Authored by Paul D. Thacker via The Disinformation Chronicle,

Yale researchers released a study today that posits millions of Americans thought to have Long COVID may have been misdiagnosed and actually have post-vaccination syndrome caused by exposure to the spike protein in COVID vaccines. Spike protein produced by the Pfizer and Moderna vaccines triggers the body’s immune response, and the FDA claimed in a 2023 Politifact fact check that vaccine spike protein is not toxic and does not linger in the body. However, Yale researchers report that some patients, who were never infected with COVID virus, were sick with post-vaccination syndrome (PVS) and had elevated levels of virus spike protein in their blood up to 709 days after vaccination.

“There is considerable overlap in self-reported symptoms between long COVID and PVS, as well as shared exposure to SARS-CoV-2 spike (S) protein in the context of inflammatory responses during infection or vaccination,” noted the study authors.

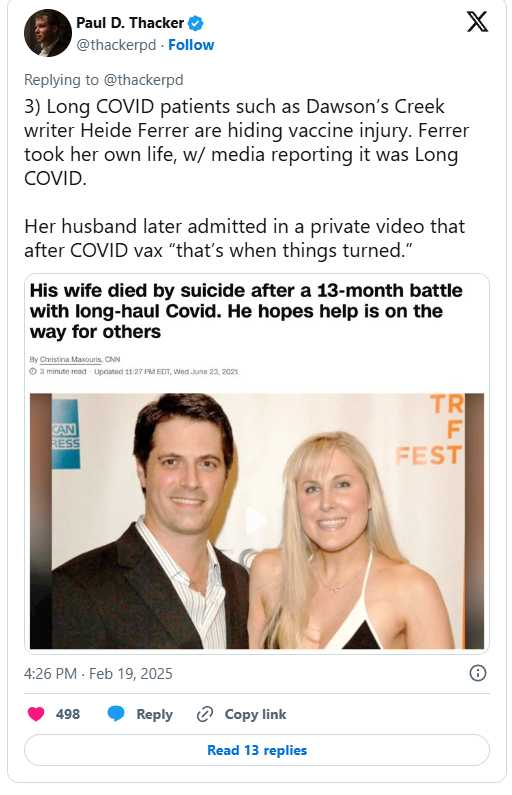

NIH has poured $1.6 billion into Long COVID research, while ignoring patients harmed by COVID vaccines, causing some well-known patient advocates to hide vaccine injury. After a 13-month battle with Long COVID, Hollywood screenwriter Heidi Ferrer took her own life after deciding death was preferable to another minute in her own “personal hell." Death of the Dawson’s Creek writer made headlines across the media including places such as People, the Guardian, Variety, CNN, Newsweek, and The Daily Mail—each recounting Ferrer’s struggle with Long COVID.

But in a private video circulating among patient groups and obtained by The DisInformation Chronicle, Ferrer’s husband Nick Guthe stated that Moderna’s COVID vaccine was the final straw, causing Heidi to develop tremors and then internal vibrations when she lay down for bed, so that even prescription sleeping pills would not allow her to sleep.

“And that’s when things turned,” Guthe said in the video.

Prominent patient advocate Beth Mazur also committed suicide after a COVID vaccine apparently worsened her struggles with myalgic encephalomyelitis (ME), a chronic illness with many similarities to Long COVID. Mazur co-founded #MEAction for patients with chronic illness. #MEAction reported in early 2021 that a significant number of ME/CFS patients experienced “both new symptoms and long-lasting exacerbations of their pre-existing ME/CFS symptoms” after a COVID vaccine.

“Beth was a compassionate advocate for ME/CFS and a fierce advocate for vaccine injury after she experienced this herself sometime before she took her own life,” said one of Mazur’s personal friends who did not wish to be identified. “Having people come after you for vaccine injury is worse than being sick itself. And people can’t handle that. It’s a shroud of shame.”

One of the study’s lead authors, Yale Medical School’s Akiko Iwasaki, previously shot down public concerns about COVID vaccine side effects. When Houston Methodist Hospital staffers sued to avoid the hospital’s coronavirus vaccine mandate in 2021, Iwasaki told the Washington Post that the employees’ fears were “absurd” because “no safety concerns” had been found in the mRNA vaccine clinical trials.

