In the rapidly evolving world of finance, standards play a crucial role in ensuring seamless communication and efficient transactions across different systems and borders. One such standard that has been gaining significant attention is ISO 20022 . But what exactly is ISO 20022, and how is it revolutionizing the financial landscape? Let's dive into the details and explore how this global standard is transforming the way financial institutions and cryptocurrencies interact.

ISO 20022 was created to establish a universal and standardized approach for financial messaging across institutions, markets, and borders. Its primary goal is to replace fragmented legacy systems with a common global language that ensures consistency, interoperability, and enriched data in financial transactions.

The standard provides a structured framework for developing financial messages using a central dictionary of agreed-upon business concepts. This allows institutions to reuse components across various financial domains, simplifying processes and reducing inefficiencies. By incorporating modern technologies like XML and ASN.1 protocols, ISO 20022 enables automation, enhances compliance measures, and improves fraud prevention.

Ultimately, ISO 20022 was designed to streamline financial communication by providing richer, more granular data while supporting end-to-end automation. It addresses the challenges of differing syntaxes and semantics in global finance, paving the way for improved transaction processing, better customer experiences, and the creation of new services.

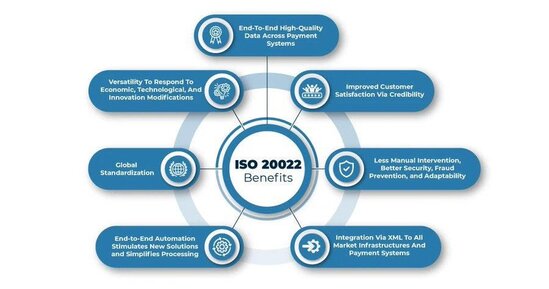

ISO 20022 offers several improvements over traditional financial messaging standards, making it a game-changer for the global payments ecosystem. Here’s what makes it better:

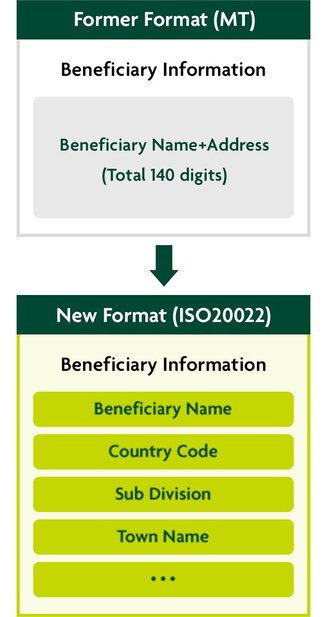

1. Richer and More Structured Data

ISO 20022 enables financial messages to carry detailed and structured data, improving accuracy and transparency. This richer data format reduces errors, enhances reconciliation processes, and supports better compliance with regulatory requirements.

2. Enhanced Interoperability

By providing a universal messaging standard, ISO 20022 ensures seamless communication between financial institutions, payment systems, and market infrastructures worldwide. This is especially beneficial for cross-border transactions, reducing friction and delays.

3. Improved Efficiency

The standard supports higher straight-through processing (STP) rates by automating processes and minimizing manual intervention. This results in faster transaction times, reduced costs, and fewer errors in payment processing.

4. Cost Savings

Standardizing messaging formats across institutions and borders eliminates the need for multiple legacy systems and reduces operational overhead. It simplifies data management and lowers maintenance costs for financial institutions.

5. Support for Innovation

ISO 20022's flexibility allows financial institutions to leverage cutting-edge technologies like blockchain, digital assets, and smart contracts. This opens up opportunities for new products and services that enhance customer experiences.

6. Better Compliance and Risk Management

The rich data format ensures that all necessary information is included in financial messages, simplifying compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. It also improves fraud detection through more precise data screening.

7. Future-Proofing Financial Systems

ISO 20022 is designed to accommodate evolving technologies and market needs. Its adaptability ensures that financial systems remain scalable and relevant as the industry continues to modernize.

By addressing inefficiencies in legacy systems while enabling innovation, ISO 20022 sets a new standard for global financial messaging, making transactions faster, safer, and more transparent.

Key Components of an ISO 20022 Message

Group Header

The Group Header contains high-level information about the message, such as the message ID, creation date, and sender details. It acts as the overarching identifier for the transaction.Payment Information

This section includes details about the payment itself, such as the amount, currency, and payment method. It may also specify instructions for processing the payment.Transaction Details

The Transaction Details block provides granular data about individual transactions within the message. This can include:Debtor and creditor information

Account numbers

Financial institution identifiers

Payment purpose

Address Information

ISO 20022 messages use discrete fields for address elements like street name, building number, postal code, town name, and country code. This structured approach reduces errors and improves automation compared to free-text formats.Business Application Header (BAH)

The BAH is mandatory in all ISO 20022 messages and contains metadata about the message type and processing requirements.Message Payload

The payload is the core business data being communicated, tailored to the specific message type (e.g., credit transfer or remittance advice). It includes detailed transaction-specific information.

