In the current web3 landscape, developers are struggling with consolidated lagging data frameworks and cracked omnichain expansions when building smart contract protocols, causing project inefficiencies and mistrust.

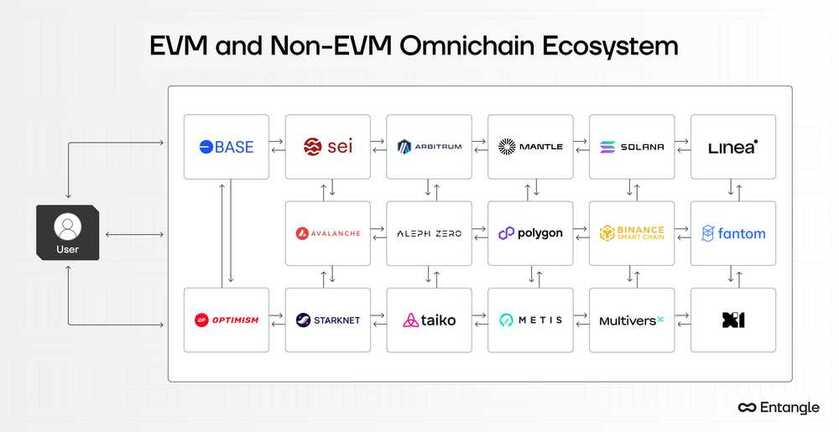

Entangle solves these issues by enabling the interconnection of an advanced decentralized ecosystem through our unique modular, interoperable architecture. Operating on the Cosmos SDK solution and the EVM module, Entangle is an omnichain connector that provides developers with a customizable and flexible infrastructure that frees them from technical and operational constraints.

The Entangle Ecosystem Infrastructure

Entangle is built on five modular stacks. They are:

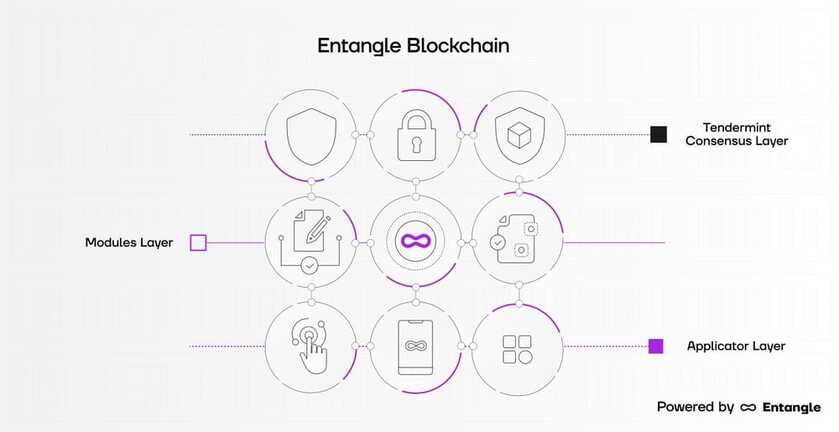

- Layered Approach: Dividing the blockchain into multiple layers for enhanced scalability and specialized improvements.

- Component-Based Development: Facilitating quick development cycles and simplifying updates through reusable and interchangeable components.

- Interoperability and Flexibility: Ensuring seamless interaction between modules and different blockchain networks via standardized interfaces.

- Security and Decentralization: Enhancing security and minimizing risks through distributed responsibilities across agents.

Layered Approach

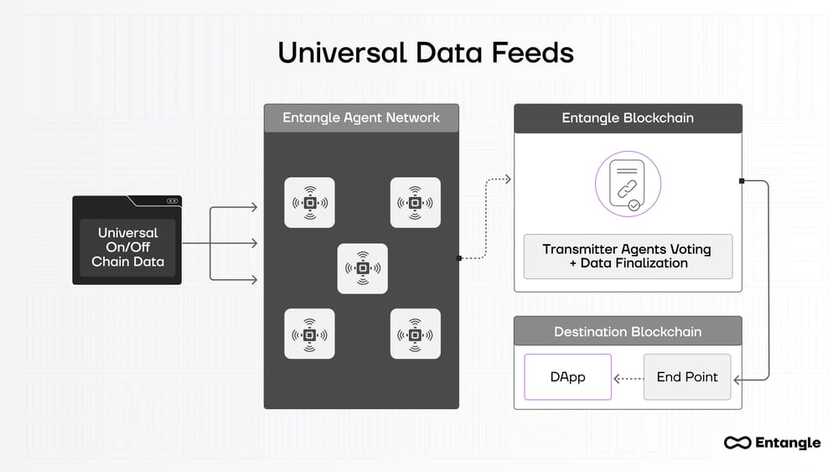

Entangle's Universal Data Feeds (UDF) are integral to our layered architecture, providing the necessary data infrastructure to support high-frequency, accurate data essential for decentralized applications. The architecture is divided into multiple layers, each handling specific functions. This separation allows for specialized improvements and scalability. They involve:

- Data Layer: This layer is the backbone of our system, managing data storage and retrieval. It ensures high-frequency and accurate data, essential for decentralized applications. UDF aggregates and distributes data from various on-chain and off-chain sources. They facilitate reliable and real-time data access for smart contracts and dApps, instilling trust and confidence in the system.

