This week, global trade tensions and Fed policy shifts kept crypto markets on edge, while tokenization of real-world assets (RWAs) gains momentum. In this issue:

FTX creditors get refunds.

MicroStrategy rebrands as Strategy.

Tokenization is scaling fast.

This week's digital asset market briefing.

Digital Asset Market Briefing

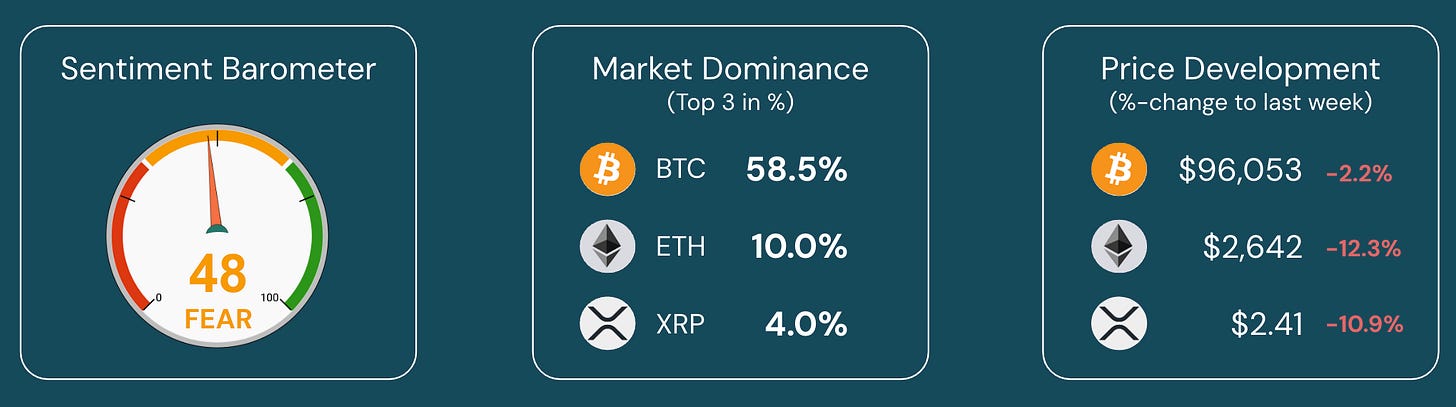

The crypto market remained under pressure last week, with total market cap declining from $3.36 trillion to $3.28 trillion. Bitcoin fell nearly 3%, while its dominance climbed from 56.3% to 58%, reflecting a shift away from altcoins. Ethereum dropped to 10% market share (from 10.8%), with major altcoins following suit, signaling cautious sentiment.

Macroeconomic Headwinds Weigh on Markets

The primary catalyst for the downturn was ongoing global trade tensions. U.S. President Trump’s announcement of a 25% tariff hike on Canadian and Mexican imports triggered panic across markets, with Mexico and Canada responding with retaliatory tariffs. Bitcoin briefly hit $92K, while Ethereum dipped just above $2.1K before recovering slightly. Meanwhile, whale accumulation surged, with XRP whales buying 520 million tokens, suggesting potential accumulation despite weak sentiment (Fear Index: 48).

Shifting Focus: Fed Policy & Treasury Yields

Amid rising market uncertainty, U.S. Treasury yields have become the administration’s key focus. The 10-year yield declined from 4.8% to 4.4%, easing pressure on the Fed to cut rates. Treasury Secretary Scott Bessent’s focus on bond markets signals a shift in economic priorities, potentially stabilizing borrowing costs but adding complexity to Fed policy.

