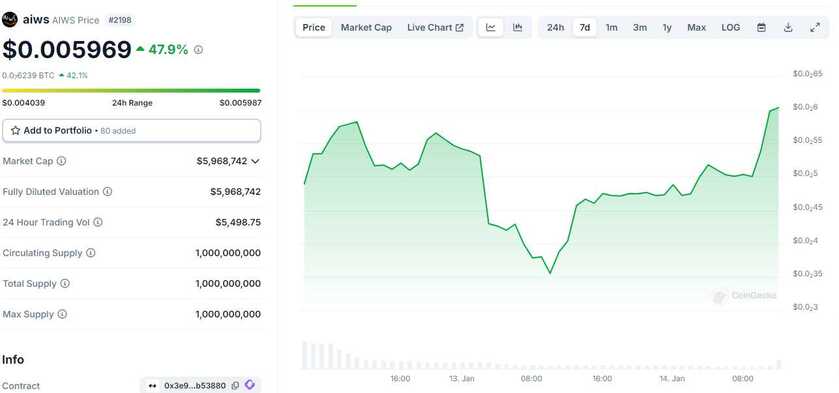

Disclaimer: I do own $AWIS as of recently. Please note that this is not financial advice. Any investment decisions should be based on your own research and consideration of personal financial goals. Always consult with a professional financial advisor before making any investment decisions. 📊💼

Unlocking the Power of Agentic Protocols: A New Paradigm in Autonomous Systems

Introduction

Agentic protocols are fundamentally redefining the operational paradigms of autonomous systems, fostering environments where independent agents execute tasks, interact, and achieve shared objectives without the necessity of direct human oversight. These systems hold immense promise across disciplines such as artificial intelligence (AI), blockchain technology, and the Internet of Things (IoT), driving innovation and enabling new technological applications.

This discourse aims to elucidate the concept of agentic protocols, delineate their underlying principles, assess their multifaceted advantages, examine their practical applications, and critique the challenges and ethical considerations they entail. Through this exploration, the transformative potential of agentic protocols within modern technological ecosystems will become evident.

What Are Agentic Protocols?

Agentic protocols constitute a set of governing principles and procedural frameworks that dictate the interactions and operations of autonomous entities, or "agents." These agents are computational entities capable of making informed decisions and executing actions aligned with predefined objectives. Common examples include machine-learning-enabled bots, intelligent sensors, and decentralized autonomous applications.

The essence of these protocols lies in structuring interactions. For example, in a transportation network, autonomous vehicles leveraging agentic protocols can collaboratively negotiate lane changes, traffic flow, and optimal routing. Such structured autonomy enables seamless coordination, minimizes systemic inefficiencies, and enhances overall operational efficacy.

Core Principles of Agentic Protocols

Agentic protocols are predicated upon four foundational principles:

1. Autonomy

Agents operate with a high degree of independence, eschewing continuous human guidance. For instance, unmanned aerial vehicles (UAVs) performing package deliveries can dynamically reroute based on evolving meteorological conditions or logistical constraints.

2. Interoperability

The ability of agents to interact across heterogeneous systems is critical. An example is the interaction between smart home devices, such as thermostats and photovoltaic systems, to optimize energy consumption collaboratively.

3. Decentralization

Decentralized structures eliminate single points of control or failure, thereby enhancing resilience. Blockchain platforms exemplify this principle through decentralized finance (DeFi) ecosystems, where smart contracts execute financial transactions autonomously.

4. Scalability

Agentic systems inherently scale to accommodate expanding networks of agents. For example, in a supply chain network, the addition of new warehouses or autonomous delivery vehicles integrates seamlessly, maintaining operational coherence.

These principles collectively position agentic protocols as vital enablers of complex, distributed technological systems.

Benefits of Agentic Protocols

1. Enhanced Efficiency

By facilitating real-time decision-making, agentic protocols significantly streamline processes, reducing delays and maximizing resource utilization. Autonomous systems in logistics exemplify this by dynamically optimizing delivery routes and schedules.

2. Increased Resilience

Decentralized architectures foster robustness against disruptions. A decentralized energy grid, for instance, can maintain operational continuity despite localized failures within the network.

