Velo Labs is at the forefront of integrating blockchain technology with traditional banking systems, aiming to revolutionize financial transactions and enhance global financial inclusivity. By leveraging Web3-based solutions, Velo seeks to bridge the gap between conventional financial infrastructure and decentralized finance, offering a seamless and efficient experience for both institutions and end-users.

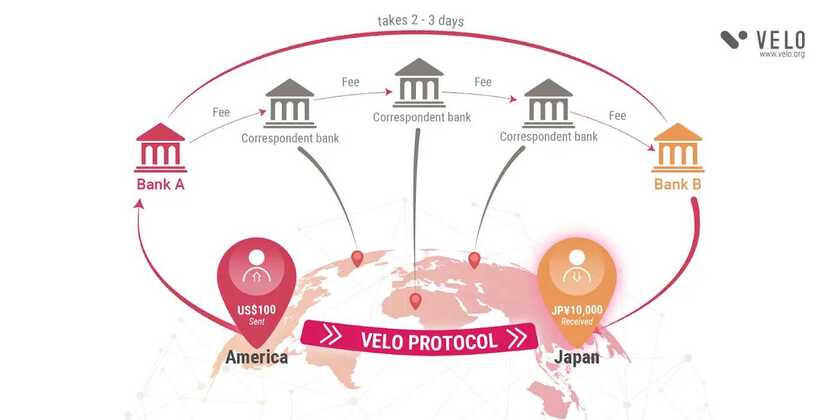

Enhancing Cross-Border Payments

One of Velo's primary objectives is to address the challenges associated with cross-border payments. Traditional methods often involve high costs, lengthy processing times, and complex intermediaries. Velo's Federated Credit Exchange Network enables financial service providers to issue digital credits pegged to any fiat currency, facilitating swift and secure transactions. This system reduces counterparty risk and ensures transactions are completed in mere seconds.

Strategic Partnerships and Collaborations

Velo Labs has formed strategic partnerships to bolster its mission. Notably, UOB Venture Management, the private equity and venture capital arm of United Overseas Bank, has made a second strategic investment in Velo Labs, underscoring confidence in Velo's vision and technological capabilities.

Additionally, Velo's collaboration with Band Protocol integrates decentralized oracles to provide reliable foreign exchange and token pricing data. This integration ensures real-time settlement systems and enhances the security of digital credit issuance.

Innovations in Asset Tokenization

Expanding its services, Velo Labs has introduced tokenized financial products to Southeast Asia. By bringing BlackRock's tokenized short-term treasury fund to the region, Velo offers secure and efficient investment opportunities, demonstrating the versatility of its platform in integrating traditional assets with blockchain technology.

Interoperability and Ecosystem Expansion

Velo is committed to enhancing its ecosystem through interoperability, connecting businesses to global funds and driving money velocity via seamless financial services powered by Web3 technology. This approach ensures that Velo's solutions are adaptable and can integrate with various financial systems worldwide.

Real-World Applications

Demonstrating practical utility, Velo has partnered with Travala, a leading blockchain-powered travel platform, allowing Velo Token holders to book over 3,000,000 flights, hotels, and activities worldwide using their digital assets. This partnership exemplifies Velo's commitment to expanding the real-world use cases of its digital assets.

Conclusion

Velo Labs is pioneering the integration of blockchain solutions within traditional banking systems, offering innovative approaches to cross-border payments, asset tokenization, and financial interoperability. Through strategic partnerships and a commitment to technological excellence, Velo is poised to significantly impact the future of banking and finance.

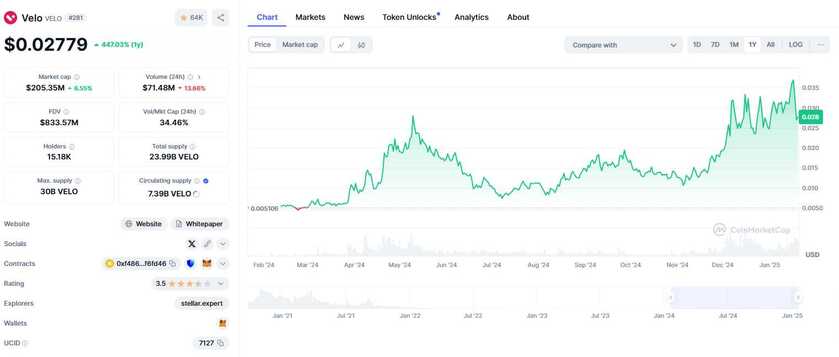

As always, do your own research and none of this is to be considered as financial advice. My main point on this post is to bring Velo to your attention.

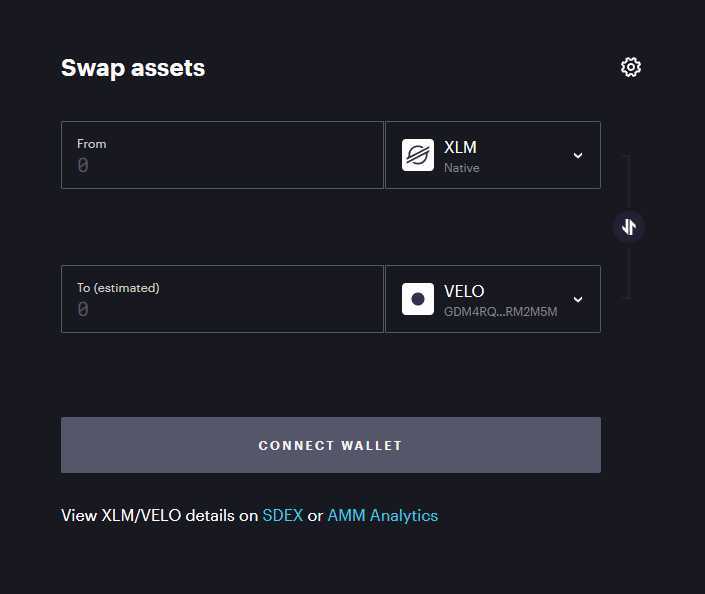

However, If you are interested in getting your hands on some Velo, the easiest way that I have found is to have your VPN engaged and go to the StellarEX Decentralized exchange by clicking the image below and simply swap XLM for VELO. I already have the link set up for the pair, so there should be no confusion. If you need further assistance, you know where to find me on my blog or on X.