What is happening on Stellar, and what are real use cases?

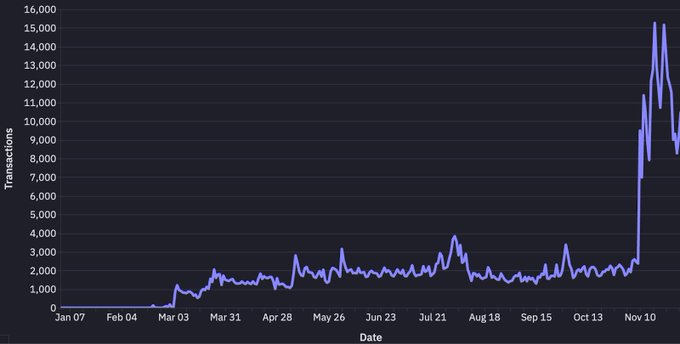

How does activity look on Soroban, Stellar's smart contract platform launched in 2024?

.

I’ve been in the fintech, payments, and insurance industries for two decades now. Prior to joining SDF, I led product partnerships and business development for Universal Access at Plaid, a leading financial data network company, built and scaled Root Enterprise with a focus on B2B solutions, and drove revenue growth and partnerships for PayPal’s North America business. I’m thrilled to now have the opportunity to leverage all that experience to lead and scale financial services and technology businesses to support the growth of the Stellar ecosystem.

Throughout my career, I’ve been driven by the goal of creating broad and equitable financial access through technology. SDF’s mission to create more equitable access to the global financial system by supporting the Stellarblockchain directly aligns with my goals to drive greater access through innovative technology. As the child of parents who immigrated from India, I saw firsthand the challenges they faced, from accessing affordable credit to sending money home. These experiences have fueled my passion to make financial services more inclusive and accessible.

There are so many examples of real world users leveraging Stellar-based solutions to access financial services in ways they’ve never been able to before, from freelancers getting paid all over the world, to refugees receiving cash aid in Ukraine, to defi lending protocols that are helping power microfinance programs in new ways. One of the stories we highlighted most recently comes out of San Francisco, Colombia. The Decaf app, built on Stellar, has transformed life for a community providing a safe, blockchain-based payment solution. This real-world application addressed a critical issue faced by entrepreneur Zac Borrowdale, who was shot while carrying cash to pay his workers. Utilizing Decaf and MoneyGram's on/off-ramps on the Stellar network, workers can now receive payments safely and cash out locally, eliminating dangerous cash transports. This solution has particularly empowered women in the workforce, contributing to the town's revitalization. I highly recommend taking 11 minutes out of your day towatch the video:.

Real world utility is something that SDF is very focused on. SDF’s goal is to create a more equitable global financial system that works for everyone, no matter where they live or what level of traditional financial services they may have access to. We believe that the best solutions to the problems people have are likely to come from within those communities. The Decaf use case in Colombia is a great example. The traditional financial system in Colombia created some real problems for Zac and his workers. Decaf is designed to solve those problems with communities like San Francisco, Colombia in mind. Product-market fit is so important for web3 technology and I think sometimes things get celebrated on crypto twitter that are not solutions for a problem that people have. If the goal is to grow adoption of blockchain technology, that technology needs to be solving problems for real people. At the Stellar Development Foundation, we are extremely outcome-oriented and we are looking for pragmatic solutions to difficult problems. We have a mission and are focused on that.

