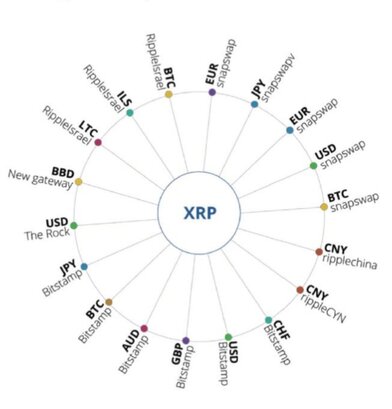

XRP is designed to work as a universal bridge currency by facilitating seamless value transfer across different fiat and cryptocurrency systems. Its utility in this role is supported by the technology of the XRP Ledger (XRPL), which enables fast, low-cost, and highly scalable transactions.

Here's how it achieves this:

⚈ Liquidity for Cross-Border Payments: XRP acts as an intermediary asset in cross-border transactions. When a currency needs to be exchanged between two fiat currencies that lack a direct trading pair, XRP provides liquidity by serving as a bridge currency. For instance, USD can be converted into XRP and then into EUR, reducing friction and costs.

⚈ Speed and Efficiency: Unlike traditional systems that can take days to settle transactions, XRP transactions settle in 3-5 seconds on the XRPL. This makes it ideal for real-time cross-border payments.

⚈ Low Transaction Costs: The cost of transacting on the XRP Ledger is minimal—fractions of a penny—making it an economical choice for micro and macro transactions alike.

⚈ Neutral Asset: XRP is not tied to any one country, central bank, or fiat currency, making it an impartial intermediary that can work across jurisdictions and systems.

⚈ On-Demand Liquidity (ODL): Ripple, a company which utilizes XRP, has developed the ODL service to eliminate the need for pre-funded nostro accounts. Instead of holding reserves in foreign currencies, financial institutions can use XRP to source liquidity instantly when transferring funds internationally.

⚈ Scalability: The XRP Ledger can handle up to 1,500 transactions per second (tps), far outpacing Bitcoin or Ethereum, making it capable of supporting global-scale payment systems.

These attributes position XRP as a potential cornerstone for creating a more interconnected financial ecosystem, bridging traditional finance with the rapidly evolving cryptocurrency world.

XRP serves as a universal bridge currency by enabling faster, cost-efficient cross-border payments while minimizing reliance on traditional systems like SWIFT. Its core strength lies in its role within Ripple’s On-Demand Liquidity (ODL) system, where it bridges different fiat currencies, removing the need for pre-funded nostro accounts. This drastically reduces transaction times—from several days to just seconds—and cuts costs for financial institutions and their customers.

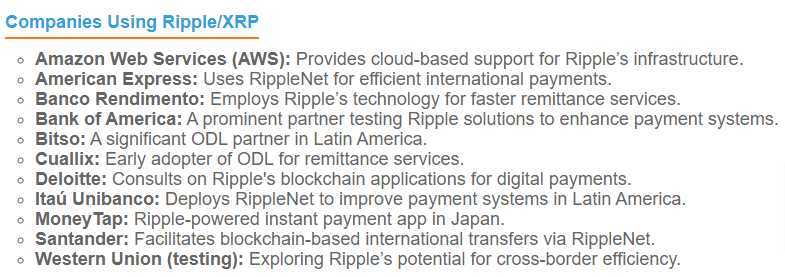

The XRP Ledger facilitates these payments securely and transparently, providing real-time settlement at a fraction of traditional fees. Global corporations, central banks, and financial institutions like Santander, Bank of America, American Express and HSBC have adopted Ripple’s technology to enhance their payment infrastructure.

By streamlining currency conversions and enabling 24/7 operations, XRP positions itself as a key enabler of seamless global trade and financial inclusivity. XRP operates as a universal bridge currency by addressing critical inefficiencies in the traditional banking and payment ecosystem.

Here are some key real-world use cases:

1. On-Demand Liquidity (ODL)

Ripple’s ODL system uses XRP to instantly bridge currency pairs, facilitating cross-border transactions without the need for pre-funded accounts in destination countries. This drastically reduces the cost and time associated with international payments. Companies like Santander and financial platforms in regions such as Southeast Asia and Latin America are already leveraging this technology to enable real-time remittances.

.

2. Improving Financial Inclusion

By reducing reliance on traditional banking rails, XRP allows smaller financial institutions and remittance providers to compete in the global market. This opens up affordable and rapid payment corridors in emerging economies, enabling better access to financial services for underbanked populations.

.

3. Liquidity Management

Banks often maintain large reserves in multiple currencies (nostro accounts) to handle international trade. XRP eliminates this requirement, providing liquidity on-demand and freeing up billions of dollars tied up in reserve accounts. This is particularly beneficial for businesses engaging in multi-currency trade

.

4. Integration with Central Bank Digital Currencies (CBDCs)

Ripple has been working with various central banks to integrate XRP as an intermediary for cross-border CBDC interoperability. By enabling seamless transfers between different national digital currencies, XRP can play a crucial role in the global adoption of CBDCs.

5. Payment Transparency and Security

The XRP Ledger offers secure, real-time transaction tracking with robust cryptographic safeguards. This transparency and reliability make it attractive for institutions managing high-value, time-sensitive transactions

For anyone interested in understanding the functionality and potential of XRP and the XRP Ledger, the official documentation at xrpl.org is an invaluable resource. This comprehensive guide provides insights into the fundamentals of the XRP Ledger, its decentralized architecture, and how it facilitates real-time, low-cost transactions globally. Whether you're a developer looking to build applications, a financial professional exploring use cases, or simply a curious enthusiast, the documentation offers detailed explanations, technical guides, and tools to help you navigate this transformative blockchain ecosystem. Visit this link to deepen your knowledge and explore the possibilities XRP can unlock!

In conclusion, XRP's role as a universal bridge currency is a transformative step toward redefining global financial systems. By eliminating the inefficiencies of traditional payment rails, such as slow settlement times and costly pre-funded accounts, XRP enables real-time, cost-effective transactions on a global scale. Through On-Demand Liquidity, partnerships with financial institutions, and potential integration with CBDCs, XRP is positioning itself as a cornerstone of modern cross-border payments. Its versatility, security, and scalability make it a critical enabler of financial inclusion and innovation, paving the way for a more interconnected and efficient global economy.

Disclaimer: This content is for informational purposes only and should not be considered financial advice. Please consult with a licensed financial advisor before making any investment decisions.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.