Over the last year, @veloprotocol has proven itself as a true leader in the RWA (Real World Asset) and DeFi (Decentralized Finance) space, delivering remarkable achievements and building strong momentum for 2025. Let’s take a deep dive into what $VELO has accomplished and what’s on the horizon.

2024 Achievements: Paving the Path to Dominance

- Groundbreaking Partnerships: Partnered with Lightnet Group to bring seamless cross-border payment solutions to Asia. Collaboration with CP Group, one of Asia’s largest conglomerates, has cemented VELO’s position in the region as a trusted financial innovator. Supported by prominent players like Laos Bullion Bank for tokenized gold-backed financial solutions, bridging traditional assets with blockchain.

- Real-World Impact in RWA: $VELO has focused on tokenizing real-world assets, including partnerships that tokenize gold, real estate, and other assets, bringing real-world utility to DeFi. Enabled frictionless cross-border payments and remittance services across Southeast Asia, tackling high fees and inefficiencies in traditional financial systems.

- Massive Ecosystem Growth: $VELO secured its place as one of the top-performing assets in the DeFi space, with over 82,000% growth in unique active wallets and a surge in trading volume. Gained significant traction in both institutional adoption and retail communities, reinforcing its position as the “ $XRP of Asia.”

- Strong Regulatory Backing: $VELO ’s ecosystem has gained regulatory clarity in Southeast Asia, ensuring a solid foundation for its financial solutions. ----------------------------------------------------------

What’s Coming in 2025?

✔️ Global Expansion of RWA Integration: $VELO aims to expand tokenized assets beyond gold, including commodities and real estate, bridging the gap between traditional finance and blockchain. This will allow businesses and institutions to access new liquidity channels while reducing operational costs.

✔️ Enhanced Payment Rails: $VELO is set to introduce enhanced payment rails for real-time cross-border transactions, with lower fees and faster processing times. These rails will play a crucial role in enabling instant international settlements for individuals and businesses alike.

✔️ Deepened Partnerships: As regulatory clarity continues to improve, Lightnet will fully unveil its integration with $VELO to scale operations internationally. Expect more partnerships with global financial giants, as $VELO becomes a core player in reshaping the financial ecosystem.

✔️ Next-Level DeFi Infrastructure: $VELO is set to integrate advanced DeFi tools, such as lending, staking, and borrowing against tokenized RWAs. The protocol will continue to innovate, offering seamless access to financial services for millions of users. --------------------------------------------------------

Why $VELO is the Future of RWA and DeFi ?

⚈ Massive Market Potential: With the global RWA tokenization market projected to hit trillions of dollars, $VELO is perfectly positioned to capture significant market share.

⚈ Strong Ecosystem Backing: Strategic alliances with Lightnet, CP Group, and Laos Bullion Bank ensure scalability and trust.

⚈ Solving Real Problems: From high remittance fees to inefficient cross-border payments, $VELO addresses real-world financial challenges with blockchain-powered solutions.

⚈ Community & Growth: With its thriving community of #Velorians and unmatched momentum, $VELO is gearing up to dominate the crypto market. The Road Ahead

As we move deeper into 2025, $VELO ’s relentless focus on innovation, partnerships, and delivering real-world impact makes it one of the most exciting projects in the crypto space. With its RWA and DeFi expertise, the protocol is not just a part of the future of finance- ITS LEADING IT!

Are you ready to ride the $VELO wave?

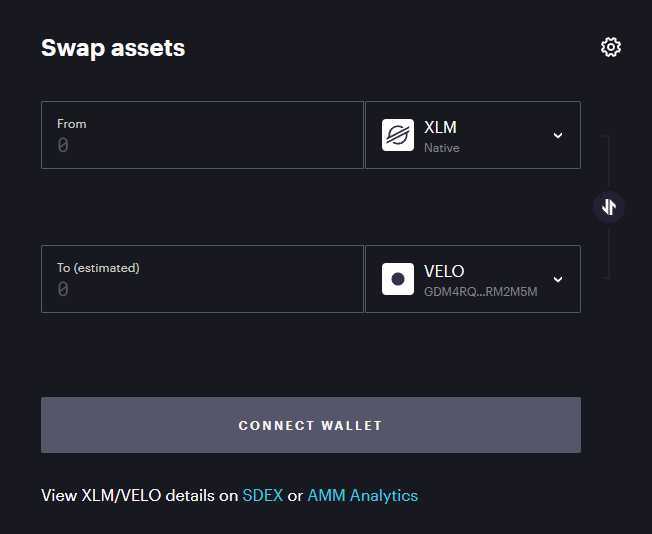

You can get $Velo, by swapping XLM-->Velo using the Stellarx decentralzed AMM:

Disclaimer: Not Financial Advice (NFA) The information provided is for informational and educational purposes only and should not be considered financial, investment, or legal advice. Always conduct your own research (DYOR) and consult with a professional before making any financial decisions. Investing in cryptocurrencies and other assets carries risks, and past performance is not indicative of future results. 📉📈💡