- Consensus Layer: This layer handles the agreement process among nodes to validate transactions, assuring security and trust in the network. It enables the validity of the data transmitted through the UDF, maintaining the integrity of the information used by dApps.

- Application Layer: UDF enhances the functionality of dApps by providing high-quality data feeds, which are essential for various applications such as DeFi protocols, gaming platforms, and real-world asset tokenization.

Component-Based Development (CBD)

Component-based development (CBD) is a plug-and-play approach that emphasizes designing and constructing computer-based systems using reusable and interchangeable components. With CBD, developers can create and integrate complex systems from smaller, well-defined parts, encapsulating data and enabling the independence of their layers. The efficiency lies in the scalability, flexibility, customizability, and development speed of the Entangle ecosystem. They are crucial for integrating advanced features such as AI, cross-chain messaging, and Decentralized Physical Infrastructure (DePIN):

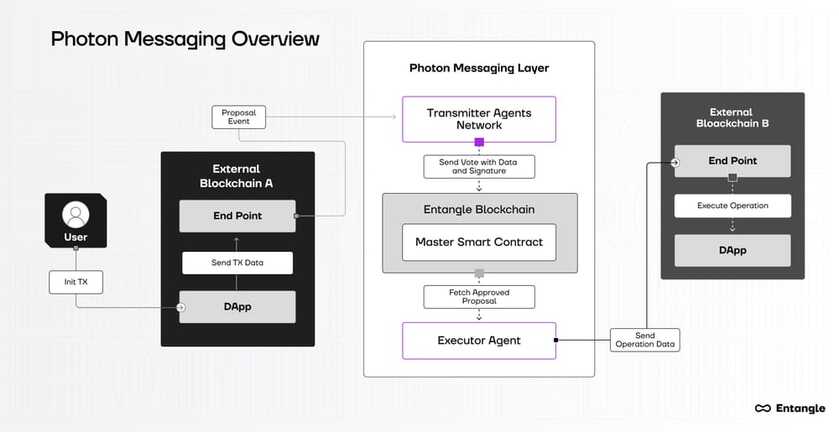

- Cross-Chain Messaging: The Photon Messaging Protocol is Entangle's solution for robust cross-chain communication. It asserts consistency and reliability across blockchain ecosystems, paving the way for seamless data transmission and platform interoperability. Photon Messaging provides APIs and services that leverage cross-chain messaging for specific use cases, such as tracking performance, detecting anomalies, and responding to security threats. This optimizes network efficiency and promotes network integrations, fostering a future where applications function efficiently across multiple networks.

- Artificial Intelligence (AI): Entangle’s capability expands to “AI integration,” enabling it to build applications with decentralized trust and economic incentives. With the necessary data infrastructure provided by the UDF, AI models can access real-time and historical data from various on-chain and off-chain sources. Overall, Entangle strengthens data integrity and privacy by enhancing AI-driven solutions in various sectors, including finance, healthcare, logistics, etc.

- Decentralized Physical Infrastructure Networks (DePIN): DePIN integration democratizes access to critical physical infrastructure, leveraging token incentives for decentralized management. This enables the management of resources such as servers, wireless networks, sensors, and energy networks, fostering a more equitable and efficient infrastructure ecosystem.

Interoperability and Flexibility

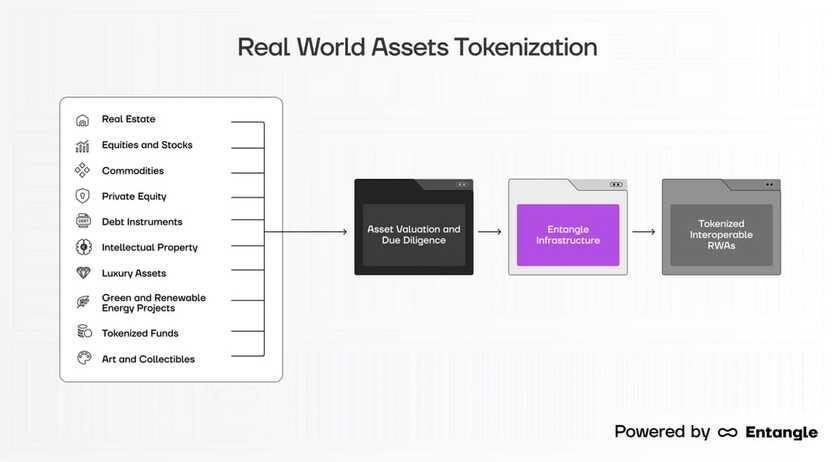

Standardized interfaces facilitate seamless interaction between modules and different blockchain networks. It supports an ecosystem of interconnected blockchains, vital for applications that rely on data and functionality from multiple sources. The focus is particularly on standardized interfaces such as Asset Vaults, Real-World Assets (RWA) protocols, and GameFi:

- Vaults: Entangle's Liquid Vaults is a dApp designed to hold, manage, and optimize the yield of digital assets. It provides users with automated strategies for maximizing returns through Synthetic Vaults, empowering them to deposit yield-bearing tokens and receive synthetic derivatives. The Liquid Vaults uses standardized APIs and protocols to interface with external DeFi platforms, enabling the integration of various financial services on several blockchains and fostering interoperability. This mechanism is positioned through Entangle as a versatile solution in the liquid staking derivative (LSD), addressing the current market's limitations by providing various choices and seamless asset mobility across different blockchains. Users can engage in yield farming, lending, and optimization of other financial instruments that benefit from accurate and real-time data provided by UDF.