Advantages of ISO 20022 Message Structure

Precision: Each data element is tagged with XML identifiers, making it easy for systems to interpret and process information.

Flexibility: The hierarchical structure allows for nested tags and detailed data representation.

Automation: Structured fields enable seamless integration into automated systems, reducing manual intervention.

By providing a standardized framework for financial messaging, ISO 20022 ensures that every component of a transaction is clearly defined and easily understood by both humans and machines. This level of detail enhances efficiency, reduces errors, and supports global interoperability in financial communications.

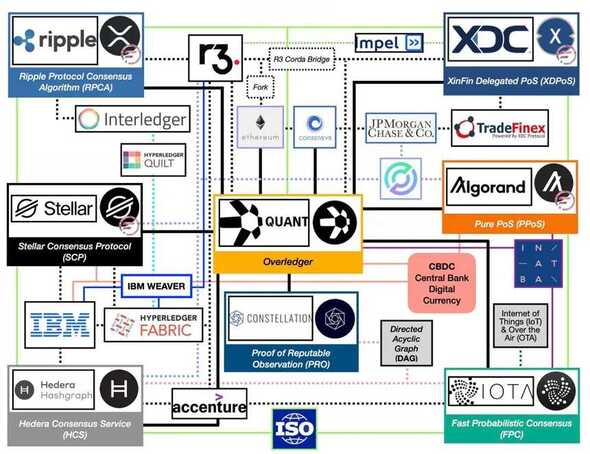

ISO 20022 has significant implications for blockchain and cryptocurrency, as it bridges the gap between decentralized digital assets and traditional financial systems.

Here’s how it impacts the crypto space:

1. Enhanced Interoperability

ISO 20022 provides a standardized messaging framework that allows cryptocurrencies to integrate seamlessly with traditional banking systems. This interoperability is crucial for enabling smoother cross-border payments and fostering collaboration between decentralized and centralized financial ecosystems.

2. Increased Adoption by Financial Institutions

Cryptocurrencies that align with ISO 20022 standards are more likely to be adopted by banks and central financial institutions. Coins like XRP, Stellar (XLM), and Algorand (ALGO), among others are already compliant, positioning them as potential tools for cross-border payments, digital reserve currencies, or integration into central bank digital currency (CBDC) systems.

3. Faster and Cheaper Transactions

The structured data format of ISO 20022 reduces errors and manual intervention, leading to faster transaction processing times. For cryptocurrencies, this translates into quicker confirmations and lower costs, making them more attractive for global payments.

4. Improved Trust and Transparency

By ensuring detailed and structured transaction data, ISO 20022 compliance enhances transparency and reduces the risk of fraud. This builds trust in crypto transactions, which is essential for broader institutional adoption.

5. Regulatory Alignment

Compliance with ISO 20022 helps cryptocurrencies align with global regulatory standards. This makes it easier for crypto projects to operate within legal frameworks, enhancing their legitimacy and paving the way for institutional investments.

6. Opportunities for Innovation

The rich data enabled by ISO 20022 opens doors to new blockchain-powered financial services, such as automated reconciliation, advanced analytics, and smart contract-based solutions.

7. Challenges to Overcome

Despite its benefits, integrating blockchain with ISO 20022 systems presents challenges:

Scalability: Blockchain networks must handle high transaction volumes.

Interoperability: Connecting diverse blockchain ecosystems with ISO 20022-compliant systems requires technical innovation.

Regulatory Compliance: Cryptocurrencies need to navigate complex legal landscapes to align with traditional finance.

The current ISO 20022-compliant cryptocurrencies include the following:

XRP (Ripple) – Optimized for fast, low-cost cross-border payments and financial institution integration.

Stellar (XLM) – Facilitates efficient international payments and asset transfers.

XDC Network (XDC) – A hybrid blockchain designed for trade finance and tokenization of real-world assets.

Algorand (ALGO) – A scalable blockchain platform supporting secure and fast transactions.

Hedera Hashgraph (HBAR) – A distributed ledger offering high throughput and low latency for secure transactions.

IOTA (MIOTA) – Focused on the Internet of Things (IoT), enabling secure data transfers and trading streams.

Quant (QNT) – Enables interoperability between different blockchains and enterprise systems.

Cardano (ADA) – A research-driven blockchain focused on scalability, security, and sustainability.

Conclusion

ISO 20022 represents a major step toward integrating cryptocurrencies into the global financial system. By fostering interoperability, improving transaction efficiency, and aligning with regulatory standards, it positions blockchain technology as a key player in the future of finance. Cryptocurrencies that adopt this standard are likely to see increased adoption, trust, and utility in both traditional and decentralized financial ecosystems.

🙏 Support My Work 🙏

If you find value in my content, consider showing your support:

💳 PayPal – Just scan the QR code 📲

🔗 Crypto – Send contributions via Coinbase Wallet to: Dinarian.cb.id

Your generosity keeps this mission alive! Namasté 🙏✨ #SupportIndependentMedia #Crypto

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.