- Migrate Rewards: Limit inflation by migrating Opera block rewards to Sonic.

- Accessing Staked Value: Simplify Sonic’s staking mechanisms to unlock hundreds of millions in LST (Liquid Staking Token) liquidity. Engaging with reputable native and external LST providers like BeethovenX, FRAX, and others.

- Supply and Burn: Enhance network security and value accrual through limiting inflation and innovative burn implementations.

- Increase ecosystem Rewards: Boost GasM rewards up to 90% returned to an exclusive number of applications.

- Vault Change: Migrate the current Ecosystem Vault rewards to the community ran SCC (Sonic Community Council)

For additional details on the upgrade from $FTM to $S as well as information on the Sonic network and technology, read this forum post 2.

Increasing Validator Value

This proposal seeks the Fantom community’s support to accelerate validator and stakeholder’s transition from the Fantom Opera chain to the new Sonic network.

First, this proposal will outline an Opera-to-Sonic migration plan for validator block rewards. This plan seeks to tap into a potentially ~$750m+ LST ecosystem, boosting overall adoption and DeFi activity. With the inclusion of this TVL and additional DeFi composability benefits, Sonic is primed to capitalize on the strong ~48% staked supply which has existed on Opera since inception. Previously, due to Opera’s constrictive staking terms and un-delegation periods, LSTs only occupy less than 4% of the total staked “supply” in comparison to 40% on fellow PoS networks like Ethereum. By decreasing the minimum and max lock-up period from one year to 14 days (while maintaining a competitive reward rate), the network can capitalize on the benefits of liquid staking while continuing to secure the network efficiently. Additionally, we’re seeking to modify our transaction fee structure to increase burn rate and dApp rewards. Lastly we are seeking to update Ecosystem vault permissions to enable further funding to the SCC to further ecosystem support from third-parties.

An active Liquid Staking Tokens (LST) market for Sonic validators provides the following benefits:

- Increased TVL and capital inflows to Sonic’s DeFi ecosystem

- Lower opportunity costs for staking, accessing the capital for alternative strategies (More yield opportunities for validators and stakers)

- Encouraging more Sonic stakeholders and aligning incentives for its growth

- Increased volume for network

- More available pairs for DeFi ecosystem

- DeFi composability and integration of LST’s into DApps such as lending, borrowing, liquidity pairs, CDPs and more.

Migrating Fantom Block Rewards

Block rewards for Opera validators are currently set to last for the next 1,344 days. This proposal introduces the reduction of Opera block rewards, as the majority of validators and stakers migrate to $S. We intend to migrate those funds as rewards for Sonic validators, while the Fantom Foundation maintains Opera validators for an indefinite period of time.

We intend to migrate those funds as rewards for Sonic validators, while the Fantom Foundation maintains Opera validators for an indefinite period of time.

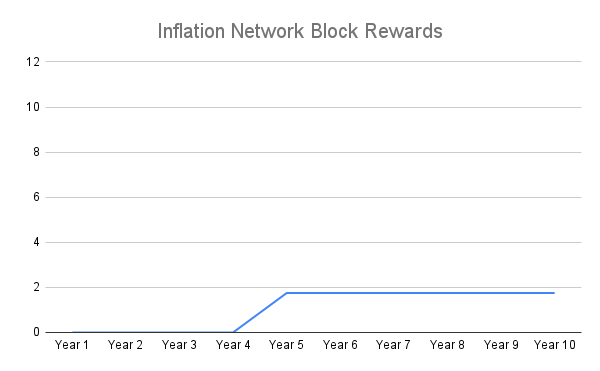

As outlined below, Sonic’s Annual Percentage Yield (APR) target is 3.5% per year. To ensure this is achievable without inflation in Sonic’s first four years, the network will migrate the remaining $FTM block rewards from Opera to Sonic as yield for Validators and Stakers in the $S token. As a result, the APR on Opera for Validators and Stakers will diminish entirely upon Sonic’s genesis.

Opera’s remaining FTM block rewards will target a rate range of 0%. Further, new tokens will not need to be minted until year four of the Sonic network deployment for validator security (see chart), retaining value for all $FTM and $S holders and ensuring Sonic will not require new inflationary block rewards at genesis.

Validator/Staker Max-Stake and Yield Targets

Currently, there is a variable up to one-year locking requirement for validators and stakers to achieve the maximum yield on Opera. While this mechanism is beneficial in sustaining network security, it impedes capital efficiency of the staked tokens and their potential to benefit the network’s DeFi landscape.

Further, this variable lock-in period creates unnecessary complexity for validators and the LSTs built around them via excessive waiting times and long un-delegation processes.

This proposal seeks to reduce the minimum and maximum lock-up period for optimal rewards from Opera’s current one week to one year with a seven day un-delegation model to a simplified hard minimum period of 14 days period without a variable APR scale, and a seven day un-delegation period.

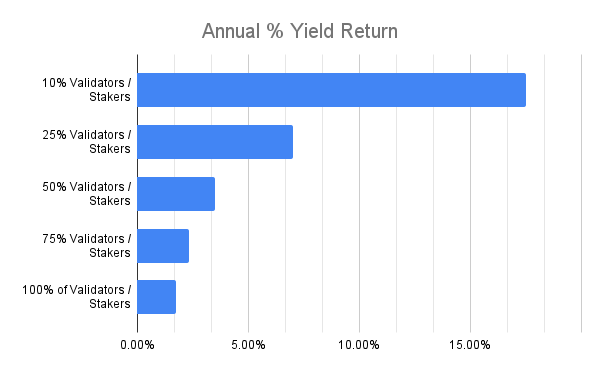

By reducing this locking period and providing more liquidity to validators and stakers, we target a 3.5% return when ~50% of the network is staked and realize a 1.75% inflation rate per annum. The graph above outlines this target yield for each percentage of the network staked. The minimum and maximum lock-up period and target rate will both change at the start of the Sonic network.

As mentioned above, this rate will be sustained for the first four years by migrating the remaining $FTM block rewards for the Sonic Network in the form of $S. At the end of this time period, new tokens will be minted from the network to ensure this target rate (and the security of the network) is properly and consistently maintained.This may be modified by a new governance proposal that passes before this four year period ends.

Burn and Gas Monetization (GasM)

The proposed 3.5% target block reward rate ensures the Sonic network can continue to support its applications. By locking in this reward rate for validators, the network can increase its token burn and provide higher fees for builders as outlined below:

- Non-GasM Participants: 50% of the transaction fee will be burned, and the remaining will be tipped to validators.

- GasM Participants: Up to 90% of the reward will be allocated to an exclusive number of dApps’, with the remaining amount sent to validators as a fee.

GasM is a novel method of rewarding builders on Fantom for the demand they drive to the network. Sonic’s scalability allows the network to offer up-to 90% “cash back” on gas used for an exclusive number of dApps.

The number GasM applications will require an approval of at least 55% approval and 10% quorum through any voting mechanism available on chain (e.g. fwallet governance, snapshot).

Potential Gas Fee Allocations

| Opera | Sonic (Non-GasM Tx) | Sonic (GasM Tx) | |

|---|---|---|---|

| Burn | 5% | 50% | 0% |

| Fee to validators | 70% | 45% | 10% |

| Vault > S.C.C | 10% | 5% | 0% |

| Gas Monetization | 15% | 0% | 90% |

| Total | 100% | 100% | 100% |

Burn and GasM: An Example

- Scenario:

- 50% of transactions from GasM participants, 50% burned/validators.

- Average cost of 1 cent per transaction.

- Network Capability: Sonic network can handle 100M+ transactions per day.

- Forecast: With increased spending on business development and marketing, we anticipate a significant impact on transactions.

- Projection:

- The network is capable of high throughput and scaling to 100M+ transactions per day. Just achieving 10 million transactions per day alone would result in:

- ~$0.1 million inflow per day

- ~$36.5 million inflow per year

- ~$9.125 million burned per year

- ~$10.095 million paid as bonuses to validators

- ~$16.425 million paid to Sonic developers and builders

- This projection utilizes less than 1/10 of the network’s capability

- The network is capable of high throughput and scaling to 100M+ transactions per day. Just achieving 10 million transactions per day alone would result in:

Sonic Labs Ecosystem Vault v2

The Fantom Ecosystem Vault 2 was initially launched to fuel the community ecosystem by sharing a percentage of total gas fees used with select Dapps in the community. You can learn more about this initiative here 1.

To extend this program to the Sonic network, we will revise the program to allocate quarterly disbursements from the Ecosystem Vault to the Sonic Community Council (SCC), 1 an independently operated collective of ecosystem members who actively contribute to elevating the Sonic community via user-based programs, assisting with developer onboarding, and dApp support. The amount will be decided at the discretion of the Sonic Foundation and reflect the SCC’s previous quarter performance.

What happens to Opera Validators?

This proposal requests validators grant the Foundation the authority to create and activate a “Migration Validator/Staker Unlock” on the day of the Sonic launch, enabling all validators to lock up at that time on Opera to access the Sonic network immediately. After discussions with many large validators, we are confident a significant majority of the network will migrate to start validating on the inception of the Sonic network.

While we anticipate an overwhelming majority (> 90%) of $FTM tokens will convert to $S, the Opera network will continue to operate as a decentralized network if the Foundation does not hold a majority of the validating power.

Next Steps

Upon passing, this governance vote will finalize the tokenomic migration plan with a concise Sonic white paper in the works, including information regarding all previous governance votes.

Outline of Governance Proposal

- Reducing the max and min lock-up period for validators and stakers from one year to 14 days.

- Migrate the remaining $FTM from the remaining validator block rewards from Opera to Sonic upon its mainnet launch.

- Target a 3.5% yield for validators and stakers when 50% of the network is staked through inflation (Inflation from rewards starting 4 years post-Sonic launch)

- Increase potential GasM distribution to as much as 90% with the remaining burned

- Increase burn for non-GasM transactions to 50% with the remaining tipped to validators

- Right to create the “Migration Validator/Staker Unlock” as described above.

Voting

Do you agree with the outlined proposal covering gas mechanics, inflation rate, burn, lock-up period, and migration of block rewards?

- Yes

- No

- I want different options

👉 VOTE NOW

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.