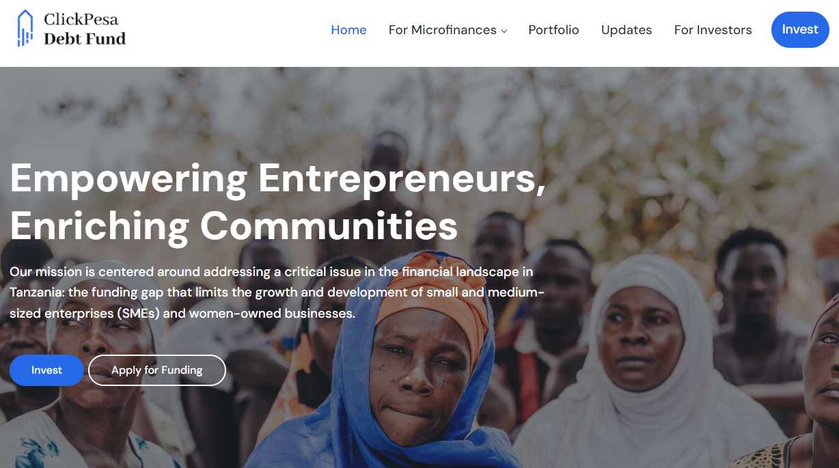

Small and medium-sized enterprises (SMEs) and women-owned businesses are the backbone of Africa’s economy, but many face significant barriers when seeking access to financing. To address these challenges, ClickPesa has created the ClickPesa Debt Fund. Built on the Stellar blockchain and powered by its smart contracts platform, Soroban, the ClickPesa Debt Fund is a DeFi fund designed to empower SMEs and women-owned businesses to grow and thrive.

What is the ClickPesa Debt Fund?

The ClickPesa Debt Fund is a dedicated debt facility that provides capital to ClickPesa MFI, which is an innovative platform designed by ClickPesa to provide capital via microfinances institutions (MFIs) to hundred thousands of SMEs of women-owned businesses. By utilizing blockchain technology, the fund ensures transparency, security, and efficiency in every transaction, making it a sustainable and scalable solution for financing SMEs across Africa.

SME I Lending Pool

The fund is launching a DeFi lending pool called SME I Pool using Script3’s open source DeFi lending protocol Blend.

Terms

The SME I lending pool is seeking to borrow between 50,000 USDc and 250,000 USDc, opening the door for both small and large participants looking to be part of in its mission. The loan period for SME I Pool is set at 1 year, with a quarterly repayment schedule. Participants can expect an interest rate of up to 12%, distributed on a frequent basis throughout the period.

Structure and Governance

Given the involvement of Real World Assets (RWAs), the operational processes are overseen by a specialized entity, CDF SME Limited, which acts as a bankruptcy-remote vehicle. This legal structure ensures the separation of the assets of the fund from other corporate obligations, providing additional assurance of stability.

Collateral

ClickPesa Collateral Token (CPCT)

