2024 was the most exciting year yet for the Theta ecosystem, as we saw more adoption than ever of Theta among academia, the crypto community, and the corporate world. The key milestone of the past year was undoubtedly the release of Theta EdgeCloud, the first hybrid cloud computing platform built on a fully distributed edge architecture powered by Theta edge network. Launched in May 2024, EdgeCloud’s debut has been a smashing success, with nearly 20 marquee customers onboarding including the NHL’s Vegas Golden Knights, FlyQuest esports, University of Oregon, Seoul National University, Liner, JamCoding and more.

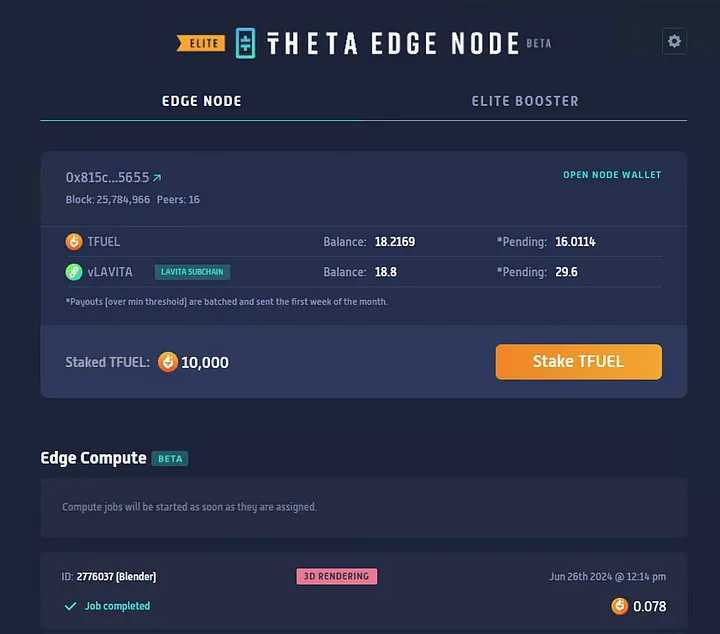

June 2024 saw the release of the Elite Booster upgrade (Edge Node v5.0.2) empowering users to earn even more TFUEL and partner TNT-20 tokens for performing GPU-intensive AI and video tasks. This release greatly increased edge node earnings and enabled all edge node operators to participate in next-gen AI, video and computing jobs on EdgeCloud.

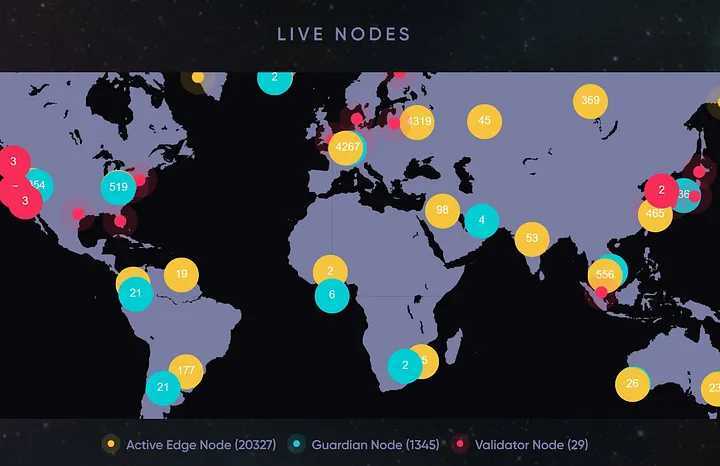

These upgrades coincided with the strong growth in Theta edge network, with more than 20k daily active Edge Nodes across the world and over 30k monthly active nodes. We expect the edge network to continue to expand in 2025 in order to support the increasing number of EdgeCloud customers, and to that end in September 2024 we launched Theta Edge Node for Android devices running calibration jobs with mobile optimized AI object detection algorithms. Over the course of the year, the daily Metachain transactions on Theta network also increased by over 50% and is now approaching 350k transactions per day, driven primarily by our subchain partners Lavita, POGS, Passaways, Grove, Replay, Bullit and others.

In the next year, we envision Theta customers utilizing EdgeCloud, RAG chatbot and AI agents across academia, enterprises, professional sports, esports gaming to begin exploring and deploying their own custom subchains to support transaction intensive, blockchain enabled AI applications, GenAI text-to-video, text-to-3D, LLM chatbots and AI agents. This will be supported by the beta release of the Theta AI Agents platform in the first half of 2025.

