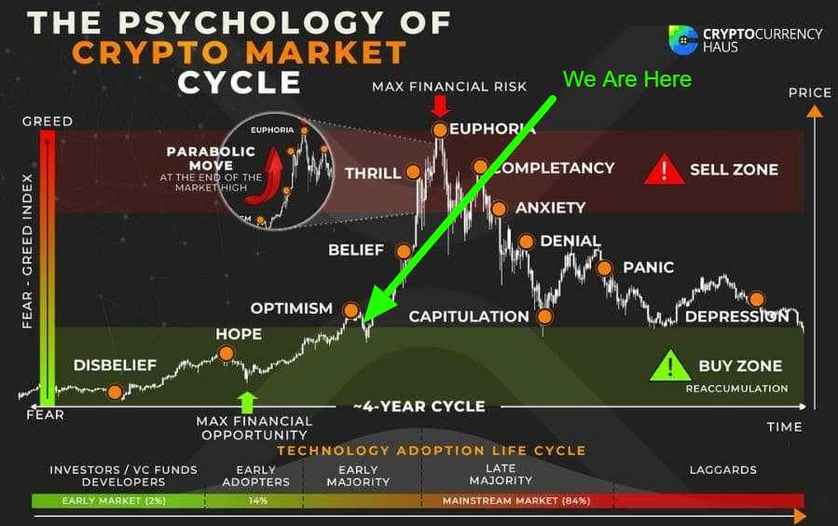

Market cycles are as much about psychology as they are about economics. Understanding these emotional stages can help investors navigate the turbulent waters of investing.

Your life has cycles, so do the economy and financial markets. When it comes to the psychology of a market cycle, emotions tend to get in the way. We often buy or sell at the wrong time, buying exuberantly at market highs and panic selling at market lows. Successful investors do the opposite. This guide will teach you the ten stages of a market cycle so you can be more thoughtful about managing your investments.

Here’s a breakdown of the 10 psychological stages that define a market cycle:

1️⃣ Hope: The First Signs of Recovery

After a brutal market downturn (a.k.a. the Disbelief Stage), early signs of a potential bull run begin to appear. Investors cautiously re-enter the market, dipping their toes in with small investments. Sentiment is shifting, but uncertainty lingers.

2️⃣ Optimism: Confidence Starts to Build

As prices trend upward for months, optimism grows. More investors enter the market, sensing a real shift in momentum. The fear that dominated the previous cycle starts to fade, and larger amounts of capital flow in.

3️⃣ Belief: The Start of a True Bull Market

Optimism turns into conviction. This is when serious investors double down, and new participants flood in. Media attention increases, institutional players take notice, and the bull market gains traction.

4️⃣ Thrill: Euphoria on the Horizon

At this point, prices are soaring, and FOMO (fear of missing out) kicks in. People start throwing money into random projects, believing that the market will only go up. Caution is thrown to the wind, and speculation runs rampant.

5️⃣ Euphoria: The Peak of the Market 🚀

Welcome to the top. At this stage, everyone believes "this time is different."

- 🚀 Extreme optimism takes over

- 📈 Prices reach unsustainable highs

- 💰 Leverage skyrockets as investors borrow to buy more

- 🔥 ICOs and meme coins flood the market

- 🚨 Fundamentals are ignored—it’s all about hype

This is where disciplined investors start cashing out, but many refuse to believe the market could reverse. It always does.

6️⃣ Complacency: The Calm Before the Storm

Markets stop climbing, but investors assume this is just a temporary dip before the next leg up. Many ignore warning signs that the bull run is ending. However, cracks begin to form beneath the surface.

7️⃣ Anxiety: The Market Reversal Begins

Reality sets in—prices aren’t bouncing back as expected. Investors grow uneasy as they start to realize the bull market is over. Many hesitate to sell, hoping for a rebound that never comes.

8️⃣ Denial: "It'll Come Back"

The market keeps dropping, but investors refuse to accept it. They tell themselves this is just a temporary setback and that prices will recover soon. Meanwhile, losses continue to pile up.

9️⃣ Panic: The Mass Sell-Off

Fear grips the market as traders scramble to exit. Panic selling leads to a massive downturn, and prices crash. At this stage, people sell at steep losses just to salvage whatever they can.

🔟 Depression: The Bottom of the Cycle

At this point, investors feel completely hopeless. Many vow to never invest again, calling crypto a scam or a failed experiment. This is rock bottom—also known as crypto winter. But for those paying attention, it’s also where opportunity is born.

The Cycle Repeats: Hope Returns

After depression, the market eventually stabilizes, setting the stage for a new cycle. Those who bought during the depression phase are positioned for the next bull market, while those who panic sold often re-enter too late.

The Key Takeaway

Understanding these market psychology stages can help investors avoid the trap of buying at all-time highs and selling at market lows. Instead of chasing hype, stay disciplined, recognize the signs, and invest wisely.

📢 Share this with a friend who needs to see it! Happy trading! 🚀

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.