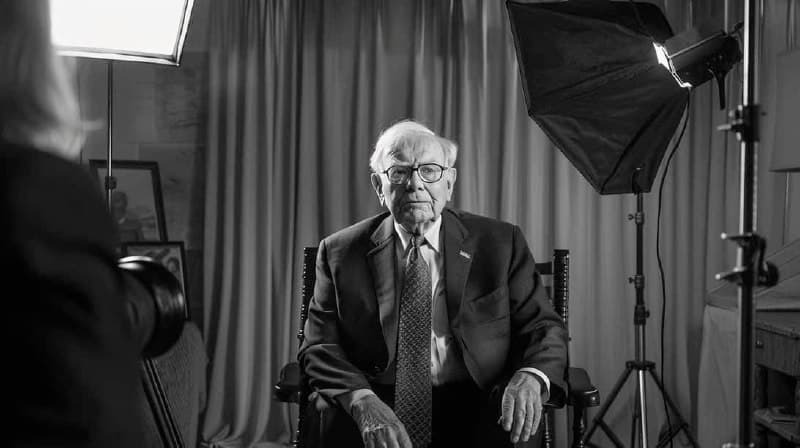

Billionaire Israel Englander, founder of Millennium Management, has significantly increased his stake in Nu Holdings (NYSE: NU), a move that aligns with the investment strategies of Warren Buffett and Cathie Wood.

These high-profile investors, each known for distinct approaches, have found common ground in Nu Holdings, a digital bank making waves in Latin America.

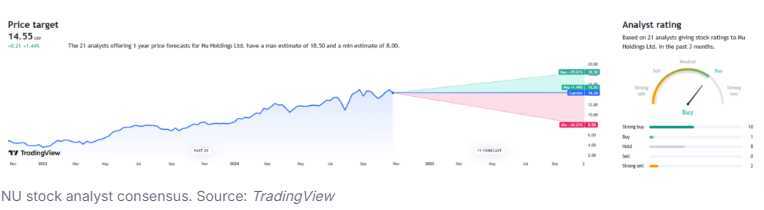

Nu Holdings, a Sao Paulo-based Brazillian neobank, has seen its stock surge by 73% in 2024, currently trading at $14.34.

Nu Holdings: A disruptor in digital banking

Nu’s appeal to investors lies in its groundbreaking approach to banking in historically underserved markets. Operating as a fully digital bank, Nu has streamlined financial services in Brazil, Colombia, and Mexico—regions long dominated by traditional banking behemoths.

With over 104.5 million customers, Nu has captured a significant market share, particularly in Brazil, where it serves more than half of the adult population.

This remarkable growth is attributed to Nu’s intuitive platform and its ability to outpace legacy banks through technological innovation and cost efficiency.

By eliminating physical branches and leveraging technology, Nu has achieved operational excellence, translating into impressive financial results.

In Q2 2024, the company reported a 65% year-over-year revenue increase and a 30% rise in average revenue per active customer.

“Our customer base grew to 105 million customers. The recent launch of checking accounts in Mexico and Colombia has ushered deposits of US$ 3.3 billion and US$ 220 million in those countries, respectively, and fuels our growth expectations in those operations.” – the bank said

Why Englander, Buffett, and Wood are betting big

Warren Buffett, through Berkshire Hathaway (NYSE: BRK.A), was an early believer in Nu. Buffett purchased his stake in the company for almost $750 million in 2021, around its initial public offering (IPO) phase.

Today, Berkshire holds 107 million shares, valued at approximately $1.7 billion. Despite being a small fraction of Berkshire’s massive portfolio, Buffett’s stake in Nu signals his confidence in its long-term potential.

On the other hand, Cathie Wood’s ARK Innovation (ARKK), through its Fintech Innovation ETF, has acquired 2.12 million shares, worth $30.3 million. These positions highlight a shared belief in Nu’s growth trajectory despite their otherwise divergent investment philosophies.

Nu’s profitability has also caught the eye of Millennium Management, which increased its stake by 371% in the last quarter.

The company has posted GAAP net income for six consecutive quarters, an impressive feat for a fintech in growth mode.

Revenue soared 65% year-over-year in Q2 2024, driven by a 30% increase in average revenue per active customer. Nu’s efficient model allows it to scale without a corresponding rise in costs, as evident from its expanding net interest margins, which climbed from 18.3% to 19.8%.

What’s Next: High expectations for Q3 earnings

All eyes are now on Nu’s Q3 earnings report, scheduled for release on November 13. Analysts project $2.9 billion in revenue, reflecting a 39% year-over-year increase, with earnings per share expected at $0.11.

The market will be watching closely for updates on Nu’s loan portfolio, delinquency ratios, and the broader economic outlook in its key markets.

Additionally, analysts maintain a cautiously optimistic outlook for Nu Holdings over the next 12 months, with the stock rated as a ‘buy’ on TradingView. However, the overall price target remains conservative, reflecting expectations of only modest upside potential.

That being said, Englander’s decision to copy-trade two of the most respected names in investing may turn out to be a brilliant move as Nu positions itself for even greater success in the rapidly evolving digital banking space.

This trio’s alignment on Nu Holdings shows the company’s potential to dominate the fintech landscape, making it a must-watch stock for growth-oriented investors.