- RWA Tokenization: The RWA (Real World Assets) architecture supports horizontal scaling (adding more instances of the same module) and vertical scaling (enhancing the capabilities of existing modules) in expanding the functions of digital tokens on a blockchain. They represent ownership or a stake in a physical asset, such as real estate, commodities, art, or any other tangible asset, without tampering with its value and legal ownership. This framework ensures the system can handle increased transaction volumes and more complex asset management tasks as it grows exponentially, making interoperability, flexibility, and scalability easier.

A property can be tokenized in real estate, with the tokens deposited into a Liquid Vault. The vault allocates these tokens to multiple yield farming pools cross-chain, generating additional income through DeFi activities across blockchains. Property owners and investors earn returns from property appreciation, rental income, and yield farming. Similarly, high-value art pieces tokenized and managed within Liquid Vaults can be used as collateral in lending protocols like Aave, Compound, or other blockchains to access liquidity without selling the artwork. Art collectors can leverage their assets for liquidity while retaining ownership and benefiting from potential appreciation.

- GameFi: Digital assets within games can move across different blockchain networks, retain their functionality, and dynamically upgrade based on player interactions and game mechanics using the Cross-chain dynamic gaming assets. Play-to-earn (P2E) models, in-game economies, staking, and yield farming activities leverage Photon Messaging and Universal Data Feeds (UDF) to improve gaming experiences with upgradeable NFTs and the efficient transfer of assets across multiple blockchains. This approach brings about more immersive, interactive, and engaging gaming environments. Players can earn, upgrade, and trade NFTs representing in-game items, characters, and achievements, while the NFTs are linked to UDF to receive real-time updates and upgrades based on external data. Tokens are earned as rewards and can be staked or used in yield farming.

Security and Decentralization

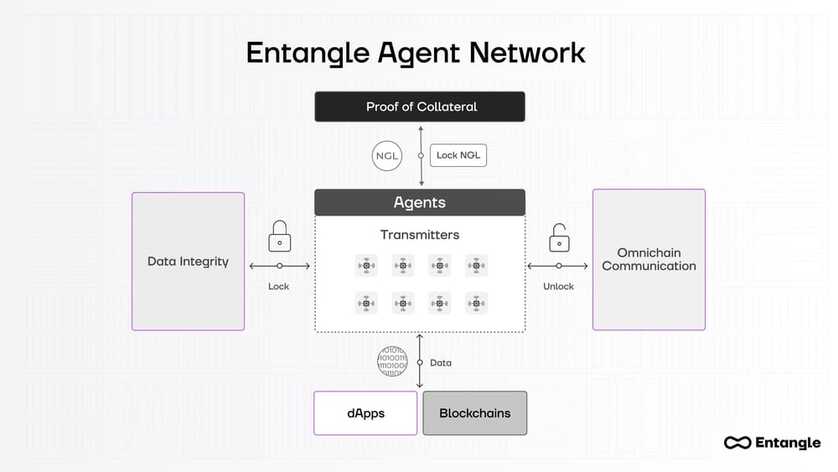

Responsibilities are distributed across different nodes or layers, maintaining security and minimizing risks associated with central points of failure. This decentralized approach ensures ecosystem resilience. The modular architecture of Entangle relies heavily on the roles of Transmitter Agents and External Developers, which facilitate efficient data transmission and system operation:

- Transmitter Agents: They act as intermediaries between data sources and the Entangle blockchain to maintain robust data pipelines. Transmitter agents operate their nodes, register with the protocol, stake NGL tokens, and find delegators, thus, integrity and efficiency of data flow are maintained within the network.

- External Developers: They leverage a cross-chain transfer framework to facilitate data collection and submission. External Developers create and manage customized protocols, lock up NGL tokens to cover rewards and fees, and define staking requirements for Transmitters. By setting operational parameters and deploying Executors, the developers' actions are coordinated through the External Developer Hub contract, which oversees their integration into the system following a KYC process.

Entangle's Strategic Vision

Entangle supports over 13 blockchain networks and is integrated with more than 50 dApps. We are committed to establishing a unified, efficient, scalable Web3 infrastructure through strategic partnerships with leading ecosystem protocols.

Future developments include expanding UDF capabilities, integrating AI algorithms, and developing the DePIN ecosystem.

Join the Entangle community today to explore the potential of our solutions.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.