Market Sentiment & Outlook

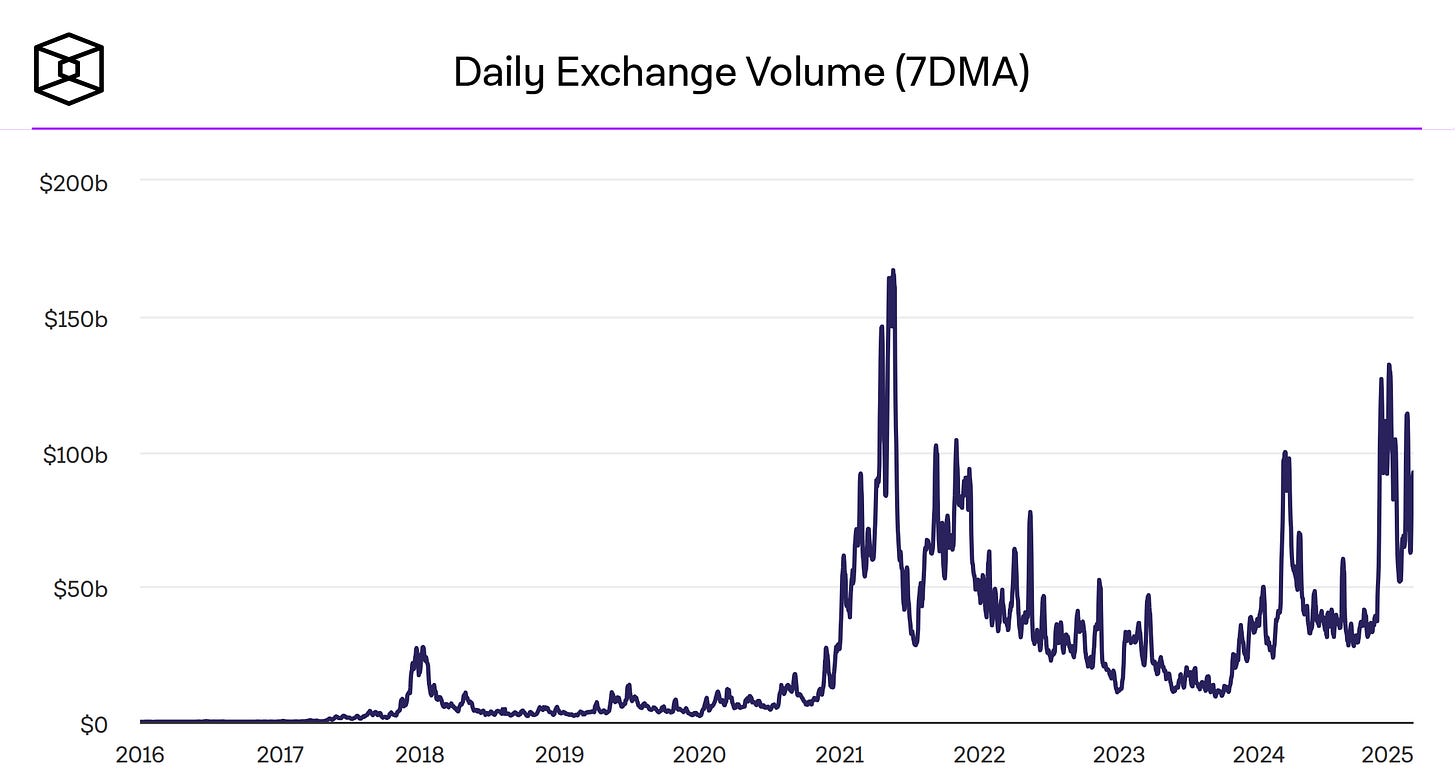

Despite the downturn, crypto trading volume peaked at $90 billion daily, up from $65 billion the prior week, indicating heightened activity. While macro uncertainty persists, rising whale activity suggests institutional interest remains strong, possibly setting the stage for a recovery.

Top 3 News

FTX Creditors Get 120% Payout

FTX creditors with claims up to $50,000 will receive full repayment plus 9% annual interest by February 18, 2025. However, the bankruptcy court denied requests for repayment in Bitcoin or Ethereum, opting for stablecoin payouts instead.

