In an environment that remains dynamic and competitive, 2024 marks a pivotal moment for Algorand—a commitment to fortify its permissionless blockchain infrastructure for the future while continuing to set new standards in performance and usability.

Performance has always been at the heart of Algorand’s technology, starting with the instant finality of transactions – which sets us apart from every other L1 blockchain; this year, it’s only getting better. Dynamic round times will elevate network performance, translating to higher throughput and lower round times. Future upgrades will continue to propel network performance to new heights.

Gone are the days when blockchains required developers to learn specialized languages. Now developers can use one of the most popular programming languages in the world – Python – to build on Algorand. Python, in its true native form, will open up new possibilities and expand the reach of Algorand blockchain technology like never before.

This year we are also making two transformational upgrades to the protocol, both of which are designed to markedly increase its decentralization. First, Algorand is introducing the incentivization of consensus, and second, it is transitioning to a peer-to-peer (P2P) gossip network. These strategic changes will give more power to Algorand users and improve the autonomy of the chain. We believe that these transformational upgrades will be an important part of driving Algorand’s widespread adoption in 2024.

The 2024 roadmap doubles down on Algorand’s core strengths as we aim to push boundaries and illuminate a path of self-reliance where performance, resilience, and usability converge to redefine the blockchain landscape.

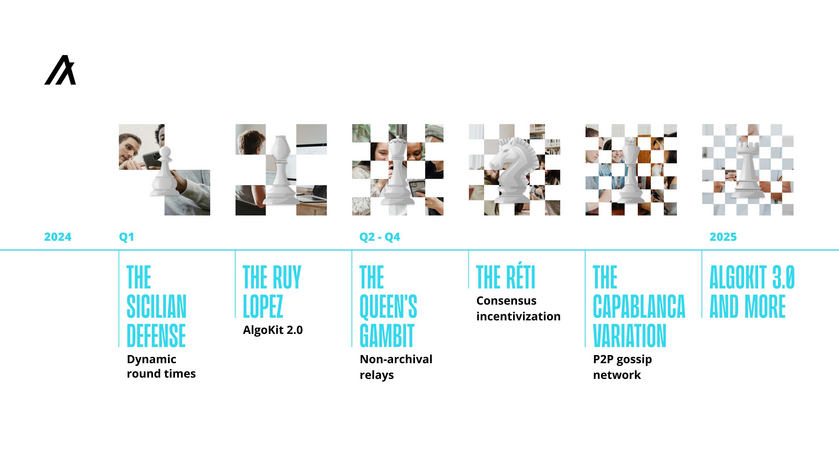

The Sicilian Defense: Dynamic round times

Sicilian Defense: A combative opening strategy that typically results in positions characterized by dynamism and sharpness.

Dynamic round times (a.k.a., dynamic lambda) will increase network performance, meaning higher throughput and lower block times on the Algorand network. Think of it like this—you're at a bus stop, and instead of adhering to a rigid timetable, the bus adjusts its departure time based on the number of passengers waiting. In blockchain terms, an algorithm adjusts block finality based on network congestion and other factors, enabling average round times to drop. With this upgrade, block times will average less than three seconds. Builders will benefit from the flexibility of dynamic round times as it enhances the efficiency and scalability of the Algorand network. End-users will experience quicker confirmations at a point-of-sale speed with which they’re familiar, creating a seamless and timely interaction with the blockchain.

This protocol upgrade was voted into the Algorand network on January 10th and went into effect on January 17th. This marks an important step in continuing to improve upon Algorand’s already industry-leading performance. Future upgrades will see block times drop even further.

The Ruy Lopez: AlgoKit 2.0

Ruy Lopez: A formidable chess opening, widely embraced by players of all skill levels, and sure to bring about winning results.

Since its inception, Algorand has been known for, and has consistently demonstrated, technical excellence. However, realizing its promise demands more than innovation—it requires widespread adoption. Algorand is answering this call with a groundbreaking move: the integration of Python, one of the world’s most popular programming languages. No longer do developers need specialized programming knowledge to build on Algorand; the doors are wide open. An estimated ten million developers worldwide, ranging from students to today's leading AI/ML professionals, can now effortlessly harness the advantages of decentralized technology with Algorand. This transformation isn't just about accessibility; it's a global invitation to innovation. The Python on Algorand experience comes wrapped in AlgoKit 2.0, a comprehensive toolset that provides everything you need to build, test, and deploy on Algorand, including an easy ten-minute onboarding. Developers can try Python on Algorand through the developer preview now.

AlgoKit will see additional upgrades throughout 2024, including improvements to localnet and sandbox, for an enriched experimenting environment. The introduction of Python unit testing will help users write secure code, and a visual debugger tool will help identify and solve issues quickly. We’re not stopping there; the smart contract experience will also be upgraded, and the rollout of app-building libraries will allow users to easily incorporate third-party smart contracts into their own applications. AlgoKit is evolving to make the development journey smoother and more feature-packed than ever before.

