Apple, X, Airbnb, and Google are not the only Big Tech names exploring stablecoins. Others include Meta, which is once again leaning into the payment technology after abandoning an ambitious earlier push that failed in the face of regulatory backlash. Uber CEO Dara Khosrowshahi said the rideshare company is in the “study” phase of using stablecoins for global money transfers at a Bloomberg conference on Thursday.

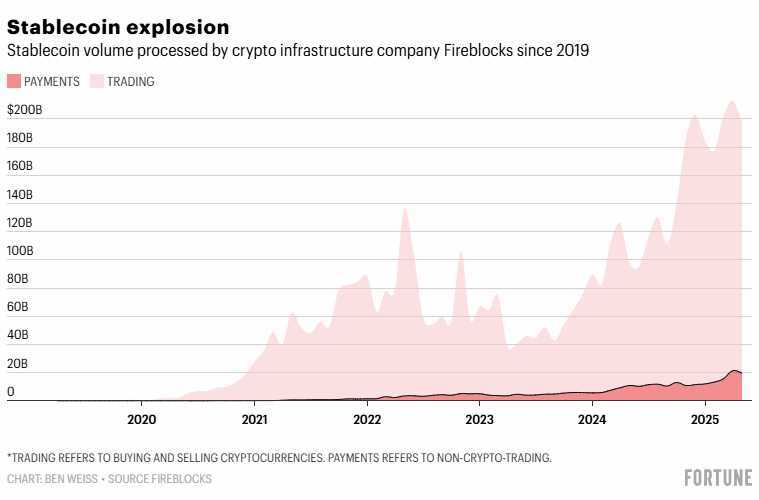

The interest from Big Tech comes as stablecoins have attracted millions in venture funding and lawmaker attention as Congress weighs two bills that would regulate the asset class. And it follows a landmark acquisition from the payments giant Stripe of the stablecoin startup Bridge, which was a starting gun for many in Silicon Valley to take the technology seriously.

“[Stablecoins] are this old idea, but finally I think we’ve got the right pieces coming together such that it’s really coming into fruition,” said Haun Ventures partner Chris Ahn, who was an early investor in Bridge.

X and Apple did not respond to requests for comment.

“It’s pretty clear that this is probably one of the biggest upgrades to payments since the SWIFT network,” Rich Widmann, head of Web3 strategy at Google Cloud, told Fortune. He confirmed that the tech giant was exploring stablecoin integrations.

“While crypto payments aren’t something we’re focused on integrating into the platform in the near future, we’re always looking at all aspects of payments for ways to improve our community’s experience with it, including developments in digital assets and their use cases,” said an Airbnb spokesperson.

Airbnb, X, and Apple

While Big Tech has long been at the forefront of payments innovation, Silicon Valley has been hesitant to move into crypto due to the regulatory crackdown under the Biden administration. That changed with the re-election of Donald Trump, whose administration has embraced blockchain and instructed agencies to loosen oversight of the crypto industry.

In the case of Airbnb, the short-term home rental platform has been in talks with crypto companies about potentially integrating stablecoins since the beginning of this year, according to four sources familiar with the matter.

Accepting stablecoins as a form of payment would allow Airbnb to cut back on the transaction fees it pays processors like Visa and Mastercard, according to one crypto company executive. The vacation rental company has been talking with one of its payment processors, Worldpay, about using stablecoins, according to another crypto company executive. Worldpay announced last week that it would enable stablecoin payouts with its partner, the stablecoin infrastructure company BNVK.

A Worldpay spokesperson told Fortune that the company “does not comment on our clients.”

Elon Musk’s social media platform X has also recently been in touch with crypto companies about integrating stablecoins into its fledgling payments app called X Money, according to three sources. Musk, a former executive at the fintech giant PayPal, has long expressed ambitions about creating an “everything app,” which would potentially include Venmo-like options for users to facilitate peer-to-peer payments. In January, X announced a partnership with Visa to create a digital wallet.

X is currently in talks with payments processor Stripe to potentially integrate stablecoin payments, according to one source familiar with the matter. A spokesperson for Stripe declined to comment.

Patrick Traughber, former head of consumer products and payments, led the discussions but left in January to work on the Sam Altman-backed crypto project World, according to two sources. Payam Abedi, a senior software engineer at X, is now leading the conversations, according to two sources. His public LinkedIn profile lists his title as “Money at X.” Abedi declined to comment, and Traughber did not respond to requests for comment.

Apple, which already has a massive presence in the payments ecosystem thanks to its Apple Pay system, has been in talks with crypto companies since January about integrating stablecoins into its payments infrastructure, according to four sources. One of these people told Fortune that these talks have included conversations with Matt Cavin, a senior director at stablecoin issuer Circle, whose public LinkedIn profile lists his job description at Circle as “strategic partnerships in stablecoin payments.” Circle did not respond to a request for comment.

Head in the cloud

While these three companies are in early conversations, Google Cloud is arguably the furthest along on stablecoin integrations. The tech giant has already accepted payments from two of its customers in PYUSD, PayPal’s stablecoin launched in partnership with the stablecoin infrastructure company Paxos. “We’ve invoiced the customer like we would normally invoice them. They’ve paid that bill the way they would normally pay it. But they’ve used stablecoins to effectuate settlement,” Widmann, the Google Cloud executive, told Fortune.

Although Widmann declined to say whether other divisions within Google were exploring stablecoins, he did say that the stablecoin payments went through Google’s central accounting office. “There isn’t a separate offshoot for stablecoin payments within Cloud,” he said.

One crypto executive involved in the Big Tech discussions told Fortune that one major roadblock for companies will be deciding which stablecoins to integrate. Tether, which issues the leading U.S.-dollar-backed stablecoin, has had longstanding concerns over its approach to compliance, and its main competitor, USDC, faces an uncertain future ownership as its parent company, Circle, just went through the initial public offering process. Other options, such as PayPal’s PYUSD face low adoption. The executive said that some Big Tech companies might consider launching their own stablecoin, though Democratic lawmakers have sought to limit this option.

🙏 Donations Accepted 🙏

If you find value in my content, consider showing your support via:

💳 PayPal:

1) Simply scan the QR code below 📲

2) https://www.paypal.me/thedinarian

🔗 Crypto – Support via Coinbase Wallet to: [email protected]

Or Buy me a coffee: https://buymeacoffee.com/thedinarian

Your generosity keeps this mission alive, for all! Namasté 🙏 The Dinarian

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.

All while Pfizer—a company with a $2.3 billion criminal fine for fraudulent marketing, bribery, and kickbacks—was given blanket immunity from liability and billions in taxpayer dollars to produce a vaccine in record time with no long-term safety data.