We recently published our points program article, detailing the assets that qualify for earning points in the S airdrop.

At the top of the list are scUSD and scETH by Rings, with boosted multipliers of 6x and 4x, respectively. You’ll earn more points by holding and using these assets in participating apps.

Why did we boost these assets for the first season of our points program? Rings plays a key role in driving a steady flow of liquidity to apps on Sonic, strengthening its DeFi ecosystem. This helps Sonic become a premier DeFi hub where users can maximize their capital efficiency.

What is Rings?

Rings is a yield-bearing stablecoin protocol, built on Veda BoringVaults and draws inspiration from Blast’s native yield concept and Solidly’s ve(3,3) model.

Let’s break down each of these terms before diving in further.

- Veda BoringVaults

These automated vaults, operated by Veda, optimize yield for deployed assets by farming yield across DeFi protocols on Ethereum. The vaults automate farming strategies and rebalance assets, enhancing capital efficiency. - Native Yield

Native yield enables bridged assets to earn yield on their original chain. Typically, when bridging ETH from Ethereum to another chain, the ETH is locked in a contract, earning nothing. With native yield, that ETH is instead deployed on apps to generate yield while the equivalent ETH is still minted for you on the destination chain. - Solidly’s ve(3,3) Model

The ve(3,3) model by Solidly combines token locking for governance (ve) with game theory incentives (3,3) to reward long-term commitment and cooperative behavior. Users lock tokens to gain voting power and direct rewards to liquidity pools, aligning incentives for ecosystem growth and stability.

Rings revolves around three key assets on Sonic: scUSD/scETH, stkscUSD/stkscETH, and veNFTs, each serving a distinct purpose in the ecosystem. Now that you’re more familiar with the core concepts behind Rings, let’s explore each of these assets.

scUSD and scETH

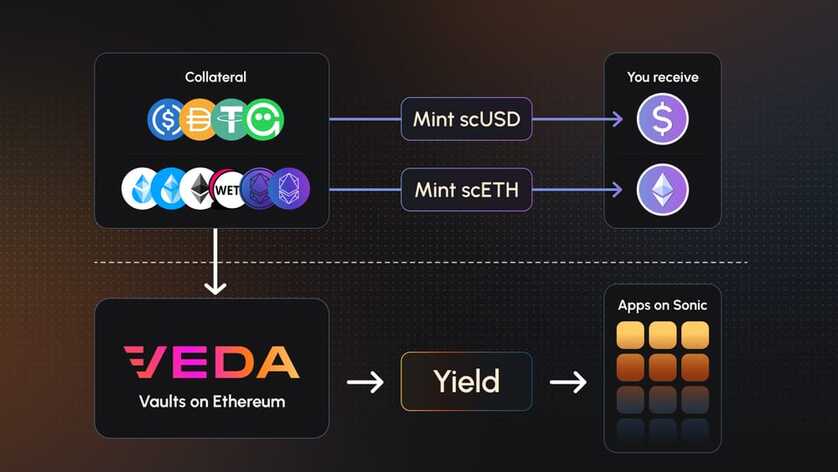

At the core of Rings are scUSD and scETH, tokens on the Sonic network that users can mint fee-free by depositing stablecoins or ETH-based tokens on Ethereum or Sonic. For example, depositing USDC mints scUSD, while depositing WETH mints scETH.

When you mint these tokens, your deposited collateral is sent to Veda-operated vaults on Ethereum. These vaults automatically farm yield through blue-chip protocols like Aave, allowing your original assets to earn yield while unlocking the utility of scUSD or scETH on Sonic.

This is the “native yield” aspect of Rings. However, it’s important to emphasize that this yield is not directly distributed to holders of scUSD or scETH. Instead, it’s distributed as liquidity to apps on Sonic. This mechanism is outlined in the veNFT section below.

stkscUSD and stkscETH

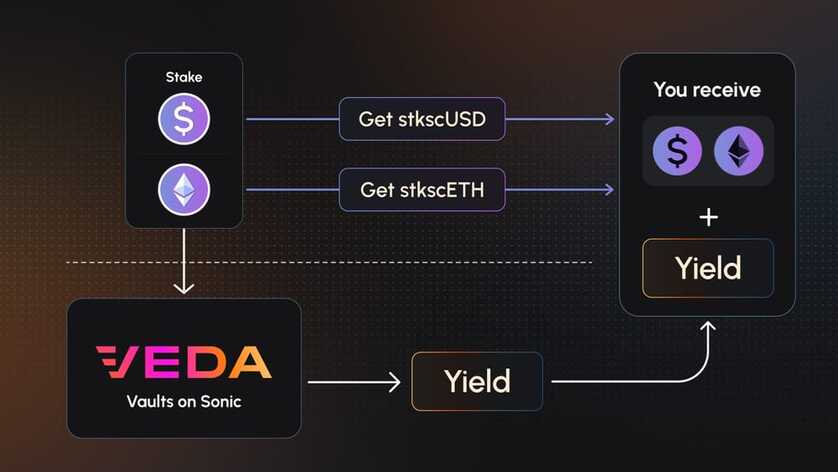

Once you’ve minted scUSD or scETH, you can stake them through Rings on Sonic to receive staked scUSD (stkscUSD) or staked scETH (stkscETH).