MicroStrategy Rebrands to ‘Strategy’

MicroStrategy is now Strategy, marking its transformation into the world’s first Bitcoin Treasury Company. The firm holds 470,000+ BTC worth $30 billion and plans to raise $42 billion for further accumulation.

Fed Explores Tokenized Reserves

Fed Governor Waller confirmed the U.S. will continue exploring tokenized bank reserves in Project Agorá, aiming to improve cross-border payments without issuing a wholesale CBDC.

What Else Happened?

The American House released a draft Stablecoin Bill, sparking comparisons with the Senate’s GENIUS Bill as regulatory debates intensify.

BlackRock plans to list a Bitcoin exchange-traded product (ETP) in Europe, expanding institutional access to BTC.

Crypto exchange Gemini is exploring an IPO, signaling renewed interest in public markets for crypto firms.

Coinbase CEO urges a blockchain-based U.S. Treasury after Musk’s DOGE agency reportedly saved taxpayers $36 billion.

Tether’s CEO warns that quantum computing could unlock lost Bitcoin wallets—some fear it could destabilize Bitcoin’s scarcity model.

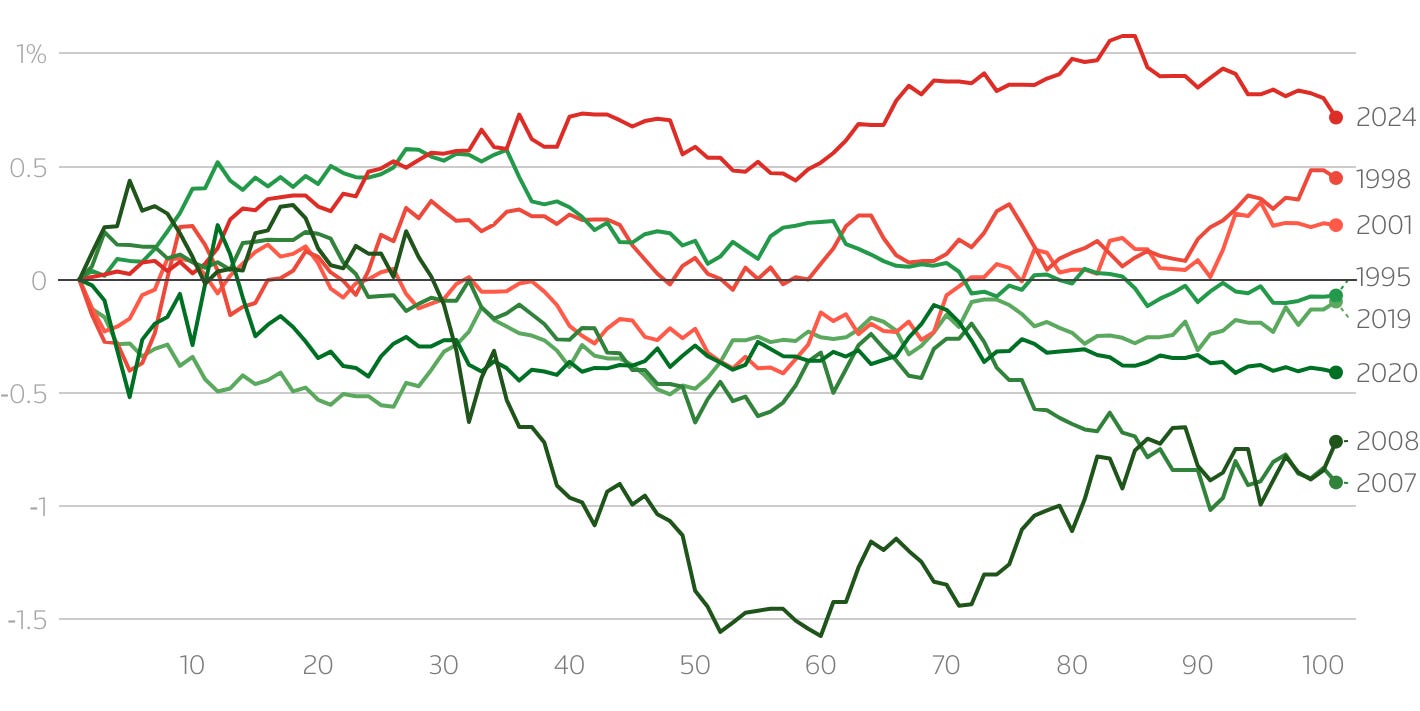

Chart of The Week

This Week’s Focus