Along with other prominent health experts, Iwasaki also signed a petition supporting the OSHA COVID-19 vaccine mandate which the Supreme Court later blocked.

Several of the study’s findings as well as research the authors cite in their paper have been labeled as false by federal agencies, medical experts, and fact checkers. Because medical journals have been rejecting studies on vaccine side effects, the authors uploaded their paper to the preprint site medRxiv.

Passages from the paper are examined below, as well as “fake fact checks” with false and misleading statements by federal agencies and medical experts that, in the past, called these new scientific findings fallacious. Hyperlinks to research papers cited by the study authors have been added to replace their footnotes.

Yale researchers point out that vaccine injury has not been totally defined and has been labeled both PVS and PACVS. Unlike Long COVID, health authorities do not officially recognize PVS, so patients get little support or care. See passage from paper:

In addition, some individuals have reported post-vaccination symptoms resembling long COVID beginning shortly after vaccination. This condition, sometimes referred to as post-vaccination syndrome (PVS) or post-acute COVID-19 vaccination syndrome (PACVS), is characterized by symptoms such as exercise intolerance, excessive fatigue, numbness, brain fog, neuropathy, insomnia, palpitations, myalgia, tinnitus or humming in ears, headache, burning sensations, and dizziness. Unlike long COVID, PVS is not officially recognized by health authorities, which has significantly limited patient care and support.

Both Long COVID and PVS rely on patient’s self-reported symptoms, which have quite a bit in common. Exposure to the spike protein during infection or vaccination causes inflammation. Various parts of the mRNA vaccine might also be problematic such as the mRNA itself which then creates the spike protein, or the tiny fat globule that encases vaccine mRNA called a lipid nanoparticle.

However, there is considerable overlap in self-reported symptoms between long COVID and PVS, as well as shared exposure to SARS-CoV-2 spike (S) protein in the context of inflammatory responses during infection or vaccination. In susceptible individuals, vaccines may contribute to long-term symptoms by multiple mechanisms. For example, vaccine components, such as mRNA, lipid nanoparticles, and adenoviral vectors, trigger activation of pattern recognition receptors.

The Pfizer and Moderna vaccines create a spike protein that is also called “S protein” or “S1”. See passage from paper:

Secondly, it has been shown that the S protein expressed following BNT162b2 [Pfizer] or mRNA-1273 [Moderna] vaccination circulates in the plasma as early as one day after vaccination.

The virus spike protein has two parts called S1 and S2. These might break down into smaller units called peptides. Some patients with PVS have been found with S protein in their blood cells. In animals, the mRNA vaccine has been found to cross over a membrane and enter the brain. If the mRNA then created spike protein, this could cause neurological problems.

Interaction with full-length S, its subunits (S1, S2), and/or peptide fragments with host molecules may result in prolonged symptoms in certain individuals. Recently, a subset of non-classical monocytes has been shown to harbor S protein in patients with PVS. Further, biodistribution studies on mRNA–LNP platforms in animal models indicate its ability to cross the blood-brain barrier, and the local S expression could result in neurocognitive symptoms.

The researcher report that patients with PVS cited the following symptoms:

The most frequent symptoms reported by participants were excessive fatigue (85%), tingling and numbness (80%), exercise intolerance (80%), brain fog (77.5%), difficulty concentrating or focusing (72.5%), trouble falling or staying asleep (70%), neuropathy (70%), muscle aches (70%), anxiety (65%), tinnitus (60%) and burning sensations (57.5%)

Patients reported symptoms from the vaccines around 4 days, and severe symptoms about 10 days after vaccination.

The median number of days for the development of any symptom was 4 [Interquartile range (IQR): 23 days], while for severe symptoms, it was 10 (IQR: 44 days) post-vaccination.

