A new asset and wealth management survey by PwC appears to show differences in appetite between asset managers and the institutional investors that they serve. That particularly relates to digital assets and tokenization.

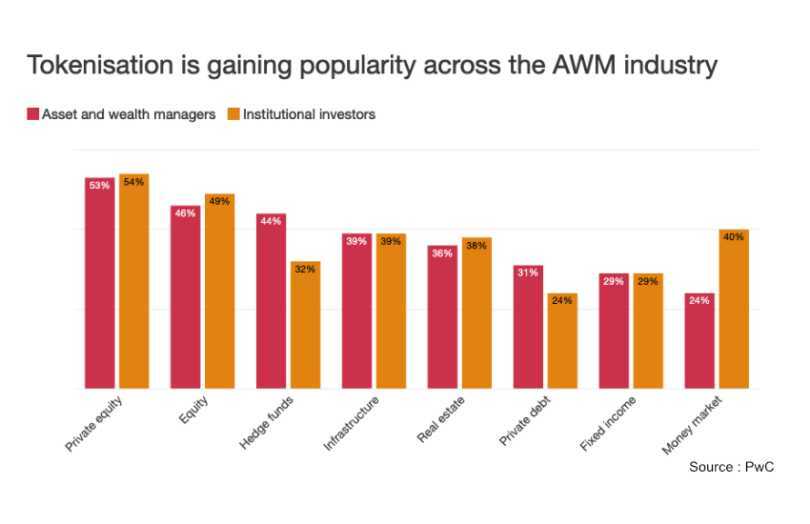

One of PwC’s questions explored which sectors institutional investors are interested in when it comes to tokenization. The biggest gap was money market funds, despite the topic grabbing plenty of press headlines. While 40% of institutional investors hold or plan to hold tokenized money market funds, only 24% of asset managers offer or intend to offer them.

In two other areas, asset managers may have overestimated investor interest: the tokenization of hedge funds and private debt. Asset managers consider private debt as a desirable area (31%) for tokenization, but it looks like there’s less interest from investors (24%). Both asset managers and investors agreed that the most attractive sector for tokenization is private equity.

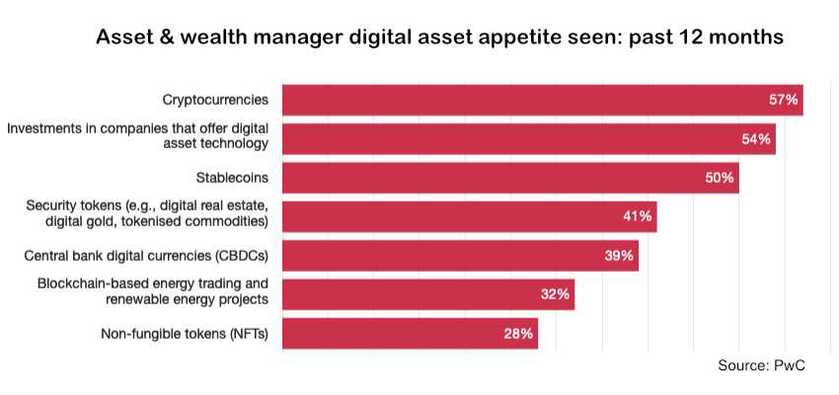

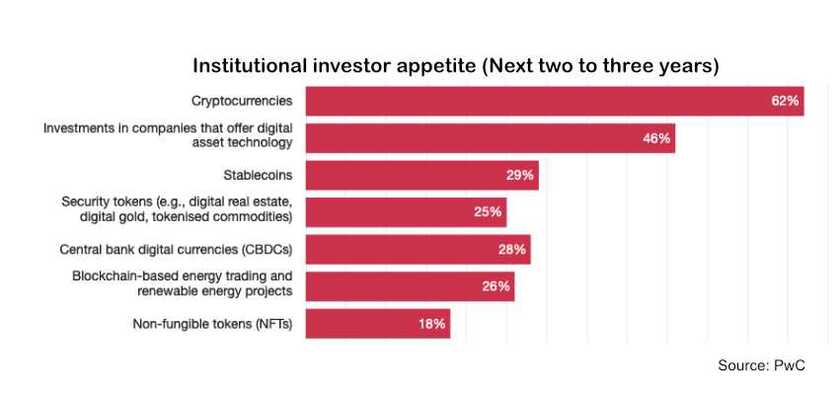

Another of PwC’s questions was less clear cut because of different time frames. It asked asset and wealth managers which digital assets were in the highest demand in the past 12 months. Whereas it asked investors which digital assets they are most interested in over the next two to three years.

Crypto dominates

Asset managers said crypto (57%) was slightly ahead of investing companies in the sector (54%), with security tokens in fourth place at 41%. Looking forward, investors are far more interested in crypto (62%) compared to any other type of digital asset. Investments in digital asset companies came second at 46%, with security tokens in sixth spot at 25%.

With some surveys, the devil is in the detail, such as who the pollster classifies as an institutional investor? If a large proportion are crypto specialists, then it can bias the results. PwC said that 264 asset managers took part and 257 investors. More than half managed assets of over $10 billion.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.