This process deposits your scUSD/scETH into Veda-operated vaults on Sonic, where they generate yield through protocols within the Sonic ecosystem. Unlike the yield generated by the collateral on Ethereum, this yield is paid directly to you.

veNFT

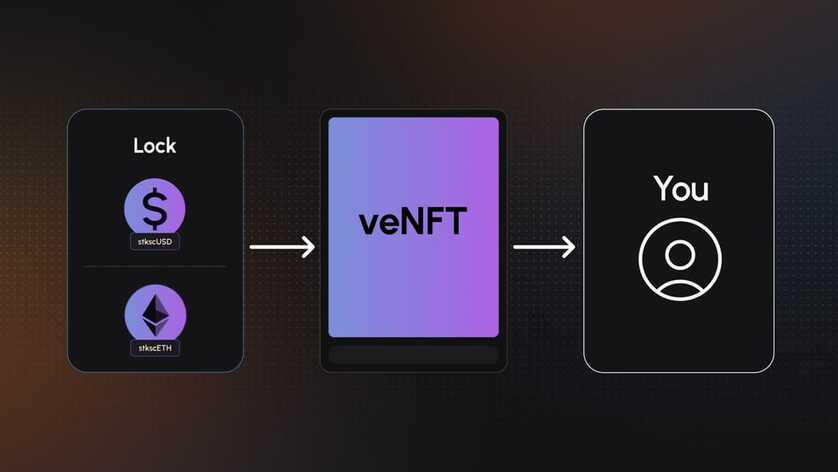

To get a veNFT, you have to lock your stkscUSD or stkscETH; the more tokens you lock and the longer the lock duration, the greater your voting power.

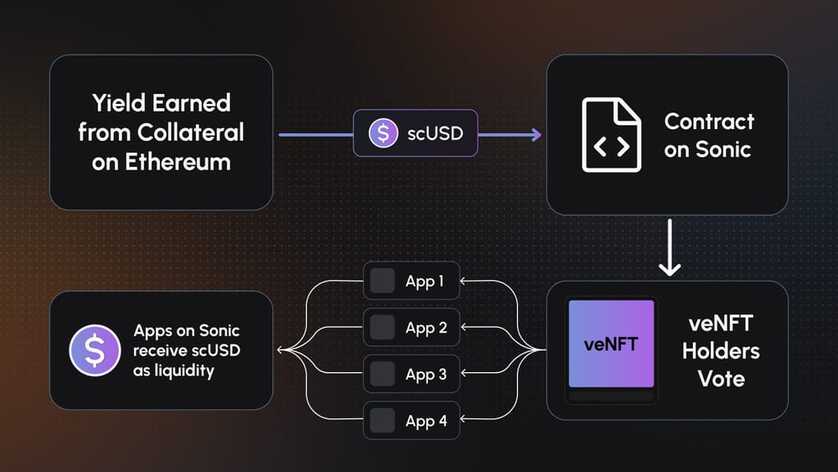

What's the utility of veNFTs? The yield generated by the collateral on Ethereum is used to mint scUSD, which is bridged to Sonic and sent to the “gauge contract”. veNFT holders play a critical role here — they vote on how this scUSD is distributed across different DeFi apps on Sonic, essentially choosing what apps receive an infusion of liquidity.

Since veNFT holders have this gauge voting power, apps on Sonic can offer them vote incentives (also called bribes) to incentivize them to vote for their app. This creates a competitive market where apps compete for liquidity, giving veNFT holders an income stream. This mechanism is the “ve(3,3)” aspect of Rings.

However, by locking your stkscUSD or stkscETH to get a veNFT, you forfeit the staking rewards from your staked scUSD or scETH. As a user, you must decide which is more valuable: the bribes offered by apps for your votes or the yield earned from simply staking.

Earn Points With Rings Assets

As outlined in our points article, by simply holding Rings assets in your Web3 wallet, you’ll be earning passive points for the S airdrop.

However, to make the most of your capital, you can deploy it as liquidity to participating apps on Sonic to earn additional activity points. Most apps on Sonic have opportunities to deploy your scUSD, scETH, stkscUSD, or stkscETH, such as DEXs or lending protocols.

A complete list of participating apps will be available on the airdrop dashboard at launch. In the meantime, you can start exploring the diverse range of apps on Sonic by following our Sonic Ecosystem account on X. Please note that the account offers no financial advice or endorsements. Use apps at your own risk.

Further Information

— Audits

— Contract Addresses

— Rings Documentation

— Veda Documentation

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.