The Queen’s Gambit: Non-archival relays

Queen’s Gambit: A popular chess opening that involves sacrificing a pawn for a greater strategic advantage. Note: The pawn can be regained.

Algorand had initially required all relay nodes responsible for spreading information across the network to be archival—in other words, to store a complete copy of the ledger. It was an early way of ensuring there were several viable copies of the chain history. This worked well in the beginning when there were fewer nodes, but as the network has grown it has become increasingly energy intensive for relay nodes to be tasked with both efficiently transmitting data and maintaining the full history of the ledger.

In reality, only some relay nodes need to maintain a full viable copy, and the network topology is being modified to reflect that. Transitioning a higher proportion of relays to non-archival status will not only make the network greener and more efficient but will also significantly reduce the costs associated with running non-archival relays. While these relays will still operate, they will now function as a value-added service, thereby contributing to a more streamlined and environmentally conscious Algorand ecosystem.

The Réti: Consensus incentivization

Réti: An opening for strategically-minded players renowned for its reliability and effectiveness, especially in long-term positional battles.

Algorand is inherently designed for decentralization, and its Pure Proof-of-Stake mechanism makes participation extremely accessible. This year, in the first significant upgrade to its consensus mechanism since inception, Algorand will now directly incentivize that participation. That is, Algorand will soon change the L1 behavior to reward block producers. The impact of incentivizing consensus is that it will drive a surge in the amount of Algo being staked and increase the number of consensus nodes in the network, thereby increasing network security and decentralization.

A portion of the consensus incentives will come from transaction fees. In the short-to-medium term, the Algorand Foundation will also contribute funds to boost the incentive reward amounts. Over time, as adoption of Algorand grows and modifications to the fee structure are implemented, transaction fees will become more meaningful and should be able to sustain the security of the network on its own.

To learn more about the proposed design for implementing consensus incentivization, read “Algorand Consensus Incentivisation: An Algorand Foundation discussion paper” or watch John Woods, Algorand Foundation CTO, talk through the paper.

The Capablanca Variation: P2P gossip network

Capablanca Variation: Moves played by a world chess champion known for his endgame skills and unmatched ability to look at a position briefly and come up with the best move.

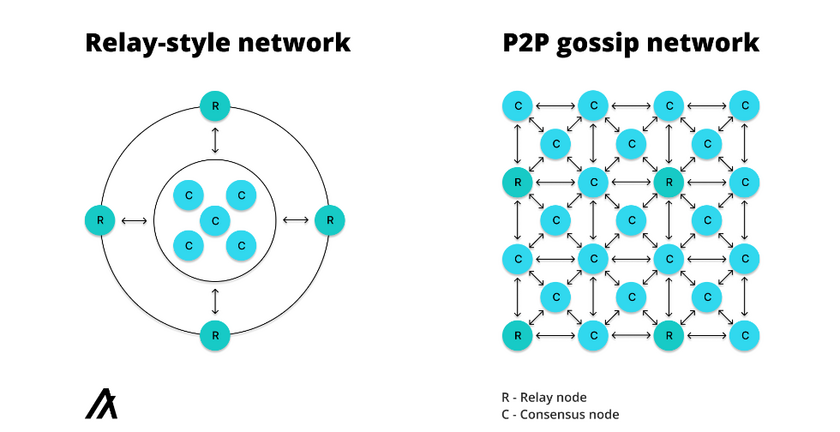

Algorand currently operates on a relay-style network, where consensus nodes (formerly participation nodes) produce blocks in a permissionless manner. These blocks are then transmitted across the network through relay nodes that form a loop for efficient data propagation. While extremely efficient, this structure is not the most decentralized form of network. To further promote decentralization, Algorand is shifting away from this relay structure to a P2P gossip network, similar to how Bitcoin and many other crypto networks operate. In this model, data flows directly between consensus nodes, creating a decentralized spider web-like structure. This looks to reduce the reliance on relay nodes, making the network fully viable even without relays present. The evolution towards a P2P network signifies a significant step towards a more enduring future for Algorand, where it can operate independently and remain resilient to potential disruptions. This adjustment aligns with the core ethos of decentralized technology, ensuring Algorand’s autonomy and resilience in the long run.

A glimpse into 2025

Embarking on the next chapter of innovation in 2025, Algorand will continue to pursue technical excellence, further solidifying its commitment to redefining accessibility in blockchain. We will introduce support for even more programming languages in AlgoKit 3.0 and incorporate more world-class tooling and debugging capabilities, promising an unparalleled development experience. Algorand developers will have an even more diverse set of tools at their disposal, fueling the long-term evolution of blockchain development.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.