Theta’s 2024 roadmap was significant, but we’re proud of the progress Theta made in achieving and even exceeding it. In H1, the EdgeCloud rollout was successful with cloud hosted nodes up and running, a suite of popular GenAI and LLMs, and a host of new partners onboarded in enterprise and academia. EdgeCloud also began offering Agentic AI as a service, empowering businesses with cutting-edge AI capabilities with its first Agentic AI product, the RAG (Retrieval Augmented Generation) Chatbot. Later in the year, persistent storage was added to meet EdgeCloud AI customer needs. The Elite+ Booster feature was rolled out for Elite Edge Nodes, and Studio-level DRM was added to Theta Video API. TDROP was also extended to use as part of OpenTheta marketplace. Though the vast majority of these milestones were hit on schedule, there were a few items on the roadmap that were delayed and pushed back for various reasons. For example, Theta Video API (TVA) was made part of the broader EdgeCloud platform, so the next major update to TVA will come as EdgeCloud itself fully rolls out in 2025. Support for EdgeCloud job prioritization will also come in a 2025 EdgeCloud update, as well as support for users running their own EdgeCloud nodes in data centers or their own personal cloud infrastructure. But aside from these revisions, the 2024 roadmap was largely achieved and we intend on the same for 2025.

Building on these successes, Theta development is pushing forward with an ambitious roadmap for 2025 and beyond. The team is now focused on the next main milestone, the beta release of the hybrid edge cloud architecture on June 25, 2025. This major release will support seamless job orchestration and optimization of compute-intensive workloads across cloud-based GPUs and Theta’s distributed edge nodes run by our community. The hybrid architecture will enable the platform to essentially run any computation jobs that can be “containerized” from AI, video encoding/transcoding, 3D rendering workloads, to GPU-intensive financial modeling, scientific drug research jobs and more.

The main challenge is that edge nodes are heterogeneous with differing specs, capabilities and geo-distributed with about ⅓ in North America, ⅓ in EMEA and the remainder in the rest of the world. These consumer grade GPUs including NVIDIA 3090s, 4090s and the newly announced 5000 RTX series have limited VRAM with various CPU configurations, and not always on which pose technical hurdles. The job orchestration and containerization layer must be intelligent and optimized for the target node with auto failover. The goal over time is to support AI inference including GenAI text-to-image, image-to-image, video transcoding, AI object detection, 3D rendering, chatbots and other AI agent workloads that can be spliced and completed in tandem.

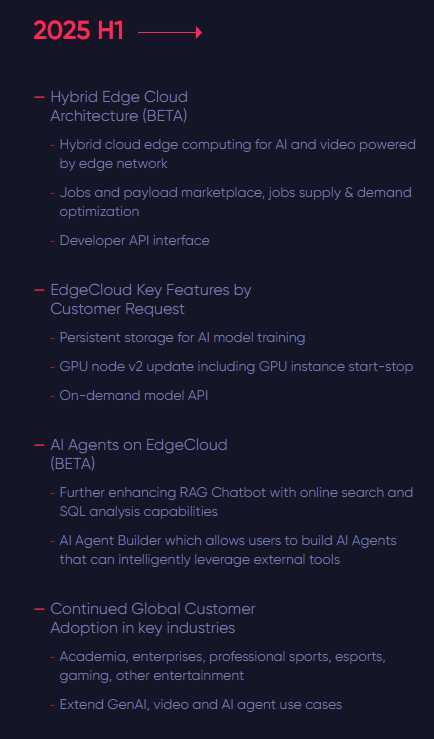

H1 2025 Roadmap

The first half of 2025 will be focused on launching EdgeCloud’s hybrid cloud edge architecture in June and expanding the fast-growing edge network in anticipation of continued demand from customers. This critical EdgeCloud release will fully support a distributed edge architecture across devices, geographies and configurations, the ability to prioritize and opt-out of particular job types, and get analytics of jobs completed. A developer API interface will also be released, building on Theta dev community like previous hackathon winner Thetaform to give developers the tools they need to efficiently develop on EdgeCloud.