3. Adaptive Problem-Solving

Agentic protocols equip systems with the agility to navigate dynamic and unpredictable environments. Autonomous drones engaged in disaster response exemplify this capability, adapting mission parameters to real-time exigencies.

4. Synergistic Collaboration

The integration of agentic protocols enhances human-machine collaboration, enabling AI-driven systems to complement human expertise effectively. This hybrid approach is evident in sectors like healthcare, where decision-support systems assist clinicians in diagnostics and treatment planning.

Applications of Agentic Protocols

The scope of agentic protocols spans multiple domains:

1. Artificial Intelligence

- Robotics: Industrial robots utilizing agentic protocols autonomously optimize manufacturing workflows, reducing human intervention.

- Intelligent Assistants: AI-driven personal assistants efficiently manage tasks, including scheduling and communication, with minimal user input.

2. Blockchain Technology

- Decentralized Finance (DeFi): Agentic protocols underpin smart contracts, enabling transparent and automated financial transactions.

- Decentralized Autonomous Organizations (DAOs): DAOs leverage these protocols to facilitate collaborative decision-making among stakeholders.

- Supply Chain Transparency: Blockchain-based agentic systems enhance traceability and accountability across complex supply chains.

3. Internet of Things (IoT)

- Smart Cities: IoT devices coordinated via agentic protocols manage urban infrastructure, optimizing energy usage, traffic flow, and waste management.

- Logistics and Transportation: Autonomous delivery systems employ these protocols to achieve seamless operational coordination.

- Environmental Monitoring: Smart sensors leveraging agentic frameworks enable proactive responses to ecological changes, supporting conservation efforts.

Challenges and Considerations

Despite their transformative potential, agentic protocols pose significant challenges:

1. Ethical and Societal Concerns

Autonomous decision-making by agents raises pressing ethical issues, including accountability, transparency, and the mitigation of biases encoded within algorithms.

2. Security and Trust

Maintaining secure interactions in decentralized environments is paramount to thwart malicious activities. Cryptographic safeguards and robust verification mechanisms are essential.

3. Technical Constraints

Efficiently implementing agentic systems necessitates overcoming limitations related to computational cost, energy consumption, and data storage scalability.

4. Standardization and Compatibility

The lack of universally accepted standards for agentic protocols impedes interoperability, underscoring the need for industry-wide consensus on best practices.

The Future of Agentic Protocols

Advances in quantum computing, sophisticated AI models, and next-generation connectivity frameworks, such as 5G, promise to augment the capabilities of agentic protocols. These innovations could enable:

- Autonomous systems to undertake increasingly complex decision-making tasks.

- Wider adoption across domains, including education, healthcare, and the creative industries.

- Novel modes of collaboration between human operators and machine agents, redefining traditional workflows.

The trajectory of agentic protocols suggests profound implications for the future of work, governance, and societal organization. As stakeholders in this technological evolution, individuals and institutions must proactively address the accompanying ethical, regulatory, and technical challenges.

Conclusion

Agentic protocols herald a paradigm shift in autonomous systems, enabling unprecedented levels of efficiency, resilience, and adaptability. By embracing the principles of autonomy, interoperability, decentralization, and scalability, these protocols offer transformative potential across myriad industries.

As we stand on the cusp of a new era in technological advancement, the imperative to engage with and shape the development of agentic protocols becomes ever more critical. What role will you play in fostering this evolution toward systems characterized by autonomy, intelligence, and collaboration?

Step by step process on how to buy $aiws on ZKsync

1) Add the ZKsync network to your wallet

🔹 https://chainlist.org/chain/324

2) Fund your wallet with ETH

🔹 from a Centralised Exchange

🔹 bridge from different chains to ZKsync

Via https://jumper.exchange

🔹 Go to DEX of your choice and swap $ETH/$HOLD/$USDC into $AIWS

KyberSwap (Aggregator): -> Best routes and lowest slippage

https://kyberswap.com/swap/zksync/eth-to-0x3e9c747db47602210ea7513c9d00abf356b53880

HoldStation Swap:

https://hold.so/swap?inputCurrency=0xed4040fD47629e7c8FBB7DA76bb50B3e7695F0f2&outputcurrency=0x3E9C747db47602210EA7513c9D00abf356b53880

Contract Account: 0x3E9C747db47602210EA7513c9D00abf356b53880

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.