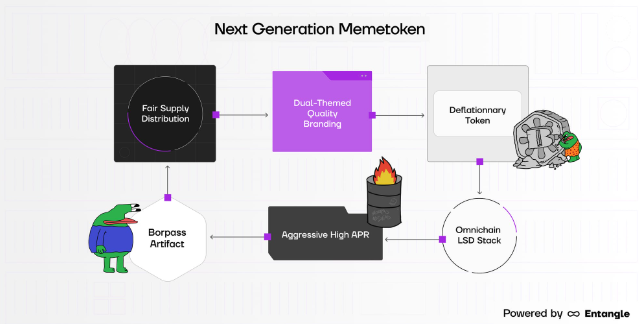

BORPA, built by Entangle Labs from the ground up, introduces a unique "dual-themed" branding strategy that masterfully blends the playful allure of memecoins with the robust functionality of DEX AMM technology. This unique approach is designed to present users with a strategic financial game that rewards them with $BORPA for participating in high-risk financial strategies.

Moreover, BORPA leverages several key infrastructure components of Entangle to create a true Omnichain experience. This integration allows BORPA to operate seamlessly across multiple blockchain networks, enhancing its accessibility and utility in a diverse crypto environment.

By leveraging this dual theme, BORPA successfully caters to both the retail audience with a sleek and professional appearance and the 'degen' audience, who participate in the big brain financial mechanics of DeFi.

The Importance of BORPA

Entangle understands the importance of memecoins.

Reflecting on the history of cryptocurrencies, memecoins like DOGE and SHIB have amassed large, vocal communities that rally around what they symbolize.

For example, in 2021, following the infamous GameStop surge, the subreddit WallStreetBets shifted its focus to Dogecoin, aspiring to push its value to $1. This price pump became a rallying cry for the community, a symbolic gesture of defiance against Wall Street institutions and corporations.

That's the real beauty of memecoins. It tokenizes something as abstract as the “collective feeling” of a community. At its core, it's almost like "tokenized culture" or "tokenized zeigeist."

Unfortunately, most memecoins are merely speculative assets, their value hinging solely on community sentiment.

But what if we could elevate this concept?

What if we could craft a memecoin that not only embodies the irreverent spirit of other memecoins but is also supported by a solid infrastructure and sound crypto-economic principles?

This is where BORPA comes in.

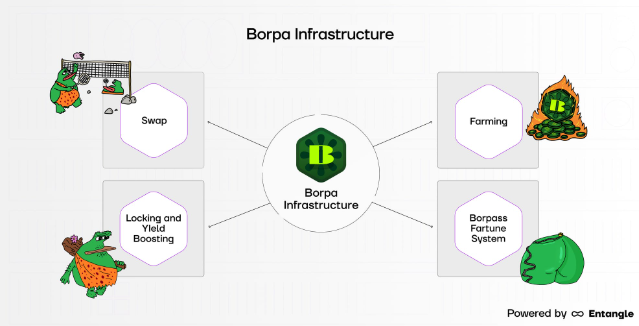

Investigating the BORPA infrastructure

Here's a breakdown of how the infrastructure functions:

- Swap

- Locking and Yield Boosting

- Farming

- Borpass Fartune System

Swap

The Swap Module is a key component of the BORPA ecosystem. It enables users to trade various assets, essential for engaging in the platform's financial game. Users can purchase $BORPA tokens or other approved assets to participate and earn rewards through this module. This flexibility allows users to adapt their investment strategies effectively according to market conditions.

Each transaction involving $BORPA tokens incurs a base transfer fee dedicated entirely to burning $BORPA, thus reducing the total supply and potentially increasing the token's value over time.

The Swap Module supports transactions on several major blockchains and decentralized exchanges (DEXes), including:

- Ethereum, via Uniswap

- BNB Smart Chain, via PancakeSwap

- Solana, via Raydium

This integration across multiple platforms ensures a broad accessibility and seamless trading experience for users across different blockchain networks.

Locking and Yield Boosting

The Lock Module within the BORPA ecosystem enables users to convert their liquid $BORPA tokens into vested $xBORPA tokens. This conversion is central to employing advanced strategies in the platform's various financial games and reward systems.

Once converted, $xBORPA tokens offer several strategic benefits:

- Yield Boosting: Users can employ $xBORPA to enhance the rewards from their existing farm positions. By locking $BORPA into $xBORPA, users can approach or even achieve the maximum 2.5x bonus multiplier offered in the Yield Boosting Module. This dramatically increases the effective annual percentage rate (APR) of their staked assets.

- Chest Mechanism: $xBORPA also plays a pivotal role in the Borpass Fartune System. Users who choose to slash large quantities of $xBORPA unlock liquidity and increase their chances of winning valuable chests.

Farming

The Farming module is designed to distribute a significant portion of the total $BORPA supply as Liquidity Mining (LM) rewards. Users can stake their LP assets in whitelisted farms across multiple blockchains, which earns them swap fees and $BORPA rewards and mints a Composable Derivative Token (CDT). This CDT allows users to borrow against their staked, interest-earning positions.

Upon staking in a farm, users incur a deposit fee of 2% to 5%. This fee serves multiple purposes: 40% is allocated to the buyback and burn of $BORPA, thus reducing the token supply and potentially increasing its value; another 40% supports the Chest Module, and the remaining 20% funds operational aspects and development.

