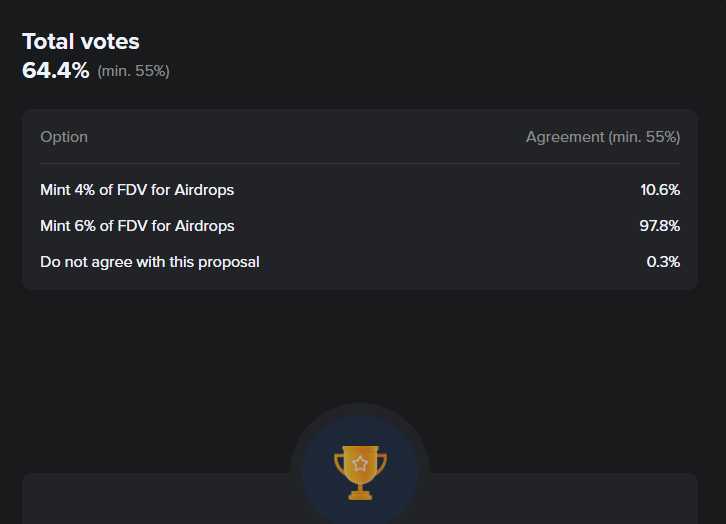

(The Below Proposal Passed With 97.8% Approval🎉

so everything here is moving forward. ~The Dinarian)

TL:DR

● The Sonic Foundation will launch a new network named Sonic, with a native token utilizing the ticker $S. This will be a new layer-1 chain with a native layer-2 bridge connected to Ethereum and beyond.

● Holders of $FTM will have the ability to migrate their tokens for a 1:1 ratio at genesis for the $S token after the passage of a recent governance vote.

● This proposal enables the launch of airdrops to incentivize users of both Fantom’s Opera chain and new users on Sonic, the airdrop is forecasted to happen 6+ months after the launch of the new Sonic network.

● The proposal intends to boost activity, application revenue, and gas fee generation across the Opera and Sonic ecosystems, while bootstrapping total value locked (TVL) upon deployment.

● A unique linear decay model (described below in detail) for airdrop vesting and token burning is crucial to this initiative’s success. Fantom remains well-capitalized and ready to onboard top 3rd party facilitators to ensure all goals are met.

For additional details on the Sonic network and technology, review the previous proposal. 106

Airdrop on Sonic ($S)

With the upcoming launch of the Sonic network, our new, high-throughput chain, the Fantom Foundation and Sonic Labs, the entity responsible for operating, marketing, and developing the Sonic network, are thrilled to share more information about our potential future airdrop initiatives and receive the community’s feedback on our proposed plans.

Opera Community Incentivizes

The Foundation acknowledges and remains grateful for the loyal community that has supported Fantom in the years since Opera’s inception. This airdrop proposal allocates a percentage of the airdrop token mint for incentives to those users engaged on the Opera network, in addition to those on the Sonic chain. Some of the historical activity held in high regard includes (but is not limited to) the following:

● Liquidity providers (LPs) across a range of Opera dApps

● Historical validators and delegators

● Opera Multichain bridge affected wallets

● Liquid staked token (LST) holders, such as sFTMx, beFTM, and ankrFTM

● Opera NFT holders, marketplace users, collection creators, etc.

● Miscellaneous Opera protocol usage and participation

Sonic Network Incentives

While we want to reward Opera users for their loyalty and dedication, we also want to acquire new users with a focus on TVL, transactions, and significant ecosystem development/growth for early Sonic applications via an airdrop token mint.

Airdrop incentives for the Sonic network could look like:

● Liquidity providers (LPs) across a range of Sonic dApps

● Staking/Validating on the Sonic Network

● Liquid staked token (LST) holders on Sonic

● Verified contract deployers with high gas consumption

● Audience activation campaign + quest participants

● Miscellaneous Sonic protocol usage and participation

● Users who have bridged funds into Sonic

How will we accurately and efficiently collect all of this data?

We have engaged OpenBlock and Sentio to manage and oversee our points and airdrop designs through data-backed decision making. If this governance vote passes(Which it did), we will move forward with both parties to ensure a structured, transparent process for all participants.

