In Brief:

- What’s next for DeFi in 2025?

- We reveal the trends we will look closely at next year.

Happy New Year from everyone here at DL News!

Last year I made some bold predictions for 2024: That permissioned DeFi would roar into life, and that modularity-focused projects EigenLayer and Celestia would redefine the DeFi landscape.

EigenLayer, despite drawing in billions in deposits, hasn’t seen much adoption of its validation services yet. Celestia, too, has been hampered by a lack of demand for its services.

Development for hooks and Uniswap v4, which will make permissioned DeFi a reality, is still ongoing, but 2024 was certainly not a breakout year.

As 2024 draws to a close, join me as I take another stab at predicting the key DeFi trends for the coming year.

TradFi dives into DeFi

This year, several Wall Street firms continued dipping their toes into DeFi.

Asset manager BlackRock launched its BUIDL fund on Ethereum in March, then expanded it to five other blockchains in November.

Rival State Street inked a partnership with crypto custody and tokenisation platform Taurus, while interest in Franklin Templeton’s US Government Money Fund steadily grew.

Over in Europe, Deutsche Bank announced earlier in December that it’s building its own Ethereum layer 2 to address the regulatory challenges of using DeFi.

But these moves may only be the start of a larger push from institutions to utilise DeFi.

In 2025, “traditional institutions are likely to transition onchain faster than expected,” Paul Frambot, CEO and co-founder of DeFi lending protocol Morpho, told DL News.

Fatmire Bekiri, head of tokenisation at Sygnum Bank, said she expects more traditional financial players to enter DeFi in 2025, fulfilling investor demand for riskier onchain products.

Unclear crypto regulations — particularly in the US — meant many financial institutions held off on experimenting with DeFi, lest they fall foul of securities laws.

But with a pro-crypto Trump administration just around the corner, that could soon change.

“People are still trying to figure out what’s compliant,” Colin Butler, Polygon’s head of institutional capital, previously told DL News.

“Once certain things get accepted as collateral at big places, then I think everybody else gets to do it. And that’s when I think you see the L curve for adoption.”

Protocols move to their own blockchains

This year, we saw big DeFi protocols move towards launching their own blockchains, usually in the form of Ethereum layer 2s.

Leading decentralised exchange Uniswap announced in October its developing its own layer 2 called Unichain.

DeFi lender Aave is mulling its own Aave Network as part of its v4 upgrade, and Sky founder Rune Christensen has also suggested building a dedicated blockchain.

There are good reasons for them to do so. Layer 2s are a great source of revenue as those running them can skim off the difference in cost between what they charge users and pay the Ethereum mainnet to finalise transactions.

Having a dedicated blockchain for a DeFi protocol means projects can stop malicious forms of MEV impacting their users, and that they don’t have to share resources and bandwidth with other DeFi protocols, potentially preventing congestion.

Daniel Wang, co-founder of Taiko Labs, the firm behind layer 2 blockchain Taiko, told DL News that he sees more fragmentation within Ethereum and the projects building on it in 2025.

But, Wang said, the increased fragmentation will also place a greater focus on interoperability between the growing number of layer 2 blockchains.

DeFi and fintech unite

My final prediction is that 2025 will be the year fintech apps finally start bringing DeFi to the masses.

We’re already seeing signs some firms are preparing. Robinhood rolled out crypto transfer services to its European customers in October, and neobank Revolut expanded its crypto exchange to 30 markets in the region a month later.

Integrating DeFi could be incredibly lucrative for the first fintech company to do so. Yields far exceed those in traditional finance, but they’ve always been viewed as too risky and difficult for many established players to take advantage of.

That impression could be changing — at least towards DeFi protocols with strong security and compliance records.

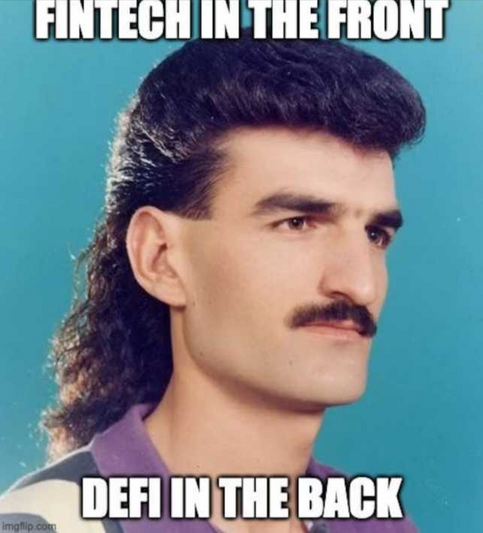

“In 2025, we’ll see the long-awaited adoption of the ‘DeFi mullet’ — where fintech apps integrate DeFi protocols like Aave or Morpho directly for safer and better financial products,” Thomas Mattimore, CEO of ABC Labs, the team behind Reserve Protocol, told DL News.

The “DeFi mullet” refers to the idea that fintech apps will abstract away the complexity and poor user experience of current DeFi protocols, and open access to their users.

Mattimore’s not alone.

Morpho’s Frambot also predicts that in 2025, access to and adoption of DeFi will be propelled by partnerships with fintech companies.

Like with institutions, the more favourable regulatory environment under the Trump administration should give fintechs the confidence to integrate DeFi.

The bigger question is whether DeFi protocols are ready for a large potential influx of investors from fintech apps. Only time will tell.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.