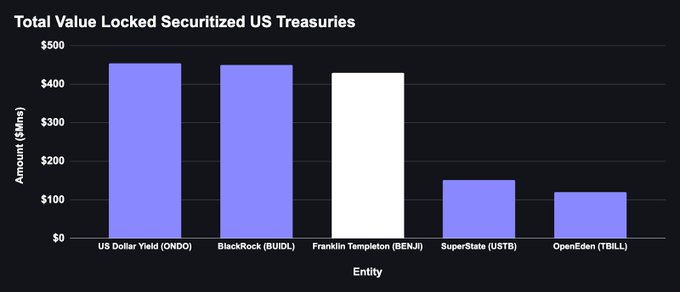

Integrating new defi protocols like Blend with the payment infrastructure built over the last 10 years on the network is the Stellar ecosystem's superpower. Wallets and applications already serving users in global markets with global on and off-ramps can now plug into DeFi protocols and offer new opportunities like staking, lending, and borrowing while still being able to cash in and out without needing a bank account. This is what we mean when we give people access to "everyday financial services." To date, we’ve seen longtime Stellar project, ClickPesa, integrate with Blend to offer a new net offering, The ClickPesa Debt Fund, a platform for global investors to generate financial returns while supporting microloans for small and medium businesses in Tanzania. Meru, the one of the first wallets to directly integrate with Blend on Stellar, is seeing an exciting response to the now available new offerings. Giving the global majority access to savings, lending, borrowing, and more in a single application will change the game. It's never been easier to onboard users into DeFi.

We celebrated 2 years of MoneyGram Access, the first-of-its-kind cash-to-crypto solution, this year. It has been monumentally important in expanding what builders can do on Stellar, and who they can reach. When we launched this with MoneyGram, the goal was to solve the last mile problem that no other network had solved, and to expand the utility and use of digital assets by creating a seamless bridge between cash and crypto that allowed a new wave of users to access the digital economy (no bank account required). One of the most exciting things to me about rolling out a solution like this globally, is seeing how people use it in the real world. We started with 2 wallet integrations, and now 30 wallets have either integrated or are in the pipeline. Since launch, we’ve seen an average transaction size of about $480 dollars. The top cash in country is the US (also the top country for sending remittances), while the top cash out countries are Ukraine, Colombia, Mexico, Argentina (which are either developing/emerging economies or in Ukraine’s case, going through a rebuilding process). What we’re observing tracks with SDF’s thesis from the outset, which was that this solution is providing new utility for things like remittances, in small but meaningful amounts, in key markets. It also became the foundation for transformational solutions like Stellar Aid Assist and the Stellar Disbursement Platform. Now, with the Stellar smart contracts platform Soroban and cash-to-DeFi capabilities, we’ve entered a new phase of seeing what builders and users will do with this utility.

The Stellar integration with Artemis is about making blockchain data more accessible and meaningful. It's exciting for three key reasons: First, it gives us a clearer window into all the incredible activity happening on the Stellar network. Think of it as turning on the lights – suddenly we can better showcase the innovative projects and real-world solutions being built on Stellar. Second, it's a game-changer for analysis. Whether you're a researcher studying blockchain trends or a developer evaluating different platforms, Artemis makes it easier to understand how Stellar fits into the bigger picture of blockchain adoption and usage. Finally, and this is particularly cool, it democratizes access to Stellar data. By presenting the network data in Artemis's user-friendly "ez" table format, we're making it simpler for anyone in the Stellar ecosystem to conduct their own analysis and create reports. If you're already familiar with Artemis, you'll find it intuitive to start exploring Stellar data right away. Artemis isn't just about metrics – it's about transparency, understanding, and empowering the community with better tools to tell the Stellar story.

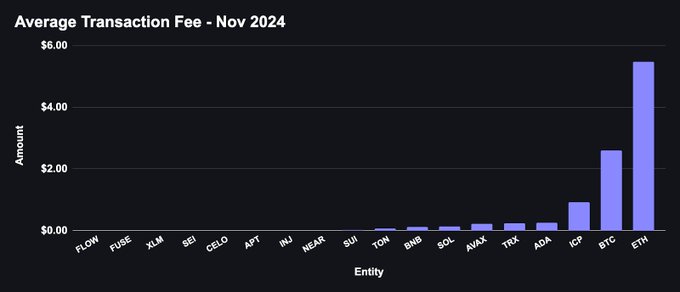

Key metrics: Stellar KPI Deep Dive vs Blockchains

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.