● OpenBlock’s data-driven incentive modeling platform powers over $1B in annual incentive spend and has been a leading provider of rewards design and efficacy analysis for leading protocols in the space including EigenLayer, Lido, Linea, Mode, Arbitrum, Solana, Sui, and many others. To initiate and sustain its ecosystem, Sonic will utilize OpenBlock’s incentive modeling frameworks, ensuring continuous and balanced growth for all actors in the system.

● Sentio is an industry-leading indexing service that aids in streamlining continuous point tracking, helping retrieve historical states of all user positions to update user points upon every interaction. With its high-performance database infrastructure, engineered to handle queries at unprecedented speeds, Sentio enables the onboarding of tens of thousands of new users easily and efficiently.

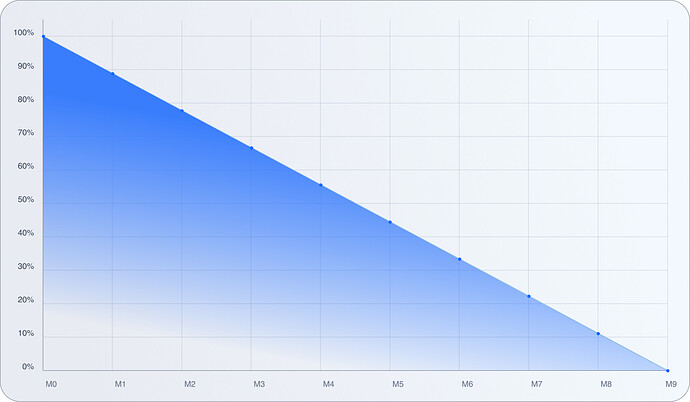

Distribution: Vesting, Linear Decay, and Burn

With more than 88% of Fantom’s token supply currently distributed and circulating, we have designed a unique linear decay mechanism that introduces game theory into the proposed airdrop to address the challenging nature of airdrop incentives on an active chain. Specifically, this airdrop requires a strategic design to minimize abrupt dislocation of circulating supply in short periods of time, which we believe a linear decay and burn solves.

The airdrop model utilizes a unique burn factor that encourages recipients to increase activity on-chain while awaiting their preferred exit burn. Further, it penalizes (through burning) those who do not wait for the full maturation of their airdropped position. For those who chose neither, there will be an fNFT marketplace to trade their underlying $S on a secondary market to speculative buyers.

On the chosen claim date, a user’s airdrop would be 25% liquid with 75% of their airdrop vested for 270 days in the form of ERC1155 (fNFT) positions. Sonic users would be able to claim this 25% portion of their airdrop immediately and are free to decide when to claim their final allocation. In the graphic below, the burn factor is outlined, along with two example scenarios. If the user chooses to hold the ERC1155 but would like to trade it on a speculatory fNFT marketplace, they may do so.

Scenario A: Andrew earns 1,000 $S in the Sonic airdrop. Andrew can claim his 25% liquid allocation at any time and receive 250 $S in his wallet. 90 days pass and Andrew returns to the claim portal, deciding he would like the rest of his airdrop. As 90 days have passed by, he can claim 249.75 $S tokens (33.3 of the remaining 750 token allocation) but must burn 500.25 $S (66.7% of his locked-up allocation).

| Day | Burn Factor |

|---|---|

| 0-30 | 100%- 88.9% |

| 31-60 | 88.9% - 77.8% |

| 61-90 | 77.8% - 66.7% |

| 91-120 | 66.7% - 55.6% |

| 121-150 | 55.6% - 44.4% |

| 151-180 | 44.4% - 33.4% |

| 180-210 | 33.4% -22.3% |

| 211-240 | 22.3%- 11.2% |

| 241-270 | 11.2% - 0% |

Scenario B: Bob earns 10,000 $S in the Sonic network airdrop. Bob can claim his 25% liquid allocation at any time and receive 2,500 $S. Bob is excited to use his $S in the ecosystem and decides he would like all of his eligible airdrop allocation after day 30. Bob claims again (the final 75% portion), receiving 1,110 $S and burning 6,667.5 $S tokens (88.9% of the final portion)

We believe this unique linear decay for the proposed airdrop minimizes the impact to the $S token circulation, while still encouraging high demand for $S tokens to use within the network plus ecosystem applications.

fNFT Marketplace

This marketplace will be facilitated in coordination with the well-known dApp PaintSwap.

