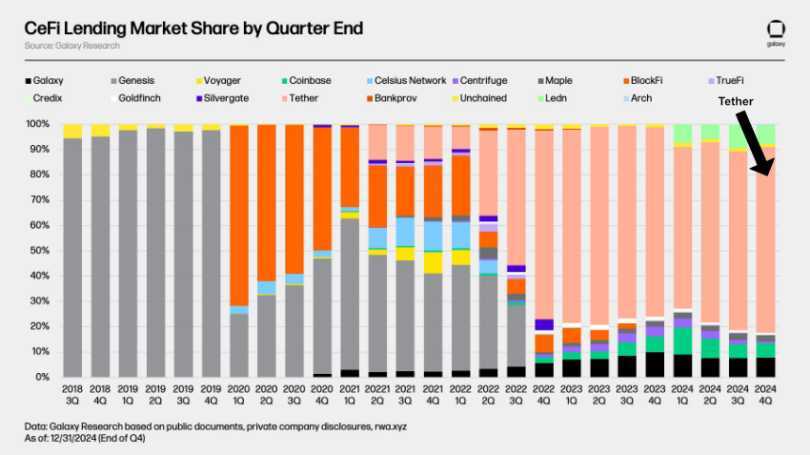

Galaxy Digital has released a report on the cryptocurrency lending market, highlighting the central role of stablecoin issuer Tether. All the major centralized lenders in the previous crypto boom went bankrupt, and Tether has stepped into the void, becoming the dominant player with around 73% of the market. Since the last boom, the majority of crypto lending has shifted from centralized lending to DeFi lending.

Tether doesn’t hide its lending activities. Its stablecoin report for the end of 2024 shows its reserves include a secured lending balance of $8.2 billion. According to Galaxy’s data, the entire market for centralized crypto loans outstanding at the end of 2024 was $9.9 billion, with Tether having a market share of around 73%. This implies a minority of Tether’s loans are not for cryptocurrencies.

Many countries introducing stablecoin legislation prevent stablecoin issuers from participating in lending. That’s in part because they start to look like banks, including from a risk perspective. Doubtless Tether would point to the $7 billion in equity sitting within the issuer, which would cover a lot of mis-steps. However, the $8.2 billion lending sits alongside several other risky or volatile assets, including almost $8 billion in bitcoin.

Crypto lending: a risky business

The top three centralized lenders are Tether, Galaxy and Ledn, with a combined share of 88.6% of the centralized finance (CeFi) market. Whether or not that’s a good group to be part of remains to be seen, given the graphic showing the number of previous participants that went bankrupt.

However, Galaxy highlighted some of the risks taken by the previous batch of lenders, implying that practices have changed. For example, the previous lenders tended to lend long and borrow short term rather like banks, so they got into trouble when they needed more liquidity. Both Celsius and BlockFi also extended some loans without collateral.

Galaxy also pointed to the entrance of traditional finance (TradFi) players, including Cantor Fitzgerald, formerly led by the current US Commerce Secretary Howard Lutnick. Cantor previously announced plans to start crypto lending with $2 billion of financing initially. That could make it one of the larger players. The report also stated that SAB 121, which prevented banks from providing crypto custody also indirectly blocked them from involvement in lending because they needed to take custody. We’d note that Basel crypto rules for banks also make it tricky, although the rules do allow some hedging for crypto, hence collateralized loans can be partially offset.

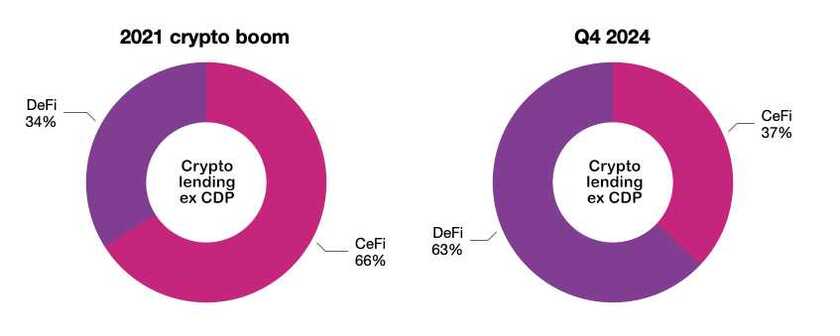

Since the previous crypto crises, the balance of crypto lending has moved to decentralized finance (DeFi) which held up well during volatile times. At the height of the previous boom, DeFi made up just over a third, whereas now it is dominant. However, that’s in part because CeFi lending outstanding at the end of 2024 was only around a third of its peak in 2021. The figures exclude crypto collateralized products (CDP) – stablecoins backed by crypto.

With new centralized lenders attracted to the market, the pendulum could swing back.

🙏Please Support My Work 🙏

If you find value in my content, consider showing your support:

💳 PayPal – Simply scan the QR code 📲

🔗 Crypto – Support via Coinbase Wallet to: [email protected]

Your generosity keeps this mission alive! Namasté 🙏✨ #SupportIndependentMedia #Crypto

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.