The rewards from liquidity provisioning are distributed using a dual-token system:

- 30% of the rewards are received immediately in liquid $BORPA tokens.

- The remaining 70% are granted as $xBORPA tokens, vested over 28 days. Users have the flexibility to "slash" their $xBORPA early for liquid $BORPA, affecting the total amount received based on the timing of the transaction.

The Farming module strategically distributes 51% of $BORPA’s total supply, focusing on enhancing liquidity for the $BORPA/$ETH pool. This pool alone directs 75% of all LM incentives, spotlighting its importance within the ecosystem.

Borpass Fartune System (Chest Mechanism)

The Borpass Fartune System is designed to drive community engagement and investment through a competitive and rewarding mechanism. This system revolves around a community chest accumulating a portion of the fees generated from various platform activities. The chest grows until it reaches a predetermined financial threshold, triggering a random draw to determine a lucky winner.

Chest Allocation and Growth:

- 40% of the deposit fees collected are converted into USDC and added directly to the chest.

- Once the chest hits its threshold, 40% of its contents are awarded to the winner.

- The remaining funds are split as follows: 30% is retained to seed the next chest, and 30% is used to buy back and burn $BORPA tokens.

Winning Mechanics:

- Users can increase their chances of winning by burning $BORPA tokens, thereby creating $bBORPA during the chest's active period. The more $bBORPA a user has, the higher their probability of winning.

- Each subsequent chest (ChestN+1) sets its threshold at 1.33 times the previous chest's (ChestN) threshold, ensuring progressively larger prizes.

Incentives for Participation

Active participation in BORPA’s various economic activities, such as swapping, liquidity provision, or slashing xBORPA, leads to burning $BORPA tokens, thereby enhancing a user's odds of winning.

The Borpass Fartune System is attractive to new participants due to its potential for large payouts. It supports the token’s deflationary strategy by incentivizing the burning of $BORPA, potentially increasing the remaining tokens' value.

How BORPA Integrates With the Entangle Ecosystem

Here's a brief breakdown of how BORPA utilizes key technologies from the Entangle ecosystem and sets itself apart from the rest of the market.

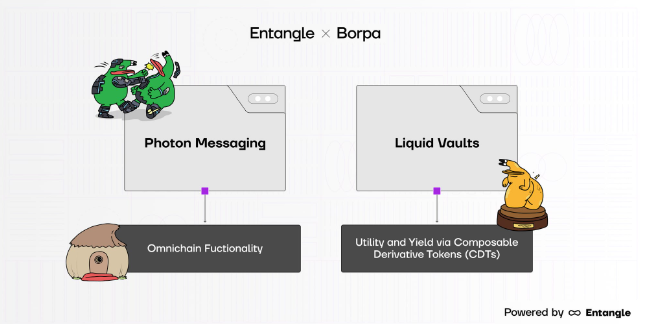

Photon Messaging

Photon, Entangle's crosschain messaging solution, plays a crucial role in enabling the cross-chain functionality of BORPA tokens. By leveraging Photon Messaging, BORPA tokens can freely move between Solana and EVM-compatible chains.

This capability allows BORPA to attract liquidity from diverse blockchain environments, enhancing its accessibility and utility across various platforms.

Liquid Vaults

Liquid vaults will further extend the utility of BORPA by providing an avenue for users to stake and earn yield on their BORPA Composable Derivative Tokens (CDTs). Here's how the synergy between BORPA and Liquid Vaults works.

- Staking: Users can deposit their BORPA token pairs on Liquid Vaults to earn yield.

- Generate CDT: Users can also lock up their BORPA pairs in various DEXes (such as PancakeSwap) and receive the corresponding LP token. The LP token can be further staked on Trillion to generate CDTs. All this process is done smoothly in one zap transaction. CDTs allow users to borrow against their staked, interest-earning positions, essentially freeing up liquidity that would have otherwise been locked up.

- CDT Utilization: Once users acquire CDT tokens, they can engage further within the BORPA ecosystem. CDTs can be further staked in BORPA's “Staking Module,” where users can utilize them in NFT Pools. This in turn generates an NFT which certifies the user's right to claim rewards from the pool.

These integrations play a major role in underpinning BORPA's unique dual-themed approach, blending the playful elements of memecoins with serious financial strategies.

Thanks to Photon Messaging, BORPA is more versatile than any other memecoin on the market. On the other hand, Liquid Vaults ensures that BORPA holders have multiple avenues to earn yields, giving them extra incentives to hold onto their coins.

This synergy of elements positions BORPA as the next evolutionary leap for memecoins.

In Closing

Building upon the rich history of cryptocurrencies and the unique cultural movements that memecoins represent, BORPA stands poised to redefine what a memecoin can achieve. Unlike its predecessors, which largely depended on whimsical community sentiment and speculative trading, BORPA successfully blends the “degen-ness” of traditional memecoins with a virtuous flywheel.

By implementing a deflationary token model alongside a suite of interactive modules, BORPA fosters a self-sustaining ecosystem where engagement directly fuels investment and token value growth. Its strategic burns and reward mechanisms ensure fair distribution and long-term value retention, making BORPA not just a token of culture, but a cornerstone of a new era in cryptocurrency.

Through BORPA, we see the embodiment of a meme transformed into a meaningful asset, demonstrating that even the most lighthearted origins can lead to serious and impactful financial innovation.