Redefining Finance: The Rise of Tokenized Real-World Assets

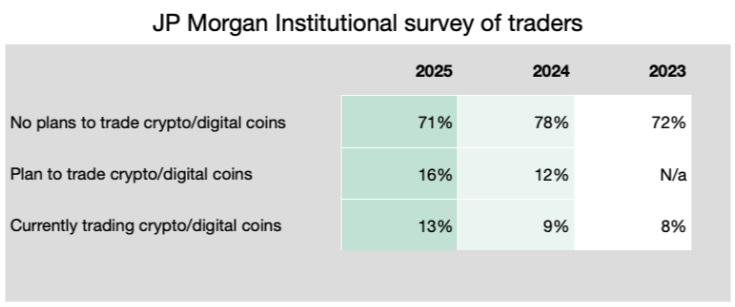

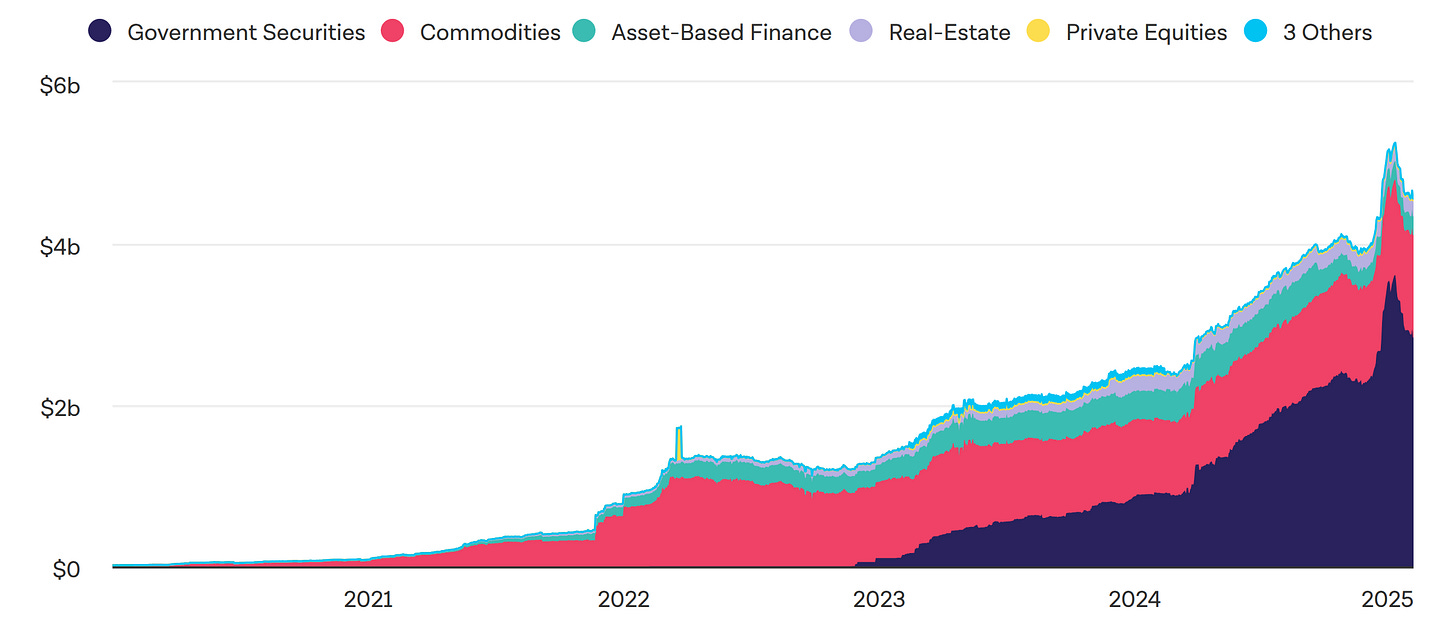

Tokenization is reshaping financial markets, unlocking liquidity, streamlining transactions, and enabling fractional ownership. The market capitalization of tokenized Real-World Assets (RWAs) has surged to $4.5 billion, driven by growing adoption in government securities, commodities, and asset-based finance. Institutional giants like JPMorgan, UBS, and HSBC are actively exploring tokenization, while regulatory initiatives in the EU, UK, and APAC signal accelerating global acceptance.

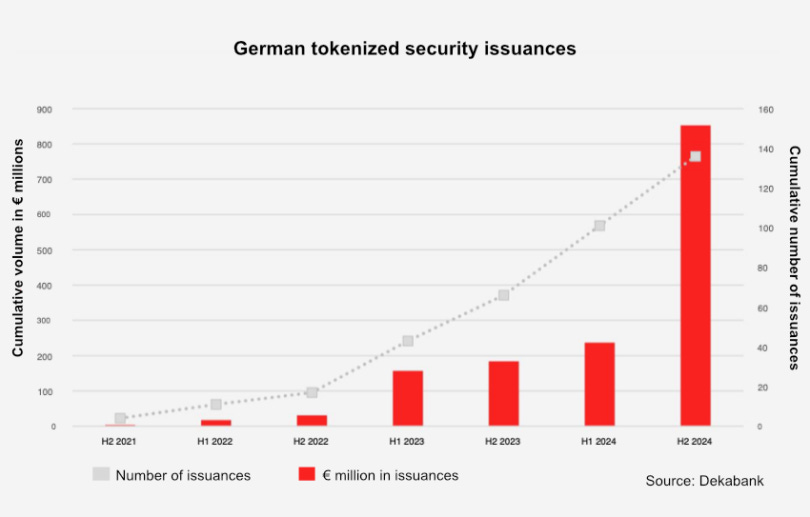

Germany’s digital securities market underscores this momentum, with tokenized issuances surging 162%—from €235M in early 2024 to €615M in the second half. On the infrastructure front, Ondo Finance’s launch of a layer-1 blockchain for institutional tokenization highlights the growing demand for scalable and compliant solutions.

RWA Opportunities:

Fractional Ownership & Liquidity: Tokenization makes traditionally illiquid assets (real estate, private equity, bonds) more accessible to investors.

Automated & Cost-Effective Settlement: Blockchain reduces intermediaries, cutting costs and accelerating transactions.

Security & Transparency: Smart contracts enforce compliance and reduce fraud risks.

RWA Challenges:

Regulatory Uncertainty: Despite progress in Singapore, Hong Kong, and the UK, global frameworks remain fragmented.

Infrastructure & Interoperability: Seamless integration between blockchains and traditional finance is still evolving.

Institutional Hesitation: Compliance and stability concerns slow widespread adoption.

Why This Matters

With $16 trillion in tokenized assets projected by 2030, the financial landscape is shifting. From programmable payments to tokenized real estate and commodities, tokenization is redefining asset ownership and market efficiency. However, regulatory clarity and scalable infrastructure will determine its full potential.

Key Takeaways

Institutional adoption is accelerating, with major banks driving real-world trials.

Regulation and interoperability remain the biggest hurdles to widespread implementation.

Government securities, real estate, and commodities are leading the tokenization wave.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.