Within the realm of traditional cryptocurrency analysis, a low circulating supply often raises concerns, potentially signaling a lack of broader utility or purpose beyond serving as a mere rewards token. However, it is crucial to approach SHX from a broader perspective rather than pigeonholing it solely as a rewards token or a conventional cryptocurrency, it is much more as you will see.

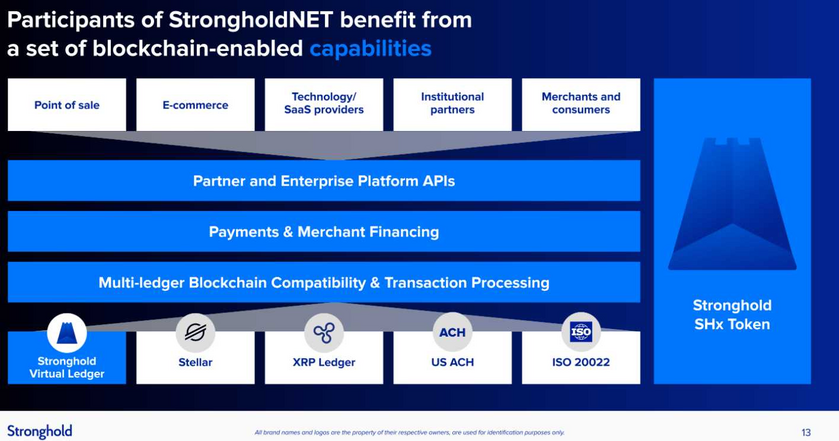

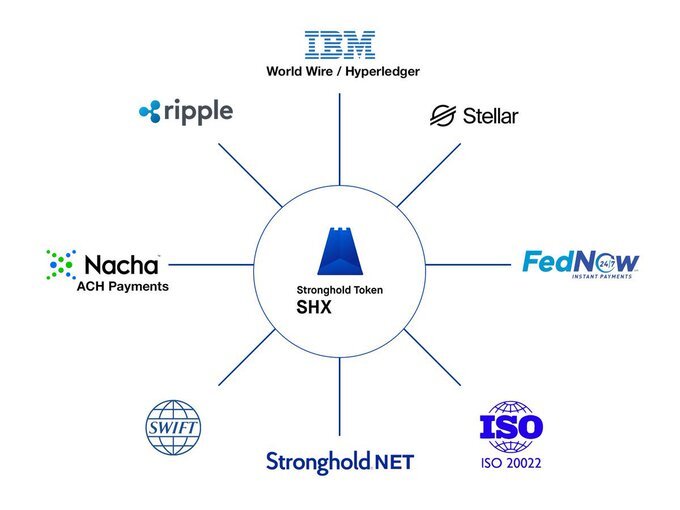

SHX stands apart as a digital asset engineered primarily to facilitate seamless transactions within institutional and business frameworks. Its inherent design focuses on enhancing liquidity and efficiency in value transfer across contemporary payment networks, leveraging the capabilities of the Stellar blockchain. By bridging various assets such as USDC, tokenized assets, and Stronghold itself, the protocol aims to provide a robust infrastructure for swift and secure transactions, catering to the evolving needs of businesses and institutions in the digital economy.

In essence, while SHX may exhibit characteristics reminiscent of rewards tokens, its underlying purpose transcends mere incentivization. Instead, it serves as a pivotal component within the broader ecosystem of modern payment solutions, offering a versatile tool for facilitating transactions and fostering liquidity across diverse financial landscapes.

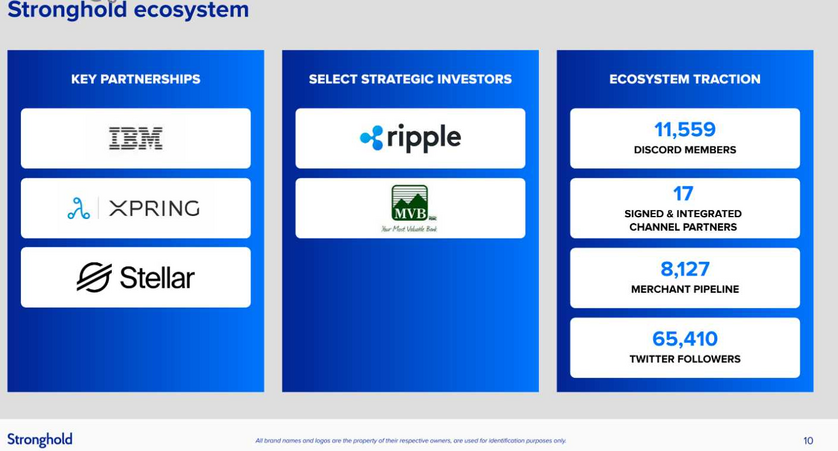

The partnership between the Stellar Foundation and Franklin Templeton since 2019, along with Meta's integration of Stronghold for their Libra project before its discontinuation, underscores the strategic positioning of SHX as a pivotal liquidity tool within digital asset ecosystems. Notably, Facebook's endeavor allowed for the creation and issuance of custom assets on Stellar, showcasing the platform's versatility and potential.

Institutions, businesses, merchants, and governments alike leverage SHX within StrongholdNET to facilitate transactions and cover fees, emphasizing its indispensable role in powering the network's operations. Moreover, the impending expansion of DeFi functionalities on StrongholdNET, pending regulatory clarity in the US, promises broader participation beyond the current select few.

Finally, the deliberate control over SHX's circulating supply, attributed to its institutional focus, safeguards against premature saturation among retail investors. This prudent approach aligns with regulatory compliance imperatives and bolsters confidence in the token's utility. Stronghold's transparent release schedule for SHX until 2050 underscores the project's long-term viability and practical application.

Finally, the deliberate control over SHX's circulating supply, attributed to its institutional focus, safeguards against premature saturation among retail investors. This prudent approach aligns with regulatory compliance imperatives and bolsters confidence in the token's utility. Stronghold's transparent release schedule for SHX until 2050 underscores the project's long-term viability and practical application.

The deflationary nature of SHX, bolstered by mechanisms such as the burning of loan origination fees through the Merchant Cash Advance Program, reinforces its appeal as a stable investment asset. Future DeFi incentives are poised to incentivize larger holders to lock up their holdings, further stabilizing the ecosystem.

Venture capitalists incentivized with SHX for every dollar transacted through StrongholdNET actively encourage their portfolio companies, including industry giants like Uber, Airbnb, and Meta, to adopt and utilize SHX. This cascading effect extends to millions of merchants and even governments, solidifying SHX's role as a universal medium of exchange.

The multi-blockchain compatibility of SHX and StrongholdNET, coupled with governance votes empowering SHX holders to shape the platform's future, enhances its resilience and adaptability. Potential future burn mechanisms, subject to community consensus, promise continued deflationary pressure on SHX supply, reinforcing its value proposition.

In essence, SHX serves as the cornerstone currency and liquidity tool within the expansive StrongholdNET ecosystem, poised to handle trillions in value transacted across various sectors. This strategic approach ensures sustainability and inclusivity, underpinning the vision of "Inclusive Financial Services and infrastructure for all." The controlled distribution of SHX safeguards against premature saturation, ensuring its continued relevance and efficacy in powering global financial infrastructure. It's essential for investors to conduct thorough research and due diligence before engaging with SHX or any digital asset, acknowledging the inherent risks involved.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.