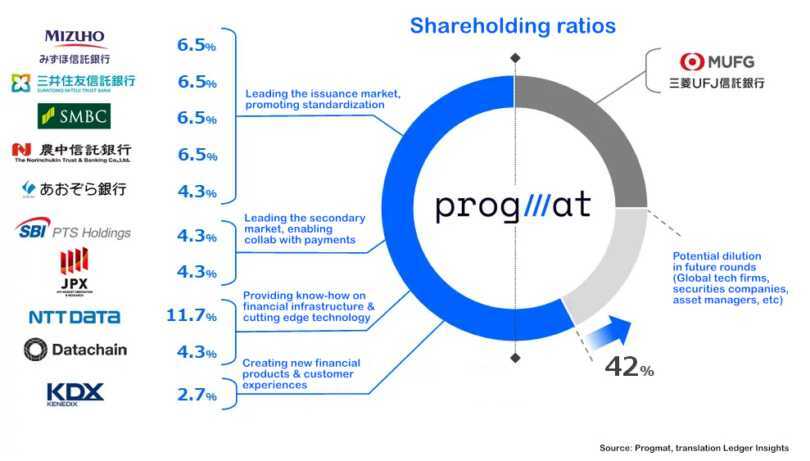

Japan’s Progmat digital securities platform, originally founded by MUFG, has completed a new funding round, introducing three new investors and slightly diluting MUFG's stake from 49% to 42%. Progmat, already the leading digital securities issuance platform in Japan, aims to expand globally while diversifying the types of tokenized assets it offers.

🔑 Key Points:

🔹 New Investors:

Norinchukin Trust Bank (Nochun): Specializes in agriculture, forestry, and fishery commodities and aims to tokenize assets traditionally limited to institutional investors.

Aozora Bank: Experienced in bond issuance, LBO finance, and real estate, with plans to advance tokenization in these areas.

Kenedix: A major real estate asset manager with experience in tokenized real estate. It plans to launch a mobile app for security tokens, utility tokens, and stablecoins.

🔹 Funding Impact:

The funding round diluted stakes for existing shareholders, including SMBC, Mizuho, and Sumitomo Mitsui Trust, whose holdings dropped from 7.5% to just under 6.5%.

Progmat CEO Tatsuya Saito emphasized the platform’s ambition to evolve from domestic "national infrastructure" into a global-scale product backed by a strong team.

🔹 Tokenization Expansion:

Japan’s focus on real estate tokenization is set to diversify with contributions from new investors looking at bonds, commodities, and utility tokens.

Stablecoins play a central role in Progmat’s vision, especially for cross-border payments and settlement of digital securities, leveraging smart contracts for automation and certainty.

🔹 Strategic Approach:

CEO Tatsuya Saito shared insights on creating innovation within a bank, framing Progmat’s founding as a “survival strategy” for trust banks—leveraging blockchain to automate ledger management.

Progmat’s independence from MUFG was emphasized through branding decisions, avoiding venture capital firms and courting neutral trust-focused investors.

💡 Why It Matters:

🔹 Global Ambitions: Progmat’s move to scale globally positions it as a key player in the international digital securities market, competing with platforms like Nomura’s BOOSTRY.

🔹 Diversified Tokenization: With plans to tokenize diverse assets—including bonds, commodities, and stablecoins—Progmat is broadening its appeal beyond real estate.

🔹 Stablecoin Integration: By acting as a stablecoin issuance platform, Progmat bridges gaps in cross-border payments and settlement automation, further enhancing its utility for institutional clients.

🔹 Bank-Initiated Innovation: Progmat serves as a model for fostering innovation within traditional banks, demonstrating how blockchain can transform ledger-based operations.

Progmat’s funding round and strategic direction underscore its ambitions to expand tokenization beyond Japan while pioneering blockchain-based financial solutions in the global market.

🙏Please Support My Work 🙏

If you find value in my content, consider showing your support:

💳 PayPal – Simply scan the QR code 📲

🔗 Crypto – Support via Coinbase Wallet to: [email protected]

Your generosity keeps this mission alive! Namasté 🙏✨ #SupportIndependentMedia #Crypto

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.