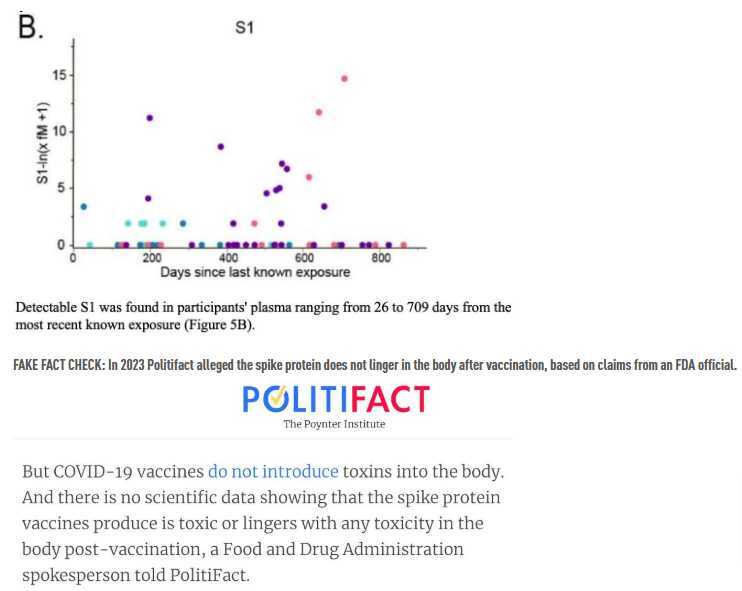

Patients with PVS had higher levels of spike protein or S1 in their blood.

The results indicated that participants with PVS had significantly higher circulating S1 levels compared with the control group (p = 0.01).

This figure from the paper shows that PVS patients had spike protein or S1 in their blood up to 709 days after they were vaccinated.

PVS and Long COVID share similar symptoms probably from exposure to S protein. Researchers have found the full spike protein and the smaller S1 protein in Long COVID patients. See passage from paper:

Given the similarities between PVS and long COVID symptoms, one hypothesis in the literature is that shared exposure to the S protein may play a role and several groups have independently reported the presence of circulating S1 & full-length S in long COVID using various detection methods.

The highest levels of spike protein were found in PVS patients who had been vaccinated but never infected by COVID virus.

Notably, we observed that the highest levels of detectable S1 in the PVS-I group were the furthest away from the last known exposure and ranging between greater than 600-700 days.

Patients vaccinated with mRNA COVID vaccines and the adenovirus COVID vaccine have shown harm. Patients with PVS had poor health as defined by standardized tests called GHVAS and PROMIS29. Few studies have investigated the cause of PVS, which has no agreed upon definition. See passage from paper:

Post-acute conditions following COVID-19 vaccination have been reported for multiple vaccine platforms including mRNA and adenoviral-vectored vaccines. We observed that the general health status of the PVS participants was far below the general US population average based on the GHVAS scores. The patient-reported outcome scores from the PROMIS29 domains were also indicative of lower quality of life. To date, only a few studies have investigated the immunological mechanisms associated with PVS and no consensus definition of this syndrome exists.

Underlying risk factors for developing PVS are similar for Long COVID. This might be due to problems caused by spike protein, but should be studied further.

The demographics at risk of developing PVS and symptom manifestations are similar to those of long COVID. Whether this reflects overlapping underlying mechanisms such as persistent S protein remains to be determined.

High levels of spike protein in the blood were found in PVS patients who had been infected with the COVID virus and those who had never been infected. This makes sense as spike protein has been found in blood cells. Spike protein has been found in the blood of patients who had myocarditis after COVID vaccination. Because PVS and Long COVID are so similar, the spike protein might be causing the chronic health problems.

By contrast, in our study, significantly elevated levels of circulating S1 and S were observed in a subset of PVS participants both in the infection-naive and infection-positive groups up to 709 days post-exposure. This is in line with the findings of S1 persistence in monocytes in people with PVS. Circulating full-length S has also been detected in cases of post-vaccination myocarditis. Given the striking similarities between long COVID and PVS symptoms, there has been speculation regarding the potential causal role of the persistent presence of spike protein driving the chronic symptoms.

More reporting on vaccine side effects in patients to come.

We strongly encourage you to subscribe to The Disinformation Chronicle.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.