Furthermore, it is specified that the Trust and its Shareholders will generally bear any losses or costs associated with these errors or related risks. The Sponsor, its affiliates, or its agents do not offer any guarantees against these risks.

The amendment also states that if the CF Benchmarks Index is unavailable or deemed unreliable by the Sponsor, the Trust’s holdings might be valued based on fair value policies approved by the Trustee. This revaluation could lead to discrepancies between the valuation and the actual market price of Bitcoin. Such a situation could result in the Shares’ price no longer accurately tracking the price of Bitcoin, either temporarily or over a more extended period. This misalignment could adversely affect investments in the Trust and the value of the Shares, potentially diminishing investor confidence in the Shares’ ability to track the price of Bitcoin.

IBIT Ticker Revealed.

Lastly, BlackRock has confirmed the ticker symbol for the Trust’s shares on NASDAQ as “IBIT,” facilitating easy identification for investors interested in tracking the ETF’s performance.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.