Other key features will roll out in response to demand from current EdgeCloud customers, like persistent storage, GPU node upgrades, and on-demand API access to AI models. These features, alongside a beta of the AI Agents platform, will automate the use of AI models with on-chain autonomous interactions to enable a myriad of use cases and lead to continued customer adoption in target key sectors of academia, private enterprise, professional sports and esports.

- Hybrid Edge Cloud Architecture (BETA)

- Hybrid cloud edge computing for AI and video powered by edge network

- Jobs and payload marketplace, jobs supply & demand optimization

- Developer API interface

2. EdgeCloud Key Features by Customer Request

- Persistent storage for AI model training

- GPU node v2 update including GPU instance start-stop

- On-demand model API

3. AI Agents on EdgeCloud (BETA)

- Further enhancing RAG Chatbot with online search and SQL analysis capabilities

- AI Agent Builder which allows users to build AI Agents that can intelligently leverage external tools

4. Continued Global Customer Adoption in key industries

- Academia, enterprises, professional sports, esports, gaming, other entertainment

- Extend GenAI, video and AI agent use cases

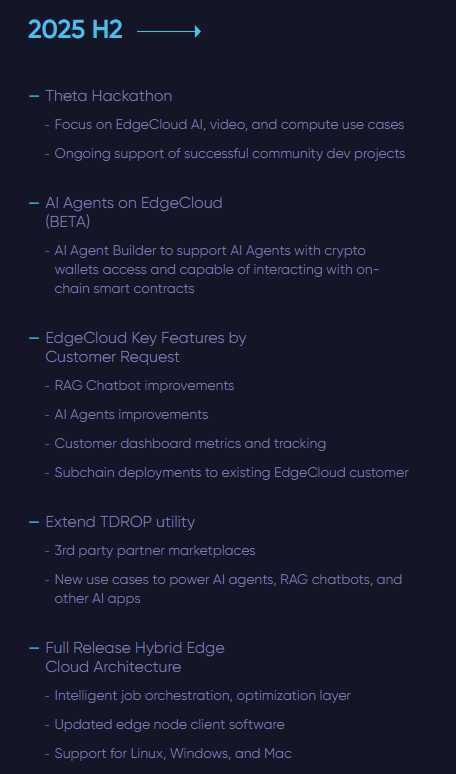

H2 2025 Roadmap

This year we’ll also be expanding the Theta Hackathon to an in-person event with significant ongoing support for the top Theta ecosystem projects. Following the successful template of collaboration with the Vegas Golden Knights, we’re in discussion with several prominent pro sports and esports teams looking to EdgeCloud for their AI strategy with the opportunity to launch subchains to support their business use cases. Third-party platforms are also looking at integrating TDROP as a user engagement token, starting with OpenTheta and with more coming online in 2025. More importantly, we’re also evaluating and potentially re-branding TDROP to extend its utility to AI Agents, RAG Chatbots and other consumer facing AI and video AI applications built on EdgeCloud. Finally, 2025 will be capped with the full release of EdgeCloud’s hybrid edge-cloud architecture, including intelligent job orchestration and optimization, and full support for Linux, Windows, and Mac. This full fledged version of EdgeCloud will represent the world’s most powerful aggregation of decentralized global compute, enabling the use cases of today and tomorrow in AI, video, 3D rendering, GPU-intensive financial modeling, scientific research and more.

- Theta Hackathon

- Focus on EdgeCloud AI, video, and compute use cases

- Ongoing support of successful community dev projects

2. AI Agents on EdgeCloud (BETA)

- AI Agent Builder to support AI Agents with crypto wallets access and capable of interacting with on-chain smart contracts

3. EdgeCloud Key Features by Customer Request

- RAG Chatbot improvements

- AI Agents improvements

- Customer dashboard metrics and tracking

- Subchain deployments to existing EdgeCloud customers

4. Extend TDROP utility

- 3rd party partner marketplaces

- New use cases to power AI agents, RAG chatbots, and other AI apps

5. Full Release Hybrid Edge Cloud Architecture

- Intelligent job orchestration, optimization layer

- Updated edge node client software

- Support for Linux, Windows, and Mac

Conclusion:

The Theta roadmap is always evolving and will continue to be updated along the way as new business opportunities and products emerge, but this overview is a blueprint for what to expect in Theta’s development in 2025. The network will continue to grow to meet new use cases with the help of the community running Edge Nodes, developing ecosystem projects, and collectively building Theta’s future.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.