The market will utilize the ERC1155 and ERC1155 metadata standards with a custom SVG showing all necessary data such as amount, unlock time, etc. The core implementation will be based on SamWitch’s ERC1155UpgradeableSinglePerToken.sol contract, which is a gas-optimized version of ERC1155 from OpenZeppelin specializing in single-amount token IDs. Contracts will use PaintSwap’s highly regarded and recently optimized marketplace contracts.

Functions on the fNFT

● Decaying unlock

● Merging

● Splitting

● Standard minting/transferring/approval

● The NFT will set the spender to be the marketplace automatically to save having to do any sort of approval when listing

● Immutable and non-upgradeable

● Contracts will burn the NFT on unlock and have no restrictions on transferring to allow safe self-custodial listings on the marketplace This fNFT ERC1155 enables a thriving secondary market based on the future price movement of the underlying $S token.

Legal Provisions

As part of the Foundation’s research and commitment to this airdrop, we have sought legal opinions to ensure its success. ⚠️The program will likely need to exclude any sanctioned country or person including all those who are citizens or residents of or residing in (the “Restricted Countries”): Belarus, Burundi, Central African Republic, Congo, Cuba, DPRK (North Korea), Guinea, Guinea-Bissau, Iran, Iraq, Lebanon, Libya, Mali, Myanmar (Burma), Republic of South Sudan, Russia, Somalia, Sudan, Syria, United States of America, Ukraine, the Crimea, Donetsk, and Luhansk regions of Ukraine, Venezuela, Yemen, or Zimbabwe.⚠️

These potential provisions may include:

● Geoblocking: Implementing geo-blocking measures for all Restricted Countries.

● Self-declaration: Requiring participants to say they are not from one of the Restricted Countries.

● Discretionary exclusion: The Foundation reserves the right to exclude any wallet address at its sole discretion.

There will be a comprehensive set of terms and conditions provided at the program’s launch.

Next Steps

● Engage OpenBlock to coordinate and facilitate a smooth, well-functioning, and ecosystem-minded airdrop process.

● Onboard Sentio’s point tracker system to index continuous point tracking and save infrastructure resources.

● Engage PaintSwap to build a unique $S fNFT marketplace.

● Engage known auditing partners to review contracts for the issuance of NFTs and the aforementioned mechanisms.

● Begin initial preparation for points programs on the Opera and Sonic networks.

● The outcome of this vote will let the Foundation propose the amount of airdrops.

● If passed, the Foundation will share information about the points and claims process in the lead up to the Sonic launch.

Voting

All mints are calculated on the fully diluted valuation (FDV) of the maximum FTM supply, which is 3,175,000,000.

Option 1: Mint up to 4% of FDV for future airdrops.

Option 2: Mint up to 6% of FDV for future airdrops.✅ (This was the winning vote)

Option 3: Mint no new tokens for airdrops.

FAQ

If I am a user on Opera, will I get an airdrop?

You will get points which you can claim on Sonic network.

How would I get points?

There will be a simple website for users to track their points.

How are points tracked?

Points are tracked via a simple website on which users can connect their wallets and see how many points they have.

Is the airdrop in $FTM or $S tokens?

The airdrop is in $S tokens.

Do my tokens earn yield whilst locked in the $S NFT? It is not likely that the tokens will provide yield during the locked period.

Where do the underlying penalty tokens go once I execute a claim on my $S NFT airdrop?

They go to the burn address.

Is there utility for me whilst holding my $S NFT?

We expect there to be secondary markets provided by native applications.

If I chose to exit my airdrop on day 1, how many $S tokens would I receive?

You will receive 25% of your total allocation.

How long will the points program run for?

We plan on running the points program for more than 6 months. However, we cannot commit to a start or end date due to the nature of airdrops.

What will be the total amount of tokens allocated to the airdrop?

It depends on the vote outcome of this proposal. However, we plan on using the allocated % for up to 3 different airdrops.

Will this be available in the US?

No, this will be geo-fenced around US claimers and other Restricted Countries outlined in the Legal Provisions section above.

Are you going to take any anti-Sybil measures?

Yes! We will be working diligently with our partners on the airdrop design to adopt anti-Sybil best practices.

-------- END OF PROPOSAL --------

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.