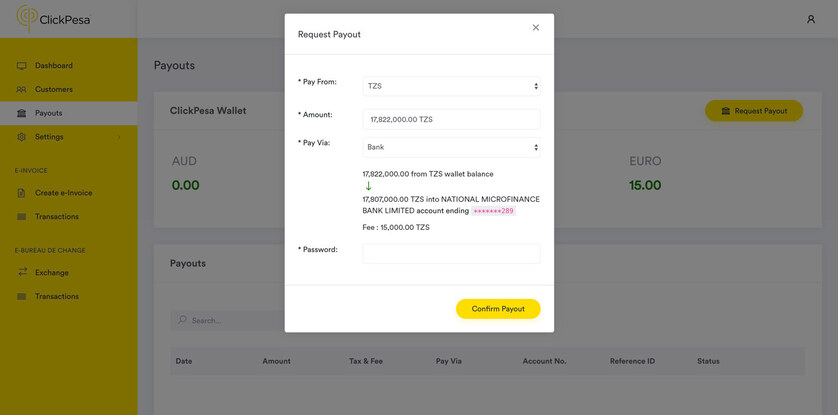

At the core of the lending pool’s collateral is the ClickPesa Collateral Token (CPCT). These tokens represent the loan books of MFIs and CPCT is pegged one-to-one with USDc. For this pool, these token are backed by the loan books of two MFIs, with a total loan book value of 1,400,000,000 TZS (approximately 515,000 USD). These tokens are supplied as collateral to the DeFi lending pool. The CPCT tokens (515,000 CPCT) are fully supplied as collateral to borrow USDc provided to the lending pool by participants and will only be withdrawn after the lending period ends.

At the core of the lending pool’s security is the ClickPesa Collateral Token (CPCT), these tokens represent the loan books of MFIs and CPCT is pegged one-to-one with USDc

By borrowing up to 250,000 USDc, we ensure the lending pool is overcollateralized, maintaining always a Loan-to-Value (LTV) ratio of less than 50% (250,000 USDc / 515,000 CPCT) . In the event that any of the MFIs default on their loans, the tokens serves as a claim on the total loan book, providing protection to participants in the lending pool. This structure ensures security and should give confidence to participants supplying USDc to the DeFi lending process.

Backstop

Blend’s backstop module functions as First Loss Capital (FLC) in the SME 1 pool, where participants agree to absorb the initial losses. It serves as a protective buffer for other pool participants by taking on the highest level of risk. In the event of underperformance or losses, the backstop module (i.e., FLC) is utilized to cover the losses before impacting other participants. For this round, ClickPesa will contribute 5,000 USDc and 20,000 BLND tokens. Each ClickPesa Pool includes a backstop module, and participants will also have the option to participate in it. By doing so, backstop providers can earn Blend tokens and potentially receive interest as a portion of the APR will go to the backstop. This portion is deducted from the APR of borrowers, resulting in the lender lender having less APR than the borrower pays.

Further details regarding the exact mechanics and offering of the SME I Pool will be shared in the near future.

Why participate in the ClickPesa Debt Fund?

- High Impact, High Returns: The ClickPesa Debt Fund enables participants to generate meaningful returns while supporting the growth of SMEs across Africa, particularly women-owned businesses.

- Transparency and Security: Built on Stellar and powered by Soroban smart contracts, the fund ensures transparency and minimizes risks traditionally associated with financial institutions.

- Collateralized Protection: The ClickPesa Collateral Token (CPCT) provides security by backing loans with real, tangible assets in the form of microfinance loan books.

- Bankruptcy-Remote Security: By raising funds through CDF SME Limited, the fund ensures added protection, separating it from other potential risks in ClickPesa’s operations.

- Sustainable and Attractive Returns: With a 1-year loan period, quarterly repayments, and up to 12% interest distributed frequently, the fund offers reliable and attractive returns.

- Sustainability: The ClickPesa Debt Fund promotes long-term economic growth and financial sustainability by providing a steady source of capital to underserved businesses.

ClickPesa Debt Fund’s SME I Pool will launch soon, offering participants a unique opportunity to participate. This initiative allows participants to make a positive impact by contributing to the growth of local businesses while also achieving significant financial returns.

Participating in the ClickPesa Debt Fund means becoming part of a movement driving financial inclusion and economic empowerment across Africa. For more details, reach out to [email protected].

Disclaimer: The ClickPesa Debt Fund and SME I Pool is not regulated by financial authorities and is not protected by any government-backed guarantee or protection scheme. Participation in this fund involves risk, and participants should carefully evaluate these risks before committing. It is highly recommended that participants conduct thorough research and seek professional financial advice to ensure their investment decisions are well-informed and aligned with their financial goals and risk tolerance. ClickPesa does not provide financial advice or assurances regarding the performance of the fund.

The ClickPesa Debt Fund Website

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.