Key Takeaways

- Innovative DeFi Solutions: Reggie Middleton has developed groundbreaking technologies that facilitate trustless and low-trust value transfers, revolutionizing decentralized finance.

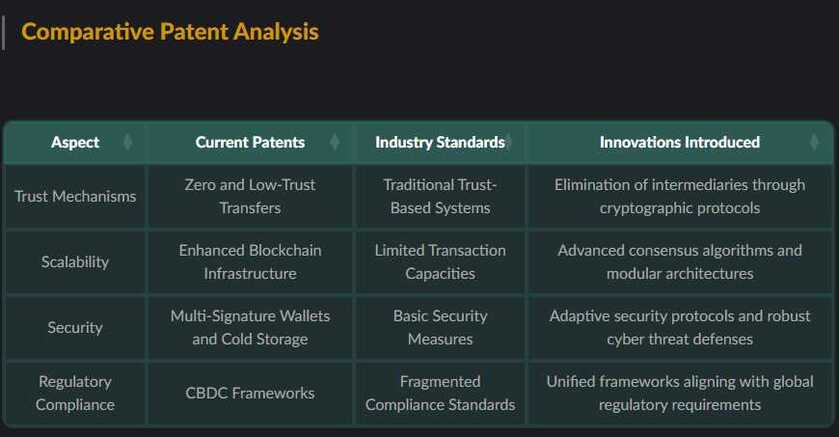

- Robust Patent Portfolio: His patents cover a wide range of applications, including blockchain infrastructure, peer-to-peer transactions, digital asset security, and regulatory compliance.

- Legal and Market Impact: Middleton's patents have significant legal standing, demonstrated by successful defenses against challenges and high-profile lawsuits, positioning him as a key player in the FinTech industry.

Introduction

Reggie Middleton is a distinguished innovator in the fintech and blockchain sectors, recognized for his extensive portfolio of patents that address critical challenges in decentralized finance (DeFi) and trustless value transfers. His work has been instrumental in advancing blockchain technology, enhancing security, scalability, and accessibility within decentralized ecosystems.

Overview of Reggie Middleton's Patent Portfolio

Trustless Value Transfer Systems

Middleton's patents in this category focus on enabling secure transactions between parties with minimal or no trust. Utilizing advanced cryptographic protocols and blockchain technology, these systems eliminate the need for intermediaries, thereby reducing costs and increasing transaction efficiency.

Mechanisms and Applications

His innovations include systems for decentralized exchanges, peer-to-peer lending platforms, and digital marketplaces. An exemplary application is the facilitation of currency exposure hedging, allowing users to swap risks (e.g., AUD/USD) via Bitcoin without prior trust between parties.

Blockchain Infrastructure Enhancements

Middleton has developed solutions that address scalability, interoperability, and consensus mechanisms within blockchain systems. These enhancements are crucial for handling high transaction volumes and ensuring seamless interaction between different blockchain networks.

Key Innovations

His patents introduce scalable blockchain infrastructures capable of supporting enterprise-level applications and multi-chain platforms. By improving consensus algorithms, Middleton's work ensures faster and more secure transaction validation processes.

Peer-to-Peer Transactions

The patents in this domain enable direct asset exchanges, such as cryptocurrencies and non-fungible tokens (NFTs), through smart contracts and decentralized networks. These innovations are foundational for modern DeFi platforms and decentralized governance systems.

Practical Implementations

Middleton's technologies facilitate seamless peer-to-peer transactions, enhancing user autonomy and reducing dependency on centralized institutions. This is particularly evident in decentralized exchanges and governance frameworks where direct asset management is paramount.

Digital Asset Security

Ensuring the security of digital assets is a cornerstone of Middleton's patent portfolio. His solutions include advanced storage systems and multi-signature wallets designed to protect against cyber threats and unauthorized access.

Security Solutions

Implementing cold storage systems and multi-signature protocols, Middleton's patents provide robust defenses against potential security breaches, safeguarding cryptocurrencies and other digital assets from malicious attacks.

Regulatory Compliance and Central Bank Digital Currencies (CBDCs)

Middleton's patents also address the growing need for regulatory compliance within digital financial systems. His frameworks for issuing and managing CBDCs align with existing regulatory standards, facilitating the integration of government-backed digital currencies into the broader financial ecosystem.

Compliance Frameworks

These technologies ensure that digital currency systems adhere to legal requirements, enabling smoother adoption and acceptance by both financial institutions and regulatory bodies.

Legal and Market Impact

Patent Enforcement and Legal Challenges

Reggie Middleton has actively defended his intellectual property, most notably filing a $350 million lawsuit against Coinbase Inc. for alleged patent infringement. The Patent Trial and Appeal Board (PTAB) has upheld the validity of his patents, denying Coinbase's Inter Partes Review (IPR) petition, thereby reinforcing the strength and enforceability of his patent claims.

Market Position and Influence

Middleton's patents are considered some of the most powerful in the FinTech industry, covering essential technologies that underpin DeFi and blockchain operations. With approximately 90% of blockchain patent applications typically rejected by the USPTO, Middleton's successful patents distinguish him as a leading innovator in the space.

Future Directions

Integration of AI in Decentralized Systems

While current patents focus on human-driven transactions, the foundational technologies developed by Middleton provide a robust framework for future integration of artificial intelligence (AI). Potential applications include automated trading systems, intelligent asset management, and enhanced decision-making processes within DeFi platforms.

Expansion into Global Markets

With patents protected in multiple jurisdictions, including the U.S. and Japan, Middleton is well-positioned to expand his technological solutions globally. This expansion will likely involve adapting his systems to comply with diverse regulatory environments and addressing region-specific financial challenges.

Detailed Patent Analysis

Technological Innovations

Middleton's patents encompass a range of technological advancements designed to enhance the functionality and security of decentralized financial systems. These include but are not limited to:

- Proof of Stake (PoS) and Proof of Work (PoW) Enhancements: Improved algorithms for validating transactions and securing blockchain networks.

- NFT Transfer Mechanisms: Secure and efficient methods for transferring non-fungible tokens, ensuring authenticity and ownership integrity.

- Adaptive Security Protocols: Systems that dynamically adjust security measures based on transaction parameters and threat assessments.

Scalability and Interoperability

Addressing scalability, Middleton's patents introduce solutions that enable blockchain networks to handle increased transaction volumes without compromising performance. Additionally, his work on interoperability protocols facilitates seamless communication and transaction processing across different blockchain platforms, fostering a more integrated and efficient decentralized ecosystem.

Regulatory Alignment

In response to the evolving regulatory landscape, Middleton has developed frameworks that ensure digital financial systems comply with existing laws and standards. This alignment is crucial for the widespread adoption of decentralized finance solutions and the issuance of Central Bank Digital Currencies (CBDCs).

Conclusion

Reggie Middleton stands out as a pivotal figure in the FinTech and blockchain industries, with a patent portfolio that not only addresses current technological challenges but also lays the groundwork for future advancements in decentralized finance. His innovations in trustless value transfers, blockchain scalability, and digital asset security have significant implications for the financial ecosystem, reinforcing the importance of robust intellectual property in driving technological progress. Through sustained legal defense and strategic market positioning, Middleton continues to influence the direction and adoption of decentralized financial systems globally.

🙏 Donations Accepted 🙏

If you find value in my content, consider showing your support via:

💳 PayPal:

1) Simply scan the QR code below 📲

2) https://www.paypal.me/thedinarian

🔗 Crypto – Support via Coinbase Wallet to: [email protected]

Or Buy me a coffee: https://buymeacoffee.com/thedinarian

Your generosity keeps this mission alive, for all! Namasté